Weekly Spekictsim #5

A lot about energy, Real life Alter Carbon...Netflix series...Check out season 1!!!, The secret stimulus continues...luckily for me I am participating. U.S. sanctions pushing Bitcoin.....

Wealthy Seek to Preserve Lives Through Century-Long Trusts and Cryonics

In a turn of events that might make the old adage "you can't take it with you" seem quaint, the elite are now exploring ways to take their wealth—and potentially themselves—into the future. As revealed by Bloomberg, the latest trend among the wealthy is to set up trusts designed to last for centuries, all in the name of cryogenic preservation.

Mark House, an estate lawyer quoted by Bloomberg, notes that “the idea of cryopreservation has gone from crackpot to merely eccentric. Now that it’s eccentric, it’s kind of in vogue to be interested in it.” The growing interest in cryonics is clear, with about 5,500 people actively planning for it. House himself has worked with around 100 individuals in this space.

Among those planning for a future beyond their lifetimes is Steve LeBel, a 76-year-old retired hospital executive from Michigan. LeBel, who writes young-adult fantasy novels in his spare time, dreams of joining the approximately 500 individuals who have already been cryogenically preserved. To make this dream a reality, he’s setting aside $100,000 in a revival trust, with the rest of his estate going to his daughter, her husband, and his foundation.

LeBel expressed his concern: “I really want to figure out a solution, otherwise I’ll be in there with my fingers crossed, hoping there’s money left over, 200 years from now, to pay for the resurrection process.” This raises a critical issue: the impact of inflation on the value of his trust. In two centuries, $100,000 might not even be enough to buy a Snickers bar.

The so-called "revival trust" is a novel variant of the dynasty trust, commonly used by the ultra-wealthy to extend their wealth through generations. Unlike traditional dynasty trusts, which aim to minimize estate taxes, revival trusts are designed with future revival in mind. The complexity arises from the need to navigate legal distinctions; a revived person cannot be their own trust beneficiary. To address this, House appoints a trust protector to oversee the revival process and manage potential legal issues.

The legality of such trusts is not without its challenges. Many states impose limits on the lifespan of trusts, often capping them at 90-100 years. However, states like Arizona and Florida have more lenient laws, allowing trusts to potentially last for centuries. This regulatory flexibility is driving interest in long-term preservation strategies.

Despite the allure, the future of these trust structures remains uncertain. Changing laws and evolving businesses present risks, underscoring the need for adaptable and forward-thinking estate planning.

As LeBel optimistically concludes, “I believe the aging process is going to be cured. It’s a disease. The technology isn’t there yet, but I can bridge that time gap with cryonics.” Whether or not his optimism will pay off remains to be seen, but for now, the wealthy are making plans to ensure their legacies—and potentially their lives—extend well beyond their mortal span.

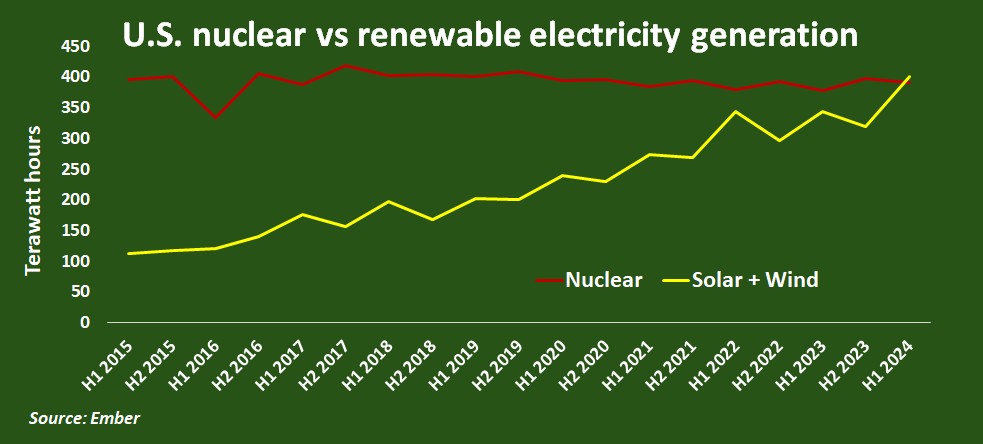

US Solar and Wind Power Overtake Nuclear for the First Time

In a historic shift, utility-scale solar and wind power generation in the U.S. surpassed nuclear power for the first time in the first half of 2024, as revealed by energy think tank Ember and reported by Reuters columnist Gavin Maguire.

