Weekly Skepticism #11

This week with some "friendly" competition between the establish empire & rising one, Carbon taxes hurt the poor-who knew, Lithium-value play?, Secret stimulus hits $1 trillion, Winter is back......

U.S. vs. China: Who Claims the Title of World’s #1 Superpower?

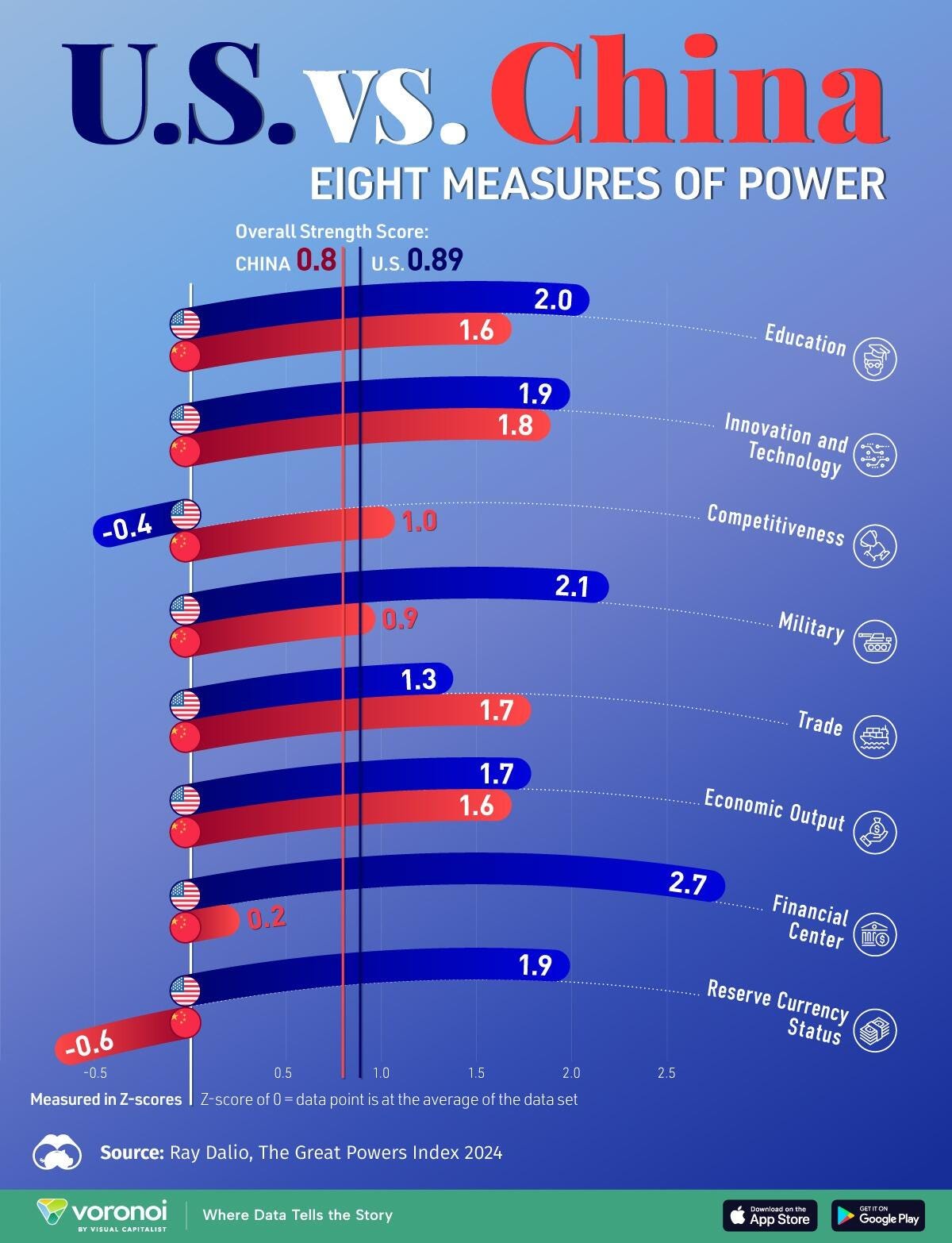

Today, the global balance of power is shaped by multiple forces, including economic clout, trade dynamics, and a nation's defense-industrial base.

While the U.S. and China emerge as the two principal powers, their sources of strength differ significantly. The U.S. maintains an unmatched position in capital markets, with its reserve currency status showing little sign of being challenged. In contrast, China has vastly increased its influence in international trade, now the top trading partner for 120 countries.

