Weekly Spetickim #10

Hurricane Milton has caused a stir of climate talks, sorry guys....America the economy is powered by CH4, Buffett keeps stacking, OPEC continues it's slow decline, Nukes get some love...

OPEC+ Faces a New Challenge: The Texas Gas Pipeline Surge

The looming surge in Permian Basin shale gas output could disrupt OPEC+’s carefully orchestrated output strategies.

Common sense suggests that with oil prices plummeting 25% over the past year, the U.S. shale industry should be hitting the brakes. Yet, paradoxically, American oil production growth is on the verge of a resurgence.

This uptick in activity couldn’t come at a worse time for OPEC+. As Saudi Arabia and Russia grapple with an oversupplied market, particularly heading into early 2025, the last thing they need is a rebound in U.S. crude output.

So why is U.S. crude production defying the typical market cycles? The answer lies in natural gas dynamics. Here’s the breakdown.

In the Permian, an energy-rich region stretching from West Texas into southeast New Mexico, shale companies often extract natural gas alongside oil. Since 2018, the production of this “associated” gas has skyrocketed, overwhelming local demand and pipeline capacity.

Consequently, natural gas prices in the Permian have plummeted, with producers sometimes forced to pay buyers to take the excess gas off their hands. While negative prices are not a new phenomenon, they’ve become increasingly prevalent in recent months. In fact, gas prices at Waha—a crucial trading hub—have dipped below zero for 46% of the year, with the situation worsening since July 26. Just this month, producers faced a record cost of nearly $5.2 per million British thermal units to give away their gas, a stark contrast to the $2 per million Btu they received a year prior.

To mitigate these financial losses, shale companies have curtailed new well production, with some even shutting down existing wells. “We’ve intentionally slowed oil production to manage our gas output,” stated Travis Stice, CEO of Diamondback Energy, in a recent earnings call.

However, this scenario is about to shift. Enter the Matterhorn Express Pipeline—a new 580-mile conduit linking the Permian to the Houston area—set to commence operations shortly. This pipeline will facilitate the movement of excess gas to demand centers along the U.S. Gulf Coast, effectively bolstering regional prices. Additional pipelines are expected to come online in the next few years, further alleviating congestion.

When the Matterhorn begins pumping, Waha prices should rebound, providing much-needed relief to shale producers. This will likely enable them to reactivate delayed wells and cease existing well curtailments, leading to an uptick in oil production during late 2024 and early 2025. While the extent and sustainability of this boost remain uncertain—especially against a backdrop of falling prices—the projections are significant.

Total U.S. oil production, which stood at 20.2 million barrels per day in July, could rise to around 20.4 to 20.5 million by year’s end. If achieved, this would represent an increase of approximately 400,000 to 500,000 barrels per day compared to December 2023.

Yet, if U.S. oil prices stay below $70 a barrel, this activity may dwindle rapidly. The beauty of shale production lies in its agility; companies can swiftly adjust spending based on market conditions, unlike the slower megaprojects of major oil firms. For the next few months, though, this surge could complicate OPEC+’s attempts to maintain market control.

Nuclear Power Surpasses Fossil Fuels in South Korea’s Energy Landscape

In a historic shift, nuclear power accounted for 32% of South Korea's electricity generation in the first half of 2024, eclipsing coal and natural gas for the first time.

This transition underscores South Korea’s urgent quest for energy security and its commitment to reducing carbon emissions. As the country—one of the world’s largest importers of fossil fuels—embraces nuclear energy, it marks a significant turning point in its energy strategy.

Data from energy think tank Ember reveals that coal and natural gas each held a 28% share of the generation mix, highlighting the growing dominance of nuclear energy. This advancement is particularly noteworthy in a nation that relies heavily on imports, positioning itself among the top global consumers of LNG and thermal coal.

The recent resurgence of nuclear power aligns with geopolitical shifts, particularly following the Russian invasion of Ukraine. In 2022, South Korea’s government abandoned a previous nuclear phase-out plan, pivoting back to a strategy that emphasizes nuclear energy’s role in its energy portfolio.

President Yoon Suk-yeol, who took office in March 2022, set ambitious goals for the nuclear sector, aiming for it to contribute at least 30% of the nation’s electricity by 2030. Currently, 26 reactors generate approximately one-third of the country’s electricity, and further expansion is on the horizon.

