News events drop that got little media attention from three different companies, in three different sector that are coverging in a way few people know or understand. The convergence will help deal with energy shortage, security, and transtions at the same time while keeping the transporation sector, space exploration, and oil & gas sector intertwined for the forseeable future.

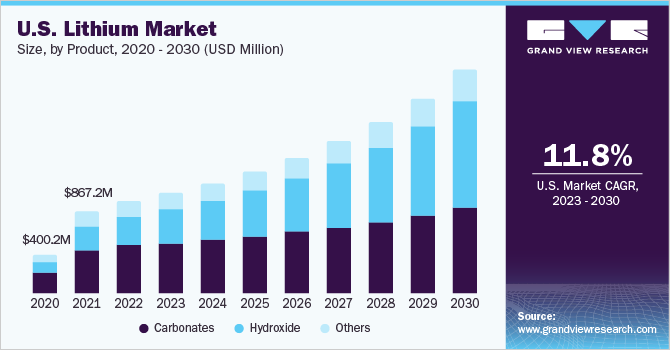

Lithum, the main mineral in EV batteries, is except to play a more prominent role in daily lives of the average person. Lithum demand is excepted to grow from 685 metric in 2023 tons to 2,114 mertic ton in 2030, more than 3x times growth. With Lithum demand except to increase because of EVs market peneration—since lithum is a commodity and commodities prices are affected by supply—we can except prices for lithum to become important for Evs buyers.

Wildcatter Elon Musk

The way it’s portrayed in the media Elon Musk move to Texas was soley a political tried of the political miss calculations of Calfornia and at first glance, it is not hard to come to that conclusion: poor forest management practices—which ironically caused emission to increase wiping out 16 years worth of reductions, job gutting regulations, tax policy, etc. Nothing could be further from the truth. Texas sits in the heart of America phycial and economicly. It’s location, in center of the country, it’s political and business climate has helped transformed Texas into an economic power house underpinned by it’s huge oil & gas reverses. If Texas were a stand alone country it will be the 9th largest GDP at $2.355 trillion as of 2022. The Lone Star State is also the largest exporter we have. As of 2021 exporting $300 billion of goods, more than Calforina, at $175 billion, and New York at, $100 billion combine. Given the state’s strategic poistion to ports, energy infrastructure, space facilities, & top rank university—producing qualified employees, it’s hard not to jump at such bounty. So when weighting his options for his varities business Texas was a logical choice:

“If a team has been winning for too long they do tend to get a little complacent, a little entitled and then they don’t win the championship anymore,” he said. “California’s been winning for a long time. And I think they’re taking them for granted a little bit.” Fortune aritcle, Elon Musk

Elon’s SpaceX and Tesla’s battery gigafactory are headquatered in Texas for two different reasons but underlying it all it access to Texa’s cheap energy, both electrical and natural gas. Made evident by SpaceX’s decision to drill for natural gas:

Elon Musk recently moved to Texas, where he launches some of his rockets and is building a battery factory. Now, for good measure, he plans to drill for natural gas in the state. The billionaire’s SpaceX intends to drill wells close to the company’s Boca Chica launchpad, it was revealed during a Friday hearing before the Railroad Commission of Texas, the state’s energy regulator.Production has yet to start because of a legal dispute between the SpaceX subsidiary Lone Star Mineral Development and another energy company. Tim George, an attorney representing Lone Star, said at the hearing that SpaceX plans to use the methane it extracts from the ground “in connection with their rocket facility operations.” Bloomberg

SpaceX also planned to build LNG terminals, which has since been scrapped. And that the fact that Telsa gigafactory in Texas had four tanker trucks belonging to Houston-based liquefied natural gas company Stabilis Energy, which could be seen parked outside the plant, with enough capacity to carry natural gas to power 32,000 U.S. homes for a day according to Detorit news. Natural gas will continue to be a proportiy for Musk.

While Elon Musk warming to Fossil fuels my seem contradictory to his business ethos which is centered around E.S.G— emphasis on the enviormental, it’s actual a play on the enviormental componentthat makes his foray into natural gas drilling so appealing.