For the first six months of 2024, solar and wind combined generated a record-breaking 401.4 terawatt hours (TWh) of electricity, outpacing nuclear's 390.5 TWh. This marks a significant milestone as solar generation surged by 30% and wind output increased by 10% compared to the same period last year.

In 2023, nuclear power contributed 18.6% to the U.S. electricity mix, with wind and solar accounting for 10.2% and 3.9%, respectively, according to the U.S. Energy Information Administration (EIA). Ember’s data suggests that wind and solar's combined share had grown to 16% in 2023, but nuclear remained the top low-carbon energy source.

The growing capacity and output of renewable energy sources have now shifted the balance, with solar and wind becoming the leading low-carbon electricity sources in the first half of 2024. The EIA forecasts a continued rise in renewable energy, projecting a 75% increase in solar power generation by 2025, reaching 286 billion kilowatt-hours (kWh), and an 11% rise in wind power, reaching 476 billion kWh.

Overall, renewable energy sources—including wind, solar, hydro, biomass, and geothermal—accounted for 22% of U.S. power generation in 2023, reflecting a significant shift towards cleaner energy.

La Niña Watch Continues: High Odds for Development This Winter

The National Oceanic and Atmospheric Administration (NOAA) has announced that the odds of La Niña developing remain elevated. According to the latest update, there is a 70% probability of La Niña forming between August and October, and a 79% chance from November to January.

The first half of 2024 has seen rapid cooling of waters across the eastern Pacific, signaling the end of a strong El Niño event. With surface waters in this region now at their lowest in months, there's potential for a robust La Niña to take hold, which could lead to a more active hurricane season.

Recent data reveals that water temperatures in June were only 0.16 °C (0.3 °F) above the long-term average. NOAA’s models, including the North American Multi-Model Ensemble, suggest a "moderate" La Niña could develop later this year.

Historical data from NOAA indicates that a La Niña winter could bring warmer and drier conditions to the southern U.S., colder weather to the north-central Plains, and wetter conditions in the Ohio Valley and Pacific Northwest/northern California.

However, there remains a 20% chance that La Niña might not materialize, with neutral conditions persisting through the winter.

NOAA has reiterated that El Niño and La Niña are natural climate phenomena, unaffected by human intervention. As always, be wary of media outlets that politicize climate and weather issues, as they often promote agendas disconnected from scientific reality.