Just last week, the Nuclear Safety and Security Commission granted a construction permit for two new reactors—Shin-Hanul 3 and 4—in Uljin, a clear indication of the government’s renewed commitment to nuclear energy.

“This construction approval aligns with the administration's energy policy, reversing the previous government’s nuclear phase-out,” stated Sung Tae-yoon, the presidential chief of staff for policy.

The revival of nuclear energy is not only about bolstering capacity; it’s also a strategic move to reduce reliance on imported LNG and coal, contributing to lower emissions. Analysts from Ember note that while South Korea has historically depended on fossil fuels, the rise of solar and nuclear has begun to shift the emissions trajectory, peaking in 2018 as renewables gained ground.

Despite still relying on coal and gas for nearly half of its electricity generation, the ascendancy of nuclear energy reflects a broader trend among countries seeking energy independence amidst escalating geopolitical tensions. South Korean firms, leveraging their expertise, are even winning international contracts to build nuclear reactors, signaling a potential export of technology and know-how.

In response to the energy crisis spurred by the Ukraine conflict, many nations—aligned with U.S. and EU interests—are turning to nuclear power as a stable alternative. At the COP28 climate summit, the U.S. and 21 other nations pledged to triple nuclear energy capacity by 2050, reinforcing its role in achieving net-zero emissions.

The International Energy Agency anticipates a global nuclear power renaissance, forecasting record electricity generation from nuclear in 2025. Despite challenges such as delays and cost overruns, global nuclear generation is set to rise by nearly 3% annually through 2026, driven by plant restarts in Japan, new reactors in China and India, and ongoing maintenance in France.

As South Korea leads the charge in this nuclear revival, it positions itself not only as a key player in energy security but also as a model for other nations navigating the complexities of the energy transition.

Sunlight and Clouds, Not CO2, Drive Earth’s Climate: Shocking New Study Reveals

This summer, we experienced scorching concrete, refreshing cold pools, and popsicles that melted in the relentless sun. Yet amid this sweltering heat, a groundbreaking study is challenging long-held beliefs about climate change.

In August, the European Commission's Copernicus report highlighted record global temperatures, soaring 1.51 degrees Celsius above pre-industrial levels. Meanwhile, researchers Roy Spencer and John Christy from the University of Alabama Huntsville noted that August temperatures were 0.88 degrees Celsius above the 30-year average from 1991 to 2020.

“Extreme heat poses serious public health threats, and our communities are struggling to cope,” stated Health and Human Services Secretary Xavier Becerra. “What we’re experiencing now is unlike anything seen 30 or 40 years ago.”

In response, President Biden unveiled the National Heat Strategy for 2024–2030 on August 14, addressing the rising temperatures largely attributed to human-induced CO2 emissions, according to the United Nations Intergovernmental Panel on Climate Change (IPCC).

“Stabilizing the climate requires rapid reductions in greenhouse gas emissions and achieving net-zero CO2,” emphasized Panmao Zhai, co-chair of the IPCC Working Group I.

However, not everyone agrees with the IPCC’s perspective. Ned Nikolov, a physical scientist affiliated with Colorado State University, contests that the focus on CO2 is misguided.

“The greenhouse theory suggests that small increases in atmospheric CO2 lead to global warming, which is fundamentally incorrect,” he stated.

On August 20, Nikolov and retired meteorologist Karl Zeller published a study arguing that the recent warming trend is not due to rising CO2 levels. Instead, they found that the Earth’s increased absorption of sunlight—driven by reduced global cloud cover—is the primary cause of rising temperatures.

NASA explains that Earth’s atmosphere continuously balances its energy budget—the balance between incoming solar radiation and outgoing thermal radiation. Disruption of this balance, known as radiative forcing, leads to temperature increases when more sunlight is absorbed or when not enough heat escapes into space.

Earth’s albedo, the proportion of sunlight reflected back into space, plays a crucial role in determining how much radiation reaches the surface. The IPCC, in its Sixth Assessment Report, claims that rising atmospheric CO2 from human activities has disrupted this energy budget, trapping more thermal energy and leading to higher temperatures and warmer oceans.

Interestingly, the IPCC notes a decline in surface solar radiation, termed "dimming," from 1950 to 1980, followed by a partial recovery—referred to as "brightening." It attributes this phenomenon to human-caused aerosol emissions and variations in cloudiness, though the exact origins remain unclear.