Methodology: Measuring the Strength of Nations

Ray Dalio identifies eight core pillars to evaluate a nation's strength:

Trade

Innovation and Technology

Education

Economic Output

Military

Financial Center

Competitiveness

Reserve Currency Status

U.S. vs. China: A Power Comparison

In 2024, the scores reveal that the U.S. holds an overall strength score of 0.89, outpacing China at 0.80. Both nations are closely matched in innovation and economic output, yet diverge sharply in reserve currency status and competitiveness.

In technology, the U.S. is home to leading tech firms driving advancements in AI, while China is rapidly developing intellectual property in key industries like semiconductors and electric vehicles.

Economically, the gap between U.S. and Chinese GDP stands at about $10 trillion. If China achieves 5% annual growth, it could surpass the U.S. by 2035. However, Dalio's projections suggest a more modest 4% growth due to challenges in its property sector and weak consumer demand.

In education, despite concerns about its stagnating high school system, the U.S. boasts top-ranking universities that enhance its score. China, with its 100 elite institutions, faces issues of inequality impacting lower-income households.

Military-wise, the U.S. has long been the leader in defense spending, outpacing China by more than twofold as of 2022. However, China's military modernization is closing the gap, and its alliances with countries like Russia and Iran pose new challenges to U.S. dominance.

The landscape is shifting, and the stakes are high as these two powers navigate their paths forward.

MF: Carbon Taxes Hurt the Poor; IMF Says We Need a Global Carbon Tax

In a classic case of "No Sh*t Sherlock" meets "You Don’t Say," the IMF's latest "Chart of the Week" reveals the inconvenient truth: carbon taxes disproportionately hit low-income households.

According to new research, lower-income groups face a heavier burden from carbon taxes because they spend a smaller share of their budgets on exempted products compared to wealthier households. In fact, these households end up paying between $1.26 and $4.95 more per tonne of CO2 than their affluent counterparts.

The study, titled Distributional Impacts of Heterogeneous Carbon Prices in the EU, shows that the average price paid for carbon in the EU in 2020 was around $11.35, significantly lower than the EU ETS price of $28.22. This gap exists due to incomplete carbon pricing across value chains, meaning not all products are taxed uniformly.

The IMF suggests that this lack of uniformity benefits the wealthy at the expense of lower-income families, leading to their call for a global carbon tax. They argue that standardized pricing both within and across countries would reduce the regressive impact of carbon taxes on household expenditures.

A global carbon tax, they say, would elevate carbon prices on imports, allowing EU economies to redistribute excess revenues back to low-income households, thus lessening the burden of carbon pricing. Their models suggest that ongoing efforts to expand carbon pricing, like the EU ETS II and the Carbon Border Adjustment Mechanism (CBAM), would help achieve this goal.

However, it’s essential to recognize that the IMF’s recommendation hinges on the premise that a global carbon tax will alleviate the economic strain on the poor. Critics argue that this proposal veils a broader agenda of wealth redistribution—what could essentially be termed carbon communism.

In practice, carbon taxes often exacerbate the financial struggles of low-income families. Canada serves as a cautionary tale; despite rebates, studies show that many households are still losing money due to carbon taxes. If a global carbon tax promises net benefits for everyone but the wealthiest, it raises serious questions about its feasibility and fairness.