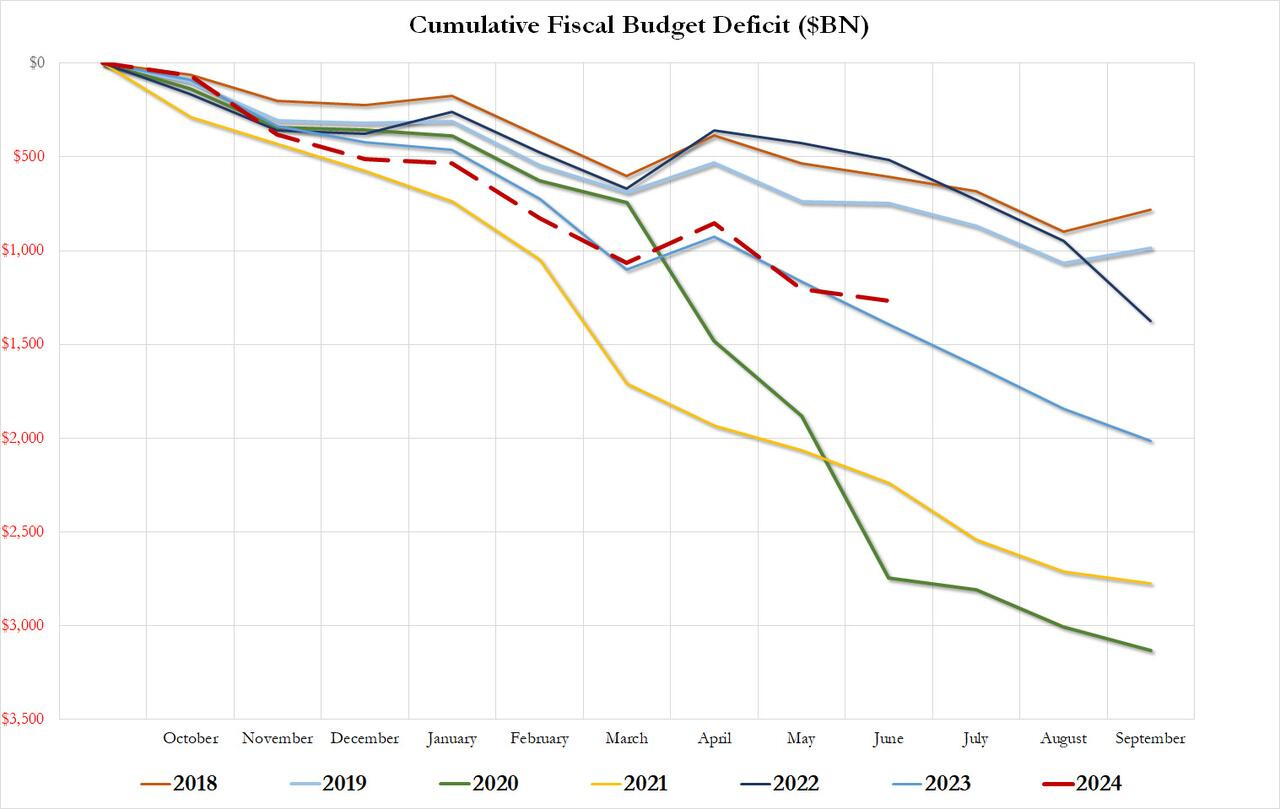

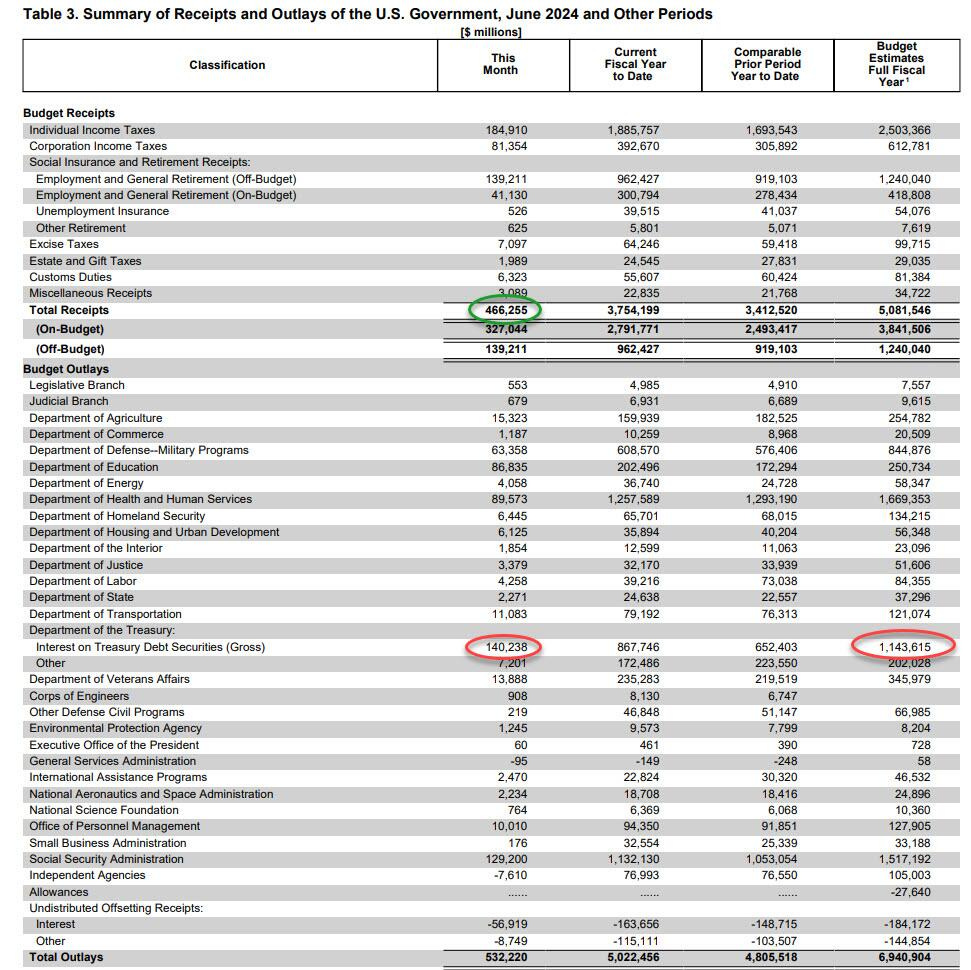

US Spends Record $140 Billion on Debt Interest in June, 30% of Tax Revenues

In a twist of financial irony, the US managed a June budget deficit of “only” $66 billion—an improvement from the market’s forecast of $83 billion and a sharp drop from last year’s $228 billion. This modest deficit helped reduce the cumulative year-to-date deficit to $1.268 trillion, down from $1.393 trillion a year earlier.