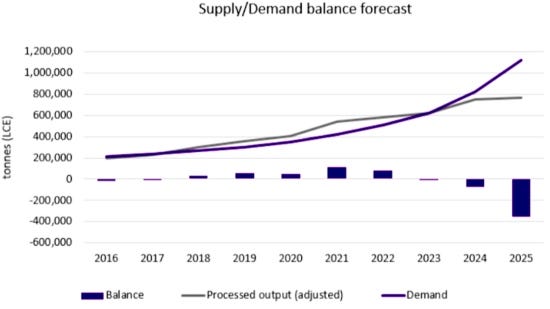

Securing lithium is going to be a top priority for any indursty that manufacturers batteries for EVs and for companies that sell EVs.

Source:FastMarkets

Seeing the deficits ahead Telsa’s CEO got to work and filed a patent on a new lithuim extraction that would cut cost by 30%. Musk described the process in a very simple way:

“What is the best way to take the ore and extract the lithium and do so in an environmentally-friendly way? We have been looking at from a first principle physic standpoint instead of just the way it has always been done. We found that we can actually use table salt, sodium chloride, to basically extract the lithium from the ore. Nobody has done this before to the best of my knowledge.

In the patent application called “Selective extraction of lithium from clay minerals,” Tesla describes the main problems with current extraction methods:

Lithium is a strategic metal for the lithium ion battery (LIB) and electric vehicle (EV) industry. Therefore, a means for economically extracting lithium from various lithium sources is important in order to reduce the cost of batteries and electric cars. The dominant lithium sources commonly used for mining are lithium brines due to the low cost associated with Li extraction from these brine sources. However, the ever-increasing demand for LIBs makes it necessary to explore other lithium sources.

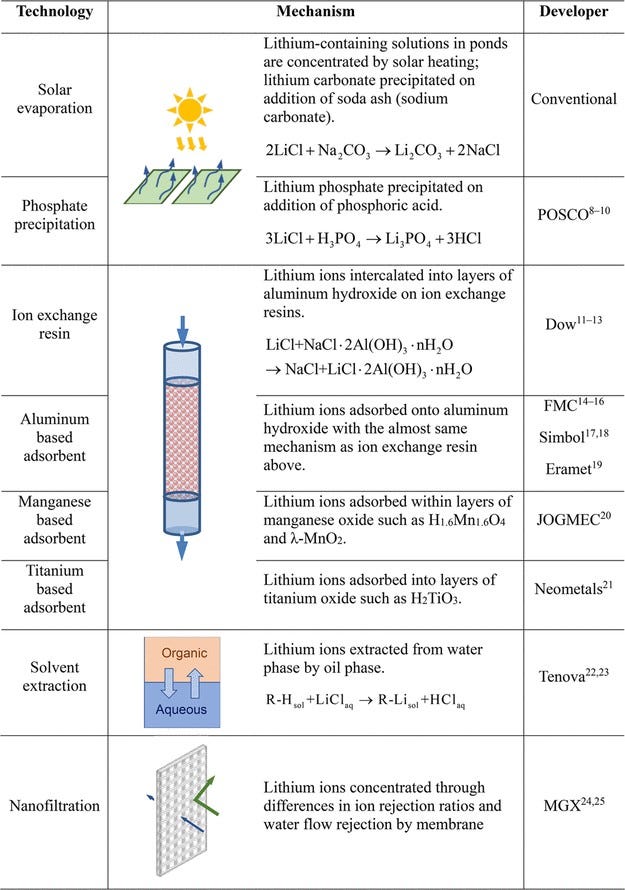

Another method for Li extraction is to extract the Li from clay minerals. In this process, the lithium is obtained by acid leaching, where clay minerals are mixed with an aqueous solution of common mineral acids, such as H2SO4 or HCl, and then heated under atmospheric pressure to leach out the lithium contained in the clay minerals. This acid leach method not only leaches out lithium, but it also leaches out high concentrations of impurities including Na, K, Fe, Al, Ca, and Mg. High lithium loss from the subsequent removal of the impurity elements, especially Al removal, may significantly lower the overall lithium extraction efficiency. Furthermore, high acid consumption and complicated leach solution purification methods also make the overall extraction process less cost-effective and not environmentally friendly.

Per Tesla summary on its new patent:

The processes for extracting lithium from a clay mineral and compositions thereof are described. The extraction process includes providing a clay mineral comprising lithium, mixing a cation source with the clay mineral, performing a high-energy mill of the clay mineral, and performing a liquid leach to obtain a lithium rich leach solution.

