EV Battery Giants Face Profit Plunge Amid Sluggish Sales

LG Energy, a major player in the EV battery industry, reported a steep 58% decline in operating profits for the second quarter, citing a slowdown in EV sales as the primary cause.

The news arrived shortly after SK On, another significant South Korean battery manufacturer, declared an emergency following ten consecutive quarters of losses due to disappointing EV demand trends.

LG Energy and SK On rank as the world’s third- and fourth-largest EV battery producers, respectively.

Initial reports from Bloomberg highlighted that LG Energy managed to stay in profit partly due to a tax credit provided under the U.S. Inflation Reduction Act. Excluding this credit, however, LG Energy faced an operating loss of approximately $180 million.

In contrast, SK On faced more severe challenges without similar tax credits, as reported by the Financial Times. The publication noted a substantial increase in net debt to around $10 billion over the past two and a half years—a fivefold rise—attributed directly to EV sales falling well below initial projections.

In a candid message to employees, SK On's CEO, Lee Seok-hee, acknowledged the difficult situation, stating, “We are facing dire circumstances. It's time for us to unite.”

According to the Financial Times, SK On’s predicament was compounded by what seemed to be a series of suboptimal decisions, including aggressive investments in Europe and the United States in anticipation of a robust EV market expansion.

In contrast, the industry leaders BYD and CATL have predominantly focused on their domestic market, where EV sales continue to thrive. This strategic focus has shielded them from the disappointing sales figures experienced in other key global EV markets.

The Hidden Costs of 'The Next AI Trade': Seizing Private Land for Transmission Lines

As America gears up for the next phase of AI development, upgrading power grids to support AI data centers, onshoring initiatives, and overall electrification comes with a significant downside for some landowners: the seizure of private property for new transmission lines.

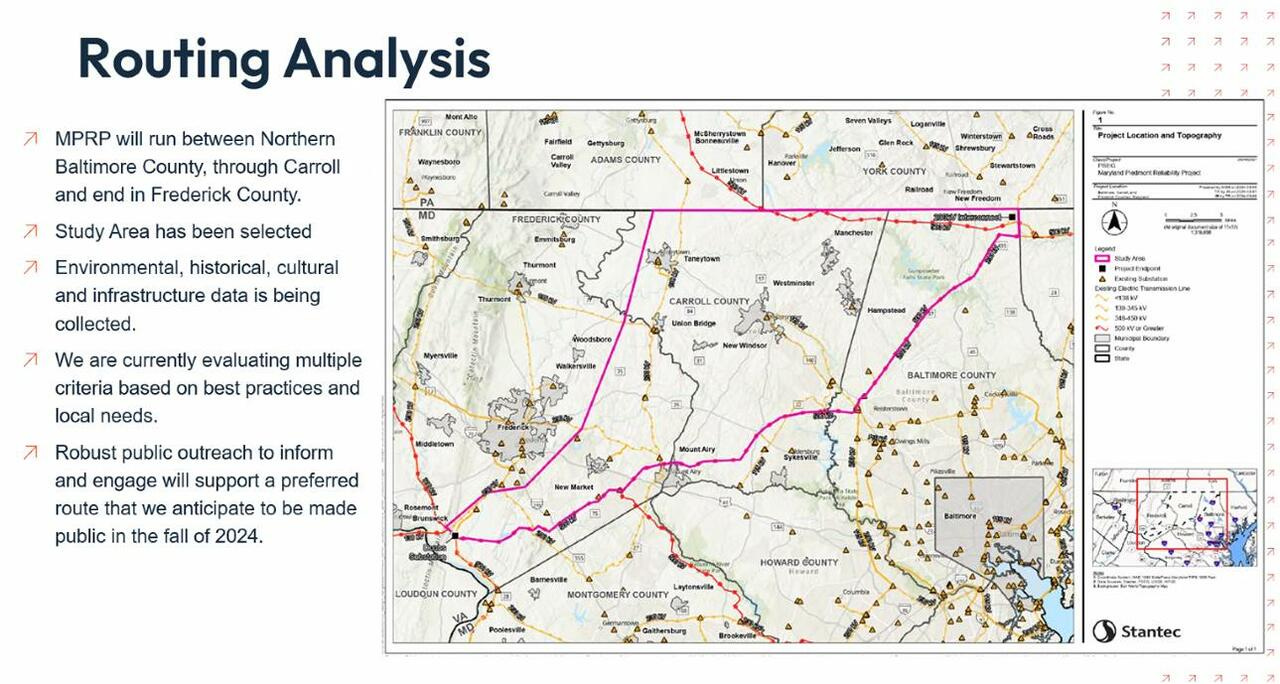

According to Fox 45 Baltimore, the Maryland Piedmont Reliability Project (MPRP) proposes a 70-mile, 500,000-volt transmission line spanning three counties—Frederick, Baltimore, and Carroll. This ambitious plan aims to connect a substation in southern Frederick County, bolstering the area's capacity to meet escalating power demands from AI data centers.