Yet, this positive spin masks a grimmer reality: the US is still heavily overspending relative to its tax revenues. The real concern is not just the growing expenses on mandatory programs like Social Security, health, and defense, but the mounting interest on the national debt. As noted in April, interest on US debt—currently the second-largest government expense at $1.1 trillion—is set to surpass Social Security, potentially becoming the largest single expenditure by the end of 2024, with projections reaching $1.7 trillion by April 2025.

In June alone, the US spent a record $140 billion on debt interest, pushing the year-to-date total to $868 billion and setting a course for a $1.144 trillion annual tally. This $140 billion represents over 30% of all US tax receipts for the month, underscoring a dire fiscal situation that’s rapidly approaching a critical tipping point.

As the chart below illustrates, this unprecedented monthly interest expenditure signals a looming Minsky moment for the US economy, where the scale of debt interest payments could soon force a reckoning.

Federal Fiscal Burden Absorbs 93% of American Wealth

A recent U.S. Treasury report reveals that the federal government’s debts, liabilities, and unfunded obligations have skyrocketed to an astronomical $142 trillion. This figure is an alarming 93% of the total wealth accumulated by Americans since the nation’s founding, which the Federal Reserve estimates at $152 trillion.

This figure isn’t just an abstract number. It directly reflects the financial burden placed on today’s Americans and their descendants. Unlike short-term deficits or partial accounting methods, this $142 trillion encompasses both current financial commitments and future obligations, giving a full picture of the fiscal strain.

Federal law mandates an annual report detailing the government's “overall financial position,” which includes not just the national debt but also extensive liabilities such as federal employee pensions, healthcare benefits, environmental cleanup costs, and unfunded social insurance obligations like Medicare. These “fiscal exposures,” according to the Government Accountability Office (GAO), represent substantial commitments that future policymakers will have to address.

However, mainstream media often overlooks these broader figures, focusing instead on simpler, incomplete metrics like the national debt. Unlike cash accounting, which only tracks money as it flows in and out, the Treasury report uses accrual accounting to reflect financial obligations as they are incurred, offering a more accurate view of the government’s fiscal health.

At the close of the 2023 fiscal year, the government’s reported shortfall includes $26.3 trillion in publicly held national debt, $16.6 trillion in various liabilities not included in the debt, and $104.2 trillion in unfunded social insurance obligations. With $5.4 trillion in federal assets subtracted, the net fiscal gap stands at $141.7 trillion.

To put these figures into perspective, the $142 trillion shortfall amounts to 93% of the net wealth Americans have accumulated. It breaks down to $430,252 per person and $1,098,087 per household, while also equating to twice the annual U.S. economic output and 30 times the annual federal revenue.

The primary drivers of this debt include rising social program costs, particularly for Social Security and Medicare, which have created significant unfunded obligations. Despite common misconceptions, military spending and tax cuts are not the primary culprits. The real issue lies in escalating expenditures on social programs.

Excessive government debt can have far-reaching negative impacts, including lower wages, higher inflation, sluggish economic growth, and increased taxes. The GAO warns that future generations will bear the brunt of this debt, potentially reducing their standard of living.

Ultimately, there are no free lunches in economics. Every dollar of government debt represents a cost, and while the U.S. can print money, this practice only postpones the inevitable consequences of fiscal mismanagement.

UK Increases Wind and Solar Power Budget by 50%

In a decisive move aimed at boosting its renewable energy sector, the UK government has elevated the budget for wind power developers by 50%, now totaling £1.5 billion (approximately $2 billion). This adjustment comes in response to the wind power industry's call for higher guaranteed electricity prices to stimulate investment amid rising material and borrowing costs exacerbated by elevated interest rates.

The Labour government's strategy places a substantial emphasis on offshore wind, with over two-thirds of this year's renewables budget, amounting to £1.1 billion ($1.4 billion), earmarked for this segment. The remaining funds will support onshore wind, solar energy, and emerging technologies like tidal power and floating offshore wind.

Tom Glover, Chairman of RWE’s UK operations, recently urged the government to significantly enhance the wind power budget if it aims to meet its installation targets. Glover warned that without increased financial support, the government might fall short of its planned additions by more than half.