This is where Nikolov’s research enters the fray. By analyzing satellite data, he and Zeller argue that changes in cloud cover significantly influence the Earth's climate, challenging the narrative that CO2 is the primary driver of global warming.

“Climate is governed by the balance of sunlight absorbed by Earth and the infrared energy emitted to space,” states NASA’s Clouds and the Earth’s Radiant Energy System (CERES).

Since March 2000, NASA has utilized satellite data to study this critical energy exchange.

“CO2 is merely an invisible trace gas that does not directly interfere with sunlight. While it's said to trap thermal radiation, this notion is fundamentally flawed,” Nikolov argues.

He emphasizes that the absorption of longwave radiation by CO2 and the process of heat trapping are distinct phenomena. According to the second law of thermodynamics, heat trapping in an open system like the atmosphere is impossible.

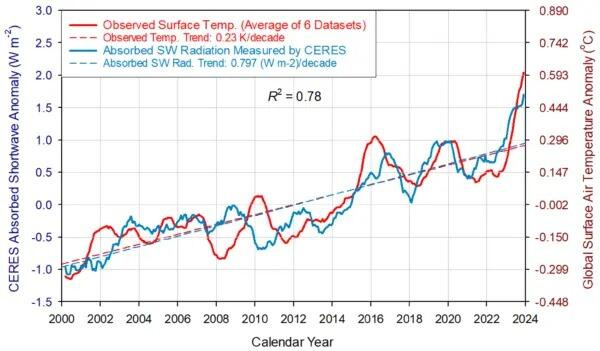

Figure 1. Monthly radiative anomalies derived from the CERES EBAF 4.2 dataset: (a) Earth’s global albedo calculated via dividing the reflected all-sky shortwave anomaly by the globally averaged incident solar flux at the TOA (i.e., the global insolation) and multiplying the resulting fraction by 100 to convert to a percent; (b) Earth’s absorbed solar flux calculated via multiplying the CERES reflected all-sky shortwave anomaly by −1 based on the fact that radiation absorption is opposite (and complimentary) to reflection. Courtesy of Ned Nikolov

He further explains that while water vapor acts as a greenhouse gas, its impact becomes evident when it condenses into clouds, which actively reflect solar radiation. The role of clouds in the climate system is both “measurable and significant.”

“Cloud formation is influenced by cosmic factors. A reduction in cloud cover decreases planetary albedo, allowing more radiation to warm the surface,” he notes.

Their paper asserts that the warming observed over the last 24 years correlates directly with decreased albedo, rather than with increasing greenhouse gas concentrations as the IPCC claims.

Nikolov and Zeller argue that the scientific community has misinterpreted the Earth’s Energy Imbalance (EEI), which is the difference between absorbed solar energy and outgoing thermal radiation at the top of the atmosphere. They contend that EEI arises not from “heat trapping” by greenhouse gases but from adiabatic processes—where thermal energy dissipates in rising air due to decreasing pressure.

Figure 7. Comparison between observed GSAT anomalies and CERES-reported changes in the Earth’s absorbed solar flux. The two data series, representing 13-month running means, are highly correlated with the absorbed SW flux, explaining 78% of the GSAT variation (R2 = 0.78). Also, GSAT lags the absorbed shortwave radiation between 0 and 9 months, which indicates that GSAT is controlled by changes in sunlight absorption. Courtesy of Ned Nikolov

Through rigorous mathematical analysis, they demonstrate that EEI is an “apparent phenomenon,” suggesting that there is no long-term heat storage in the Earth system due to increasing greenhouse gases, nor is there “warming in the pipeline,” as the latest IPCC report posits.

The researchers also highlight the potential drivers of reduced cloud cover, such as cosmic rays and solar wind interactions.

“While we have hypotheses regarding the mechanisms behind these changes, we lack a definitive model,” Nikolov admits.

He calls for extensive interdisciplinary research to explore the physical mechanisms that govern Earth's albedo and cloud physics, asserting that these elements are the true climate drivers over multi-decadal timescales.

“The current climate science recognizes that cloud cover is declining and albedo is decreasing, but it mistakenly attributes these changes to internal variability. This is incorrect. The alterations in cloud cover and albedo are externally influenced,” he argues.