Lithium-Ion Batteries: A Downward Price Spiral

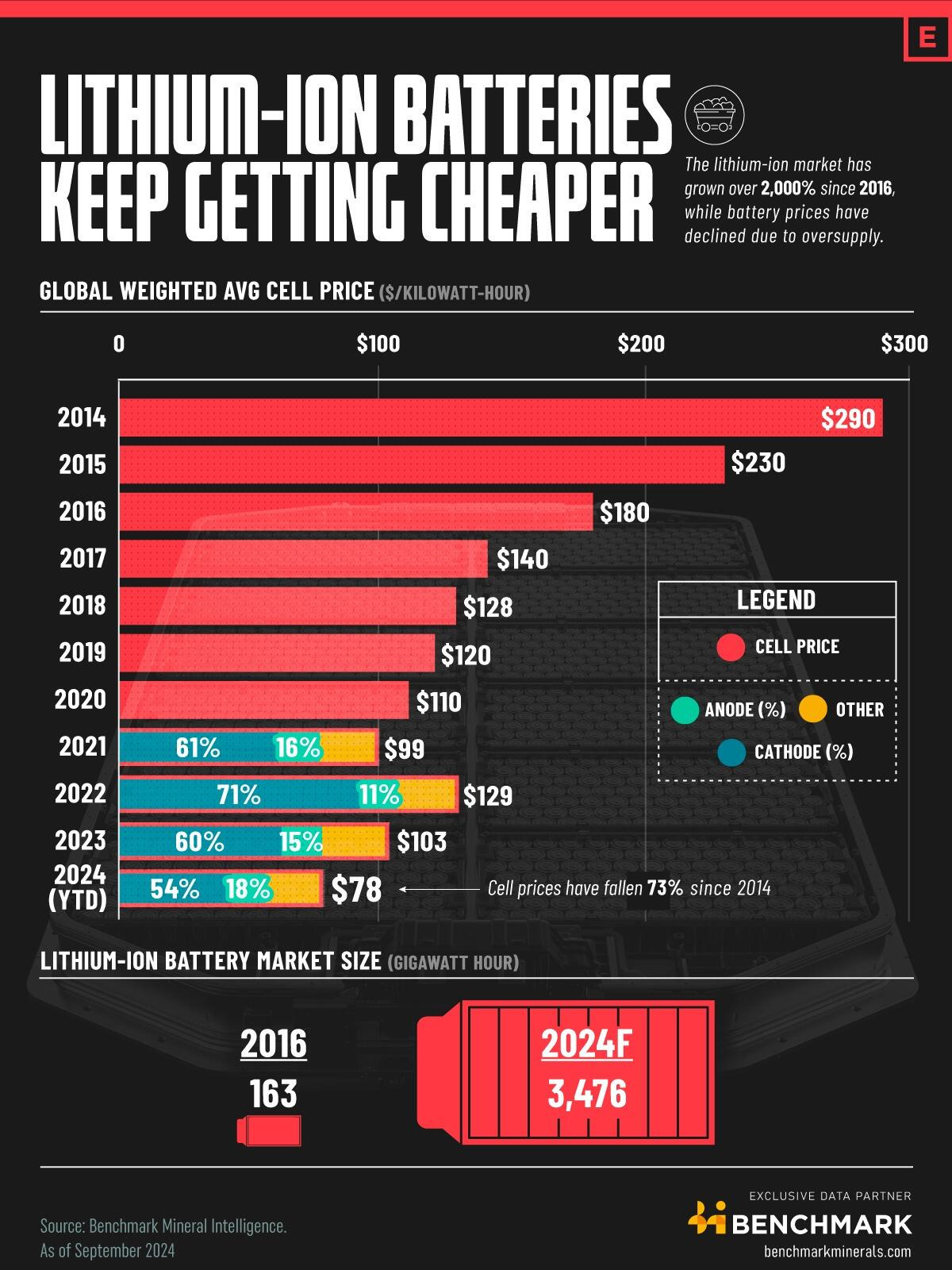

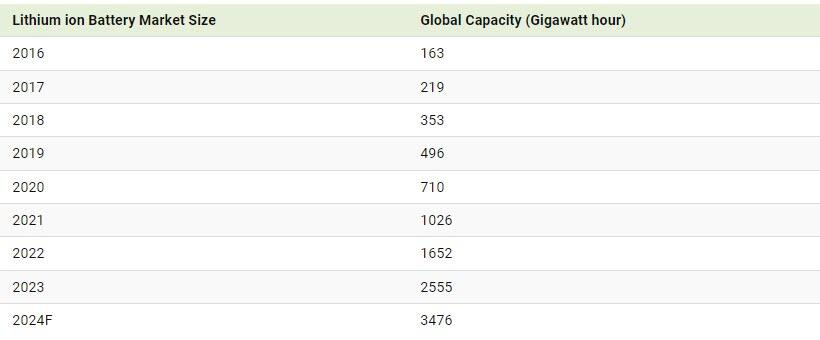

Battery metal prices are feeling the pressure as an influx of new production clashes with a slowdown in electric vehicle adoption, lithium prices have plummeted nearly 90% since their late 2022 peak, forcing mine closures and directly impacting the cost of lithium-ion batteries in EVs.

A Decade of Declining Prices

Exclusive data from Benchmark Mineral Intelligence reveals a striking trend in battery pricing over the past decade. Currently, the cathode accounts for 54% of the cost of a battery cell, while the anode contributes 18%, with the remaining 28% tied to other components.