MPRP's official website outlines that acquiring private property will be necessary, utilizing eminent domain—a government-mandated seizure—to facilitate construction if negotiations with property owners fail to reach mutually agreeable terms.

The Valleys Planning Council, a local conservation group, expressed concerns via Facebook that the project will disrupt forests and farmland. They attribute the necessity of this new transmission infrastructure to Maryland's legislative restrictions, which prohibit the construction of new fossil fuel power plants, thus forcing the state to import electricity from neighboring regions.

It's increasingly evident that the push to power America's AI ambitions will involve government land grabs through eminent domain, exemplified in Maryland where residents face potential loss of portions of their farms and forests for this essential infrastructure.

Critics argue that this situation is exacerbated by the progressive policies in Annapolis, where lawmakers have prioritized green initiatives over practical energy solutions. They contend that the decision to ban new fossil fuel power plants, despite rising power demands, has exacerbated Maryland's energy deficit, as highlighted in a recent report by ESG Legal Solutions, LLC titled "Maryland's Energy Crisis: The Critical Need to Boost In-State Electricity Generation." The report underscores that Maryland currently consumes approximately 40% more electricity than it generates.

In conclusion, the expansion of AI-related infrastructure is poised to involve significant land seizures across Maryland and potentially elsewhere. Critics lament that such developments are driven by ideological policies rather than pragmatic energy management, placing undue burdens on local communities affected by these decisions.

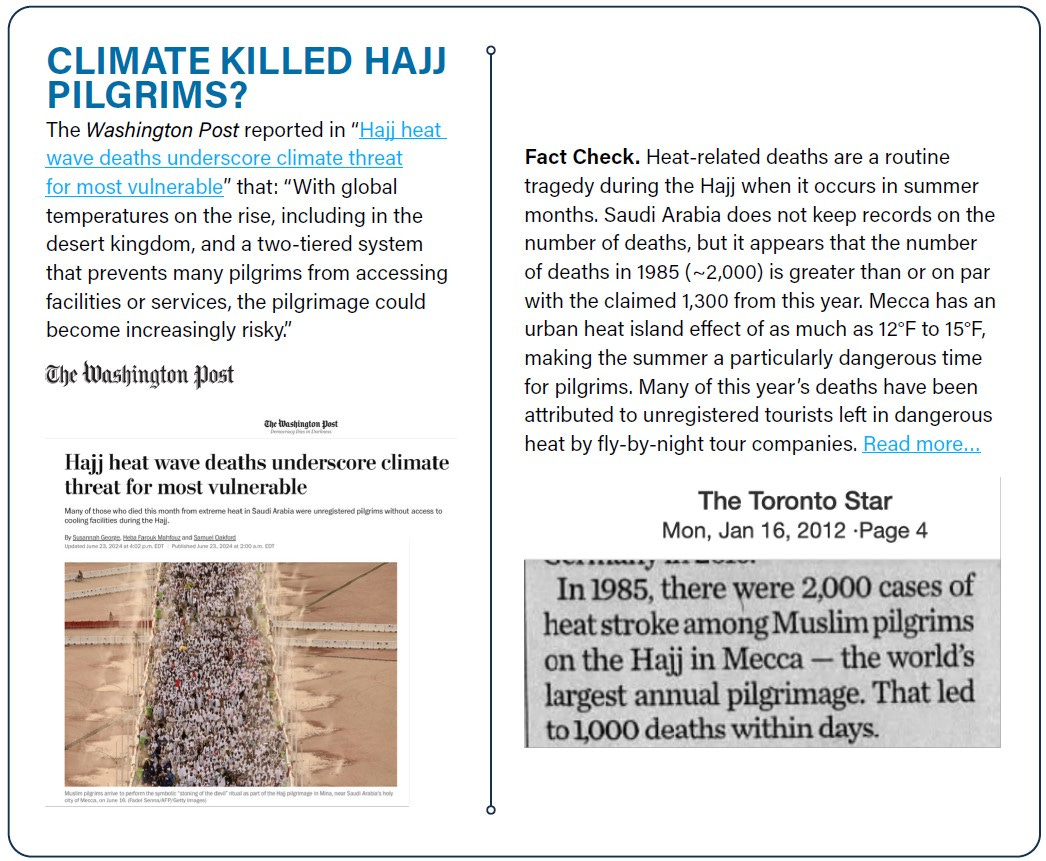

Climate Truths

More proof renewables don’t work

China Faces Grid Strain Amid Renewable Energy Surge

China's substantial expansion of wind and solar capacity is causing regional electricity imbalances, leading to increased curtailment of renewable energy.