Nikolov asserts that if rising temperatures were due solely to greenhouse gases, we would have observed more significant warming.

“The reality is that solar forcing alone accounts for the entire warming observed in the 21st century, leaving no space for anthropogenic influences.”

This perspective poses an uncomfortable truth for the UN’s Climate Agenda, potentially explaining why the IPCC’s Sixth Assessment Report largely omits discussion of the observed decrease in Earth’s albedo and its implications for recent warming.

NASA’s stance, stating that the Sun is not responsible for the recent warming trend, contrasts sharply with Nikolov's findings. As the IPCC remains silent on these claims, the debate around climate dynamics continues to evolve, challenging the foundational narratives of climate science.

U.S. Natural Gas Consumption Surges: A Dilemma for Clean Energy Ambitions

Natural gas-fired power generation in the United States is experiencing an extraordinary surge, reaching unprecedented levels and propelling global gas demand to new heights. From January to September, U.S. producers generated a staggering 55.6 million megawatt hours (MWh) from gas plants—an increase of 5% year-over-year and the highest output since at least 2021, according to LSEG data highlighted by Reuters' Gavin Maguire.

Gas now accounts for a record 46% of the nation’s power generation, a trend that poses a significant challenge to the Biden Administration's goal of achieving a 'clean power' grid by 2035. As demand escalates—driven by increasing electrification and the insatiable energy appetite of data centers—power-generating companies are announcing the largest volume of new natural gas capacity in years. In just the first half of 2024, plans for new capacity matched the total unveiled throughout all of 2020, according to Sierra Club data reported by Bloomberg.

After a prolonged period of stagnation, America’s electricity consumption is on the rise, fueled by the AI revolution and a resurgence in tech manufacturing. With natural gas consistently providing around 40% of the country's electricity, the current trajectory suggests that dependence on this fossil fuel is not merely a passing trend but a deeply entrenched reality, complicating the pursuit of ambitious climate goals. The pressing question remains: how long can this reliance endure while simultaneously advocating for a cleaner energy future?

UK to Increase Electricity Imports from the EU: A Renewable Energy Paradox

The UK is poised to ramp up electricity imports from the EU as it navigates potential supply shortages following the closure of its last coal power plant. A recent Bloomberg report, citing the rebranded National Energy System Operator (NESO), indicates that the UK anticipates an 8.8% spare capacity cushion this winter—up from 7.4% last year—thanks to new interconnectors with Europe, including a recently established link to Denmark. NESO highlights enhancements in battery storage and increased generation from distributed networks as critical factors offsetting the retirement of older plants like Ratcliffe-on-Soar.

Yet, as winter approaches, Europe is grappling with its own rising electricity demand, raising concerns about its capacity to export power to the UK. With forecasts of lower wind speeds and reduced solar output in the colder months, the UK's reliance on imports underscores a troubling contradiction in the renewable energy narrative. The closure of coal plants was intended to mark a transition to a greener future, but this dependency on imported electricity reveals a significant vulnerability in the UK's energy strategy.

Meanwhile, the EU is also working to expand its interconnector network to bolster support for all member states and Ukraine, whose grid has suffered due to ongoing conflict. Should winter prove colder than expected, Europe may find itself stretched thin, complicating the UK's energy landscape even further. NESO has already signaled the potential for tight supply days, noting, “We may still need to deploy our standard operational tools, including system notices.”

This situation raises a crucial question: can the UK genuinely claim to be transitioning to a renewable energy future when it remains heavily reliant on external sources amidst an increasingly volatile supply chain?

Hurricane drought for 103 years!

Tampa Bay, with its population exceeding 3.3 million, stands as a remarkable anomaly in the realm of meteorological threats. For an astonishing 103 years, this bustling region has managed to evade a direct hit from a major hurricane—a streak unmatched in modern history. This unique resilience raises questions about the interplay of geography, climate, and luck that has shielded this vibrant area from the brunt of nature's fury. As the storms grow fiercer and more frequent—not really, Tampa Bay's fortunate history may soon be tested, but for now, it remains a rare haven in the stormy landscape of the Gulf Coast.

GII 2024: Emerging Economies Challenge Established Innovators

The World Intellectual Property Organization (WIPO) has released the Global Innovation Index (GII) 2024, ranking 133 economies based on their innovation capabilities and performance. This year’s findings reveal a shifting paradigm in global innovation, with emerging economies increasingly challenging traditional leaders, underscoring the ongoing decline of U.S. dominance.