The average price of lithium-ion battery cells has dropped from $290 per kilowatt-hour in 2014 to just $103 in 2023. With China's oversupply expected to drive prices even lower in the coming months, the market is poised for further declines.

New Supply, Greater Pressure

Recent announcements of a staggering 19 million tons of lithium discovered in the Smackover formation—equivalent to nine times the world’s current demand—will only exacerbate the downward pressure on prices. This massive new supply ensures lithium remains abundant and accessible. Shameless plug here!

Rising Demand Amidst Falling Prices

Despite these price drops, the demand for batteries is projected to soar—potentially increasing ninefold by 2040. Total capital expenditure in the battery sector is set to nearly triple, climbing from $567 billion in 2030 to a staggering $1.6 trillion by 2040.

In short, while battery prices are in a free fall, the appetite for lithium-ion technology is only set to rise. The dynamics of supply and demand will be critical as we navigate this rapidly evolving landscape.

"Hundreds of Millions" Funneled into Electric Semi Truck Charging Infrastructure

In a sector that has largely flown under the radar—especially as the auto market shifts back toward hybrids—attention is finally turning to the crucial charging infrastructure for large electric trucks.

According to Bloomberg, significant spending is underway, with "hundreds of millions of dollars" in grants being disbursed through both state and federal programs.

For instance, Greenlane Infrastructure LLC—a $675 million joint venture involving Daimler Truck North America, NextEra Energy, and a BlackRock fund—is now constructing its flagship site for a 280-mile commercial charging corridor between Los Angeles and Las Vegas.

Moreover, TeraWatt Infrastructure Inc., backed by over $1 billion in funding, is developing a heavy-duty charging network stretching from California's Port of Long Beach to El Paso, Texas. Meanwhile, WattEV, supported by Apollo Global Management and Vitol, currently operates several charging depots with plans for 15 more along the West Coast.

Erika Myers, executive director of Charging Interface Initiative North America, remarked, “We’re seeing industry making bigger investments.” She noted the growing “excitement and enthusiasm for the development of electrification in the medium- and heavy-duty space.”

Electrifying medium- and heavy-duty trucks appears to be a logical strategy for cutting emissions; these vehicles represent just 5% of U.S. road traffic but contribute nearly a quarter of the transportation sector's greenhouse gases. Yet, adoption remains sluggish. BloombergNEF even classifies the U.S. as a global “laggard” in decarbonizing commercial fleets, with electric medium- and heavy-duty trucks making up only 6% of sales by June 2024, and fewer than 1,000 sold in the first half of the year.

The situation reflects a classic "chicken-and-egg problem": manufacturers hesitate to ramp up production of electric trucks without sufficient charging infrastructure, while developers are reluctant to invest without a substantial fleet in place.

Challenges abound, from a strained power grid and high vehicle costs to uncertain policy support—especially with the impending presidential election complicating matters.

Just days ago, we noted that prices for EV semis need to drop between 30-50% to compete effectively with diesel trucks. Currently, less than 2% of the EU's heavy freight vehicles are electric or hydrogen-powered, yet this figure must surge to 40% of new sales by 2030 to meet EU climate targets. Electric trucks are 2.5 to 3 times more expensive to produce than their diesel counterparts, placing a heavy burden on logistics companies reluctant to absorb the higher costs.

McKinsey suggests electric truck prices should ideally be no more than 30% above those of diesel models, necessitating significant advancements in battery technology.

Reuters further emphasizes that reducing charging costs by 25% and establishing 900,000 private charging points by 2035—requiring a $20 billion investment—are essential components of the EU’s CO2 strategy. Additionally, European truck manufacturers are facing increasing competition from Chinese firms, which have captured 20% of the bus market with lower-cost products.

Volkswagen Cuts Profit Forecast Again Amidst Dwindling Car Demand

Volkswagen AG has once again slashed its profitability forecast, marking the second reduction this year as the automaker grapples with plummeting passenger vehicle demand. This downturn highlights the tumultuous shift toward electric vehicles, compounded by a faltering German economy that may already be in recession. The situation is exacerbated by a slowdown in China, further pressuring sales for luxury German brands.

The carmaker, renowned for its extensive lineup including Audi, Bentley, Lamborghini, and Porsche, announced on Friday that its operating return on sales forecast has been cut to 5.6%, down from a previously expected 7% in July. This adjustment reflects not only weak demand but also anticipated closure costs for an Audi plant in Belgium.