To address this issue, the government is focusing on enhancing long-distance transmission infrastructure and improving coordination of power generation plans across provinces.

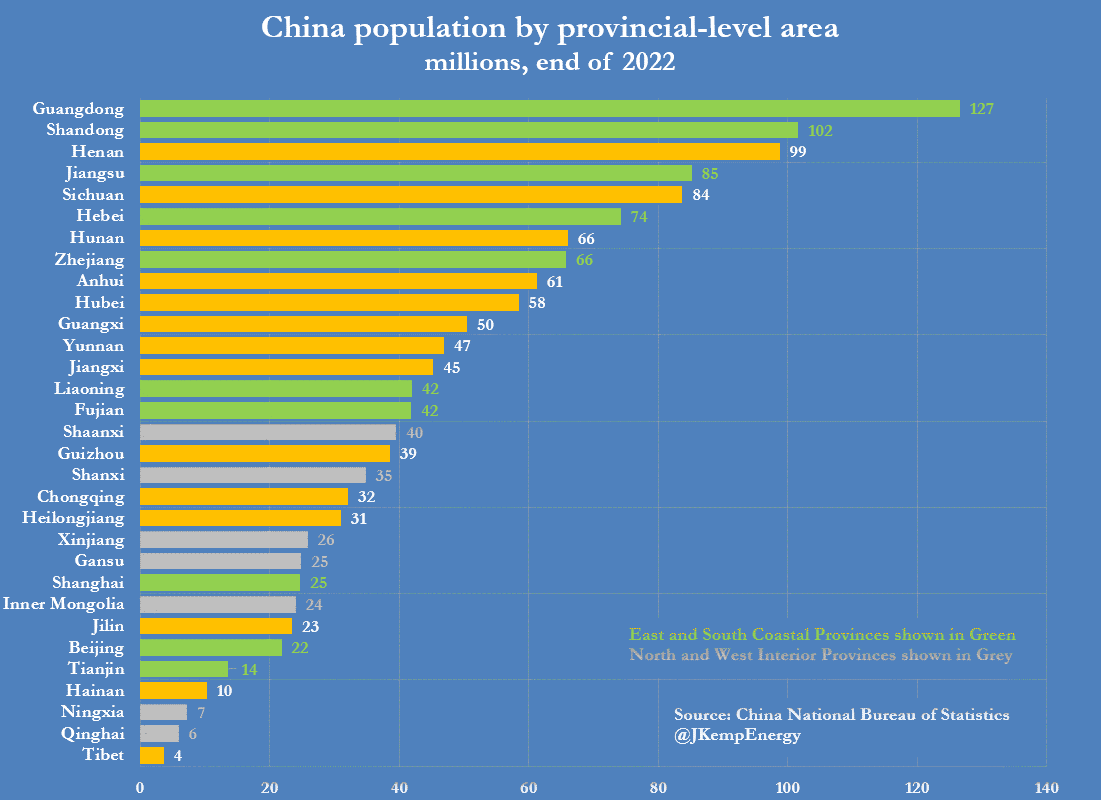

China's northern and western regions possess abundant energy resources—coal, gas, wind, and solar—but lack the population and industrial demand to fully utilize generated electricity.

China's unprecedented deployment of wind and solar power has exacerbated regional electricity imbalances, necessitating the shutdown of surplus renewable generation when local consumption capacities are exceeded.

Government measures aim to mitigate renewable energy curtailment by expanding long-distance transmission networks and harmonizing generation strategies among provinces.