The GII evaluates economies across seven critical innovation pillars, encompassing 78 indicators in total. Scores reflect average performance across these pillars, visualized in a heatmap that ranges from deep blue (lower scores) to vibrant yellow (higher scores).

For the 14th consecutive year, Switzerland reigns supreme as the most innovative nation, scoring 67.5. Here’s a look at the performers:

The U.S. retains a strong third-place finish, excelling in Market Sophistication (#1) and Business Sophistication (#2). However, its overall score is dragged down by a concerning Infrastructure rank of #30, highlighting systemic issues that signal a diminishing influence in global innovation.

A standout theme this year is the emergence of "innovation overperformers"—countries that have outstripped expectations relative to their development levels. India, Moldova, and Vietnam lead this group, showcasing remarkable advancement over the past 14 years.

The GII 2024 report offers a detailed snapshot of the global innovation landscape:

Technological Progress: Growth in green technologies has stalled compared to the decade’s average, with supercomputer energy consumption emerging as a significant hurdle.

Technology Adoption: There's a notable uptick in the uptake of 5G, robotics, and electric vehicles, signaling a shift towards more sophisticated technological infrastructure.

Socioeconomic Impact: Mixed progress is evident, with lingering effects from the COVID-19 pandemic. Poverty levels remain elevated compared to 2018, and life expectancy has stagnated at 2015 levels.

The GII reveals a landscape where innovation is increasingly a global endeavor, with emerging economies stepping up to contest established powers. The trends underscored in this year’s report highlight the urgent need for sustained investment in technology and infrastructure to maintain momentum. The relative decline of the U.S. in the innovation sphere serves as a critical reminder of the necessity for adaptation as the global balance of power shifts. Navigating these dynamics will require an ongoing interplay between innovation and economic resilience—key drivers of future growth.

Buffett's BofA Dump: $10 Billion and Counting

Warren Buffett, the 94-year-old titan of finance, is making headlines with a dramatic sell-off of Bank of America (BofA) shares. Since mid-July, his firm, Berkshire Hathaway, has offloaded a staggering $10 billion worth of BofA stock, raising eyebrows and signaling potential economic turbulence ahead.

Berkshire's traders initiated this selling spree as market pressures mounted, leading to a consistent decline in BofA shares. In just the last three trading days, they unloaded an additional $383 million. This marks the first substantial divestment from BofA since just before the pandemic, a move that shouldn't be taken lightly.

Despite this aggressive selling, Berkshire's stake in BofA remains significant, valued at $31.35 billion. However, with Buffett's ownership now down to 10.1%, he’s dangerously close to slipping below the crucial 10% regulatory threshold. Once crossed, Berkshire will no longer be obligated to report further sales to the SEC—a detail that could keep market watchers guessing.

The motivations behind Buffett's actions are the subject of much speculation. Analysts point to several factors, including:

Market Overvaluation: Is Buffett sensing an inflated market ready for correction?

Recession Risks: Economic indicators are flashing warning signs; could a downturn be on the horizon?

Consumer Weakness: Signs of a consumer slowdown could signal trouble for banks.

Regulatory Concerns: An expanding U.S. regulatory investigation into anti-money laundering, particularly surrounding fentanyl-related transactions, could be casting a shadow over major banks.

Buffett's cash reserves have soared to unprecedented levels, adding another layer of intrigue to his strategy. Interestingly, he has also recently divested half of Berkshire's Apple shares—another sign that the "Oracle of Omaha" may be adjusting his playbook.

In October 2008, Buffett famously urged investors to "Buy American," projecting confidence in the nation’s recovery. Fast forward to today, and the narrative has flipped; rather than buying, Buffett is selling American assets at an alarming rate.

This latest maneuver speaks volumes about his outlook on the economy. As he navigates these turbulent waters, the implications of his actions will resonate throughout the financial landscape. The question remains: what does Warren Buffett know that the rest of us don’t?

Thanks for wrapping up the week with me. Before you dive into your weekend, remember: thinking is the first step to change. Consider joining The Monterey Skeptic to make a difference and shift perspectives. Like and share to spread the word.

Thanks. I didn't know about S Korea's significant shift toward nuclear.