Key Takeaways from VW's Updated Guidance

Operating Return on Sales: 5.6% (previously projected at 6.5% to 7%)

Vehicle Deliveries: 9 million units (estimate lowered to 8.1 million)

Automotive Net Cash Flow: €2 billion (down from €2.5 billion to €4.5 billion, with a consensus estimate of €3.27 billion)

VW faces a multitude of challenges: dwindling demand in China, intensifying competition in the EV market, and an increasingly hostile macroeconomic climate.

Recent reports paint a grim picture for the legacy automaker:

Volkswagen's Dilemma: Cut costs and fire union workers or face bankruptcy.

Union Wars: VW is dismantling three-decade-old job protections.

Job Cuts: Up to 30,000 employees could be let go in Germany.

Adding to the turmoil, electric vehicle demand in Germany has collapsed by a staggering 69%.

As Bloomberg notes, “The downturn in EVs is putting carmakers like VW and Renault SA at risk of hefty fines as tighter European Union fleet-emission regulations come into effect next year.”

But the real crux of the issue lies in the 'green' policies championed by far-left officials, which are strangling Western economies and hampering competitiveness against Asian manufacturers. In China, energy is not just abundant but cheap—an advantage that starkly contrasts with the energy policies in Germany.

While Western companies struggle under climate regulations and high energy costs, China is busy constructing new coal plants at an unprecedented rate, supplying its manufacturers with a wealth of inexpensive energy. The conclusion is stark: without a significant shift in strategy, the West cannot hope to compete.

Californian Households to Receive Climate Credit in October Utility Bills Amid Rising Prices

In a bid to mitigate soaring utility costs, over 11.5 million customers of California’s private utility companies will automatically receive an average credit of $71 on their October bills, as announced by Governor Gavin Newsom on October 2.

These climate credits aim to “offset increases while preserving incentives for energy conservation and reducing greenhouse gas emissions,” according to the California Public Utilities Commission. The funding for these credits stems from the state's cap-and-trade program, which penalizes companies exceeding carbon limits.

Breakdown of Credit Amounts

PG&E Customers: Over 5 million households will receive $55.17.

Pacific Power Customers: Approximately 46,000 customers will see credits of $174.25—the largest in the state.

Bear Valley Electric Service Customers: Residents in this Alpine County region will receive the smallest credit at $32.24.

“Not only does this credit provide much-needed relief for families, it’s helping Californians transition to cleaner energy,” said Newsom.

This follows a similar initiative in April, which brought the total climate credits for the year to an average of $217 per household. Since 2014, Californians have received an average of $971 in climate credits, totaling over $14 billion statewide.

Criticism of California's Climate Policies

Despite the apparent relief, critics argue that these climate policies are little more than high-cost burdens on consumers. Southern California journalist Susan Shelley criticized the cap-and-trade program as a “hidden tax on energy,” impacting everything from utilities to manufacturing.

A 2022 study titled Zapped: How California’s Punishing Energy Agenda Hurts the Working Class indicated that rising utility prices are squeezing millions of residents. Wayne Winegarden, who analyzed the study, noted, “There is nothing unique about California that should cause the state’s electricity rates to be significantly higher than the rest of the country.”

Alice Reynolds, president of the California Public Utilities Commission, admitted that the state’s green energy initiatives come with a cost: “Any investment in clean energy technology... is funded through electricity bills.”

The Rising Cost of Energy

Since the cap-and-trade law took effect in 2013, energy prices have surged, with Californians paying about 67% more than the national average in 2022. Some residents face rates five times higher than the lowest in the nation.

Utility companies like PG&E have acknowledged that increased costs are tied to the state’s decarbonization strategy, warning that declining gas consumption could lead to higher rates.

Legislators across the political spectrum are acknowledging the toll of these climate agendas on living costs. “These energy mandates jacked up utility rates,” said Republican Assembly Minority Leader James Gallagher, emphasizing that taxpayers and consumers are footing the bill for these expensive policies.

Democrats have echoed concerns from constituents about rising energy costs. Assemblywoman Cottie Petrie-Norris highlighted that California’s utility rates are the highest in the nation, with families feeling the pinch and small businesses struggling to stay afloat.

More than a million small businesses will also benefit from credits on their October utility bills, according to Newsom’s statement. But with prices still climbing, the question remains: are these credits merely a band-aid on a deeper wound?

Fall Snow in Siberia: A Climate Anomaly Unnoticed

News from Siberia rarely captures the headlines—unless it’s a summer heatwave or rampant forest fires. Yet, one has to wonder if the media's fixation on Germany’s speed limits or the installation of more wind turbines could overshadow the real climatic shifts occurring elsewhere.