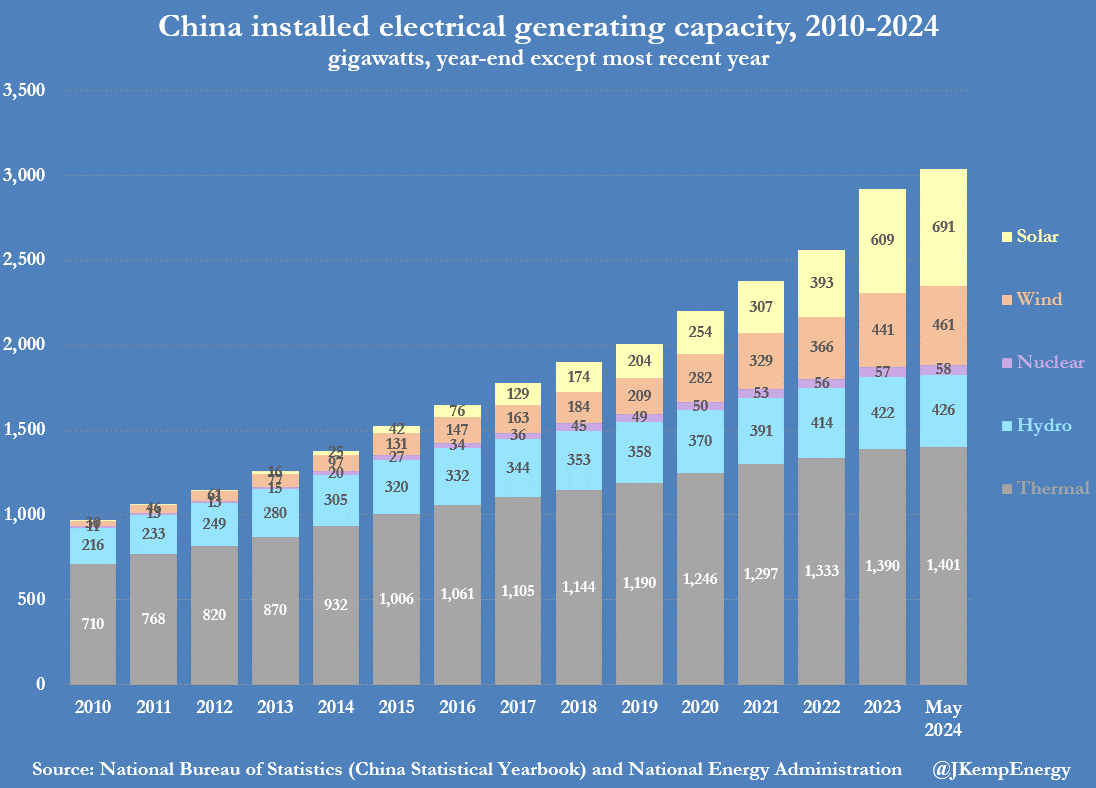

Since late 2018, China has added a total generating capacity of 1.137 billion kilowatts (kW), achieving an annual growth rate of 9%, as per data from the National Bureau of Statistics (NBS). During this period, thermal capacity, primarily from coal-fired plants with some contribution from gas-fired generators, expanded by 257 million kW annually ("China Statistical Yearbook", NBS, 2023).