Exxon Minning

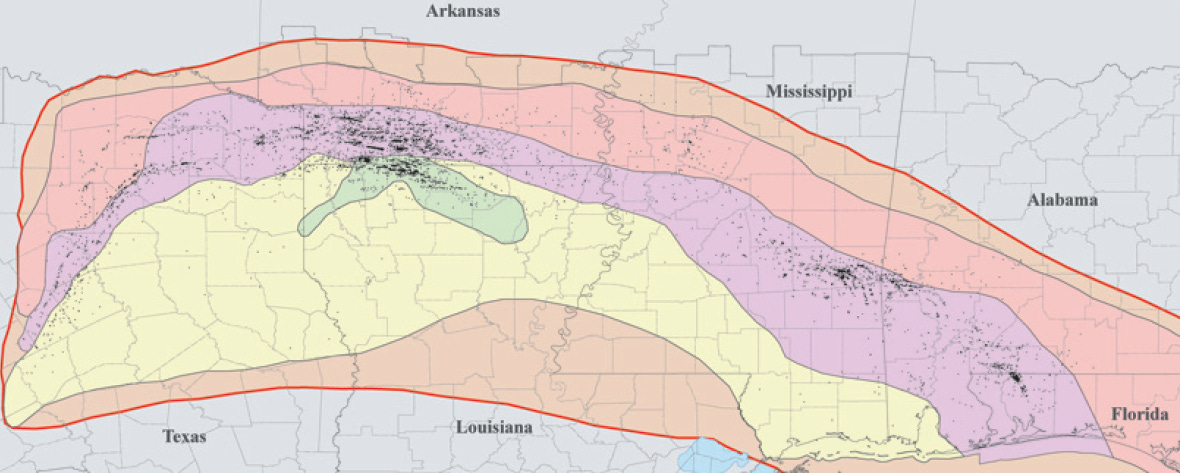

In a piece reported by the Wall Steet journal it was confirmed that Exxon acquiring drilling rights in southern Arkansas.

The Wall Street Journal reported the oil giant paid $100 million to exploration company Galvanic Energy for the 120,000-acre property, estimated to contain enough lithium to supply 50 million electric vehicles (EVs).

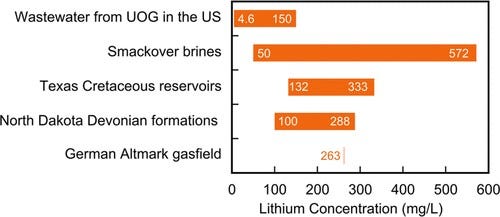

Exxon purchased drilling rights is the home to the Smackover Formation responsible for the 1922 Arkansas oil boom.

In addition to oil & gas, the formation is also home to significant amount of America’s lithium in the form bromine which just so happens to be used in the oil & gas indursty. Treated as a waste product bromine is usually reinjected for enhanced oil recovery, E.O.R, see https://pubs.acs.org/doi/10.1021/acsenergylett.9b00779 for details

Housed in it’s low-carbon business unit, Exxon sees what I am seeing. Using the same in frastructure and techniques already in place, it’s not hard seeing Exxon being a leader in this feild. This strategic move will allow Exxon to accomplish:

Low risk growth in low carbon business

Lower carbon itensity of it’s operation and products

Extend the proven reserves

Having the ability use current physical and regulatory infrastructure in oil & gas for lithium will give Exxon a cost advantage that few will be able to replicate. And with Elon Musk’s new patent for lithium extraction from clay, which is used in oil & gas drilling, we can see a day where Tesla creats a oil and gas subsidiary and parters with Exxon or another oil & gas company to drill for lithium!

Taking a step back I can see the foundations were being laid long before I realized them. From the adoption of peak oil theory, tax subsidies for low-carbon/engery-efficiency, or the narritive of man made climate-change, all culminating to an energy road map desing to:

24/hr access to energy

minimize over dependence on a single source

geopolitical hedge

With both ExxonMobil and Telsa out in front of the pack on this I see no need to find a new start up or small cap getting into this space. Investing in Exxon or Tesla, either directly or in a fund, should prove to been beneficial.

This is not investment advice. This is nothing more than my opinion and observations. I could be wrong and look forward to any other points of view that challenges mine, please feel free to challenge.