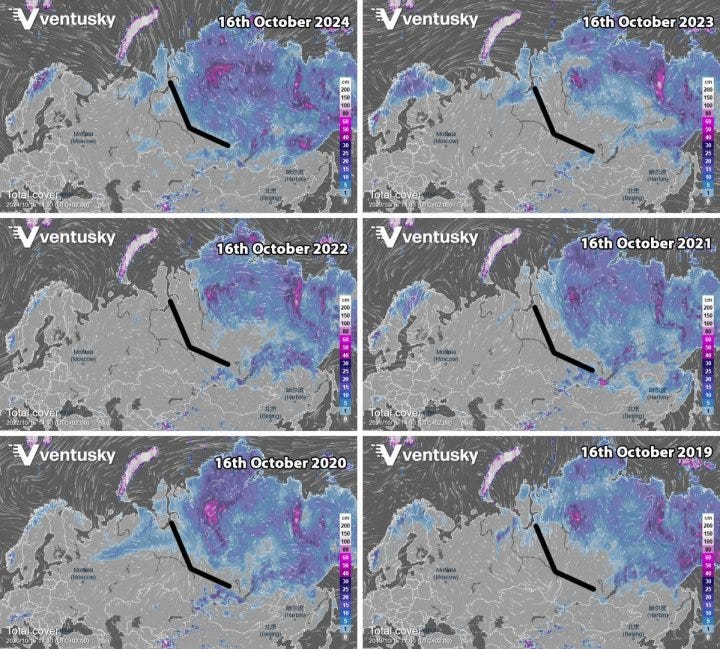

Right now, the snow cover in Siberia for mid-October 2024 is greater than it’s been in recent years.

Ventusky suggests this substantial snow cover could influence winter weather patterns in Europe, given that large areas are already blanketed in white. A comparison with previous years shows a marked difference, indicating a significant climatic anomaly.

Yet, this anomaly is unlikely to garner media attention. It’s compelling evidence of increased moisture in the atmosphere, a phenomenon that could disrupt typical weather patterns and temperatures. But let’s be honest—such data doesn’t exactly drive clicks.

Interest Payments Outstrip Defense Spending for the First Time—Thanks!

In a stunning turn of events, the Treasury Department’s latest report reveals that interest payments on the national debt have officially eclipsed defense spending for the first time in U.S. history. This seismic shift is a direct byproduct of policies championed by Kamala Harris and her administration.

During a recent appearance, Harris asserted that she had no regrets about the decisions made during her tenure. Perhaps she should reconsider, especially in light of the grim fiscal realities outlined in the report covering fiscal year 2024, which ended in September.

The federal deficit surged past $1.8 trillion this year—the third highest ever recorded, trailing only the two years of COVID-19 emergency spending. Notably, revenues increased by nearly $500 billion, yet spending soared by over $617 billion, marking a 10% spike under the Biden-Harris watch.

But the real jaw-dropper? Interest payments on the national debt soared to $882 billion—an astonishing 35% increase from last year—surpassing the $874 billion allocated for national defense. By 2029, projections suggest interest payments could exceed defense spending by a staggering $200 billion.

Why this dramatic escalation in interest costs? The answer lies in Harris’s tie-breaking votes that enabled unprecedented spending at a time when the economy was already rebounding from the pandemic. This reckless fiscal strategy ignited inflation and sent interest rates skyrocketing, dramatically inflating the cost of servicing the national debt.

Interest payments have become a secret stimulus for the country, consuming an ever-growing portion of the federal budget and limiting funds available for critical investments in infrastructure, education, and public services. Instead of strengthening the nation, these payments effectively drain resources that could be used to build a more prosperous future.

Prior to Biden and Harris taking office, the Congressional Budget Office (CBO) forecasted that interest payments for this year would hover around $284 billion based on the policies left by Donald Trump. Instead, Biden/Harris's actions have resulted in a 210% increase in interest costs in just one year.

If elected president, what would Kamala Harris propose to remedy this fiscal disaster? Likely more of the same: trillions in inflationary spending, economically burdensome tax hikes, and a plethora of regulations that stifle growth.

Harris is right about one thing—it’s time to turn the page. The question is whether we’ll do it before it’s too late.

Thanks for wrapping up the week with me. Before you dive into your weekend, remember: thinking is the first step to change. Consider joining The Monterey Skeptic to make a difference and shift perspectives. Like and share to spread the word.