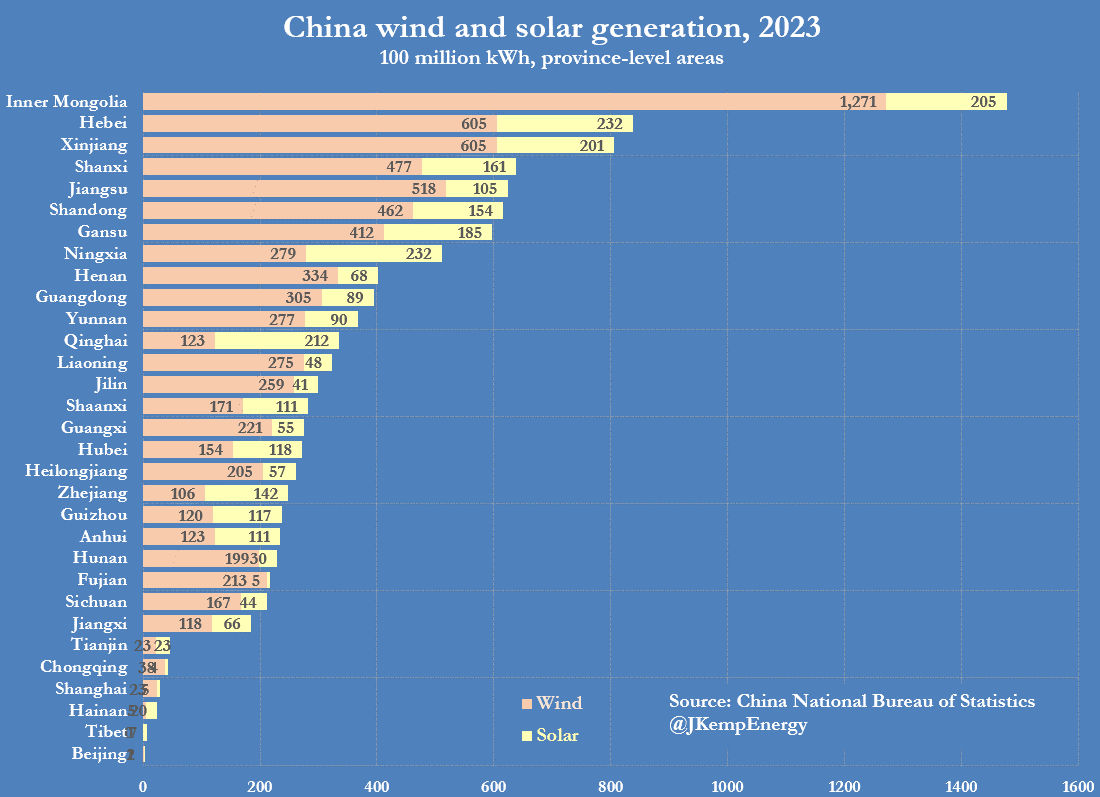

However, the bulk of capacity additions originate from what the government terms "new energy sources"—wind farms (277 million kW, 19% annually) and solar installations (517 million kW, 29% annually). The increased penetration of intermittent renewables complicates management of a national grid already challenged by significant regional disparities in generation and demand.

The strategy to stabilize variable wind and solar outputs involves spreading fluctuations across a broader array of generators spanning vast geographical areas, necessitating increased transmission infrastructure and improved scheduling mechanisms.

Long-Distance Transmission

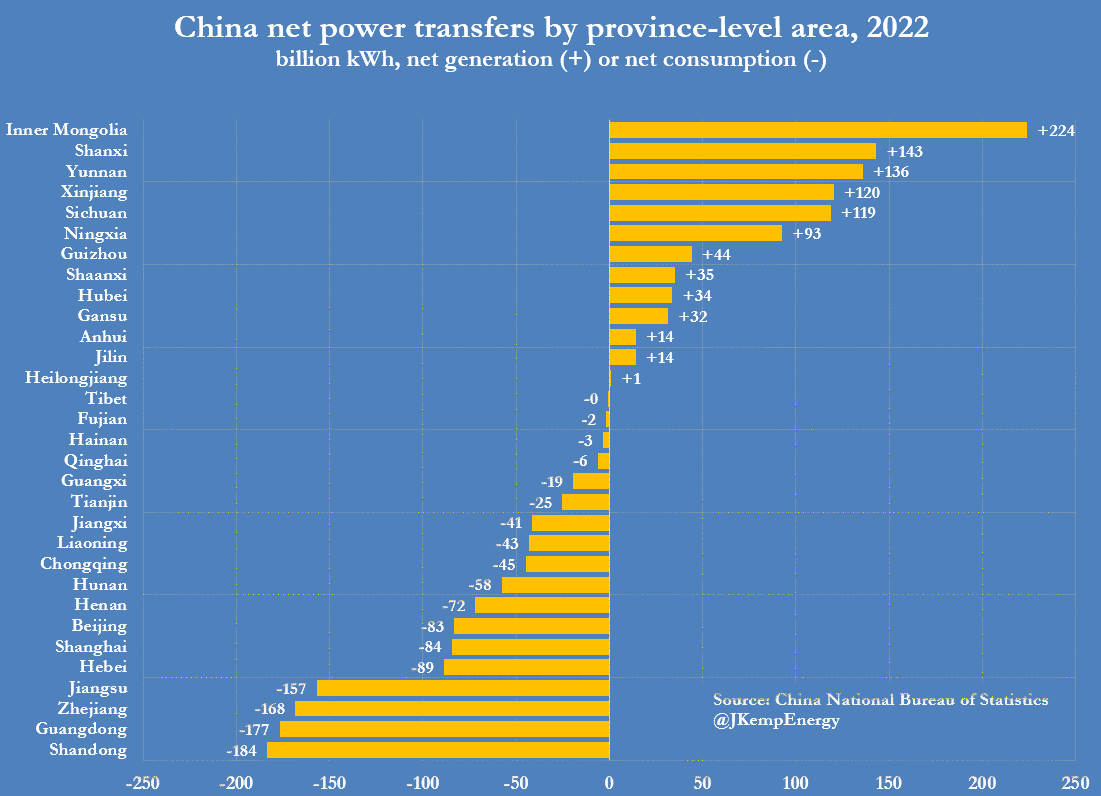