Energy Secretary Ed Miliband touted the increased budget as a step toward restoring the UK's leadership in green technologies and advancing energy independence. However, Germany's recent shift away from guaranteed prices for wind and solar due to negative electricity prices serves as a cautionary tale.

Russia Legalizes Bitcoin for International Trade

In a strategic legislative move to bypass Western sanctions, Russian lawmakers have approved a bill allowing businesses to use Bitcoin and other cryptocurrencies for international transactions. This new law, set to be enacted in September, is designed to streamline international payments, particularly with major trading partners like China, India, and the UAE.

Central Bank Governor Elvira Nabiullina, a key advocate of the law, announced that the first cryptocurrency transactions will take place before the end of the year. The central bank plans to develop an "experimental" payment infrastructure, though specifics are yet to be detailed.

Nabiullina highlighted the growing risks of secondary sanctions, which have complicated import payments and led to an 8% drop in Russian imports in Q2 2024. Despite efforts to use alternative currencies and develop a BRICS payment system, many transactions still rely on the SWIFT system, risking further sanctions.

This legislative change aims to mitigate the economic impact of sanctions and facilitate smoother international trade operations. Anatoly Aksakov, head of the Duma's lower house of parliament, characterized the legislation as a "historic decision" in financial policy.

US Sees Surge in Natural Gas Power Amid Weak Wind Output

Natural gas-fired power generation in the US has surged this week due to the lowest wind power output in 33 months. On July 22, wind power generation hit its lowest point in the Lower 48 states since October 2021, according to the EIA. This shortfall, combined with rising cooling demands during a hot summer, has significantly increased reliance on natural gas.

July has seen a dramatic increase in days with poor wind performance, with six of the worst days for wind power occurring this month alone. This contrasts sharply with last year, which had only two such days in July.

Despite the addition of 6.2 GW of new wind capacity last year, wind generation experienced its first annual decline since the mid-1990s, falling by 2.1%. In response, natural gas use has increased to meet rising electricity demands, with year-to-date generation from natural gas up compared to last year.

Natural gas remains the dominant power source in the US, accounting for around 40% of total generation and projected to provide approximately 42% of the nation's electricity this year. With an expected 3% increase in consumption in 2024, natural gas will continue to be a crucial component of the energy mix.

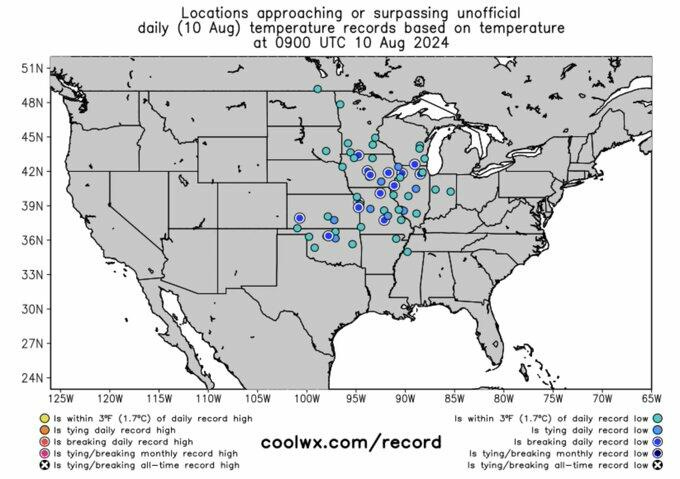

Extreme Weather Reporting and Arctic Sea Ice

Amid the surge of extreme weather reports and climate warnings, some notable discrepancies have emerged. For instance, BAM Weather recently reported that "dozens of nighttime low-temperature records" have been broken across the US, with temperatures dropping into the upper 40s and lower 50s. This has been downplayed by mainstream media, which often focuses on dramatic heatwaves and records.

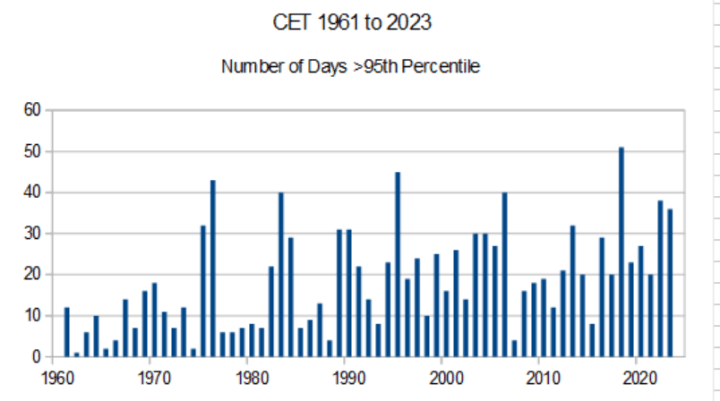

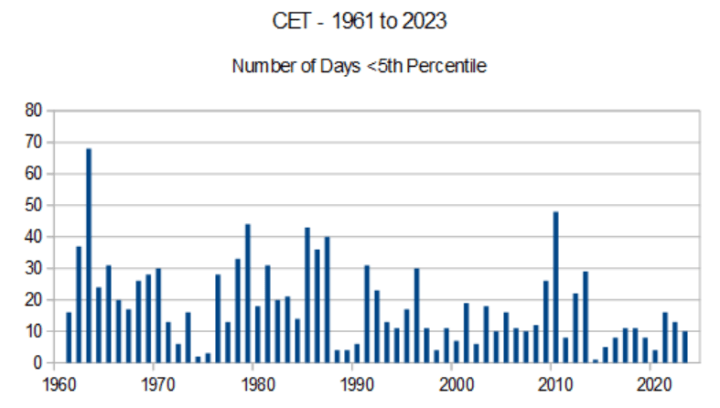

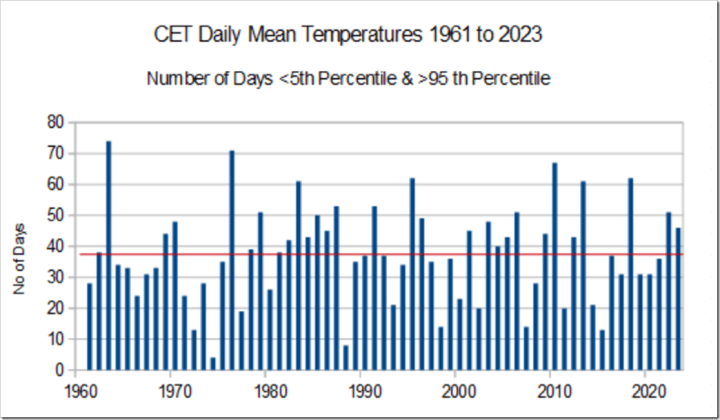

The Met Office's recent claims of increased temperature extremes in the UK have been contested. Analysis of Central England Temperature (CET) data since 1961 shows an increase in hot days but a significant reduction in extreme cold days, challenging the notion of a consistent rise in temperature extremes.

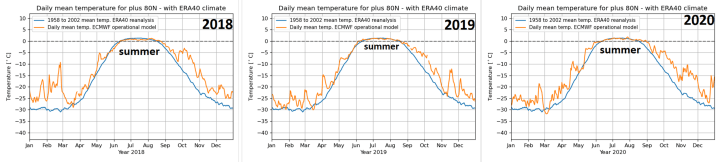

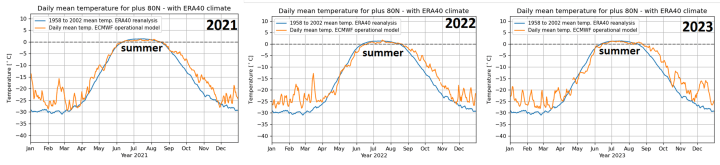

In the Arctic, summer temperatures have remained near normal, indicating resilience in sea ice extent. The summer melting season has not shown significant deviations from historical averages, despite warmer temperatures in other parts of the year. Arctic sea ice volume and extent have shown resilience in recent years, with a generally stable trend since 2012.

In conclusion, the Arctic's sea ice resilience and the varied weather extremes highlight the complexity of climate patterns and the need for nuanced reporting beyond sensational headlines.

.

.

Thanks especially for the piece on the overall federal fiscal burden estimate of 142 trillion. As you said, the future unfunded obligations are rarely mentioned.

There is another obligation that probably isn't even included - the subsidies for wind and solar, etc, that are legislated to go on and on until net zero is reached - with no built in stop in case net zero is not reached by 2050.

Speaking of wind and solar, it's interesting that their output is proven to be unreliable by "Natural gas-fired power generation in the US has surged this week due to the lowest wind power output in 33 months", ironically, in the same article where you posted "utility-scale solar and wind power generation in the U.S. surpassed nuclear power for the first time in the first half of 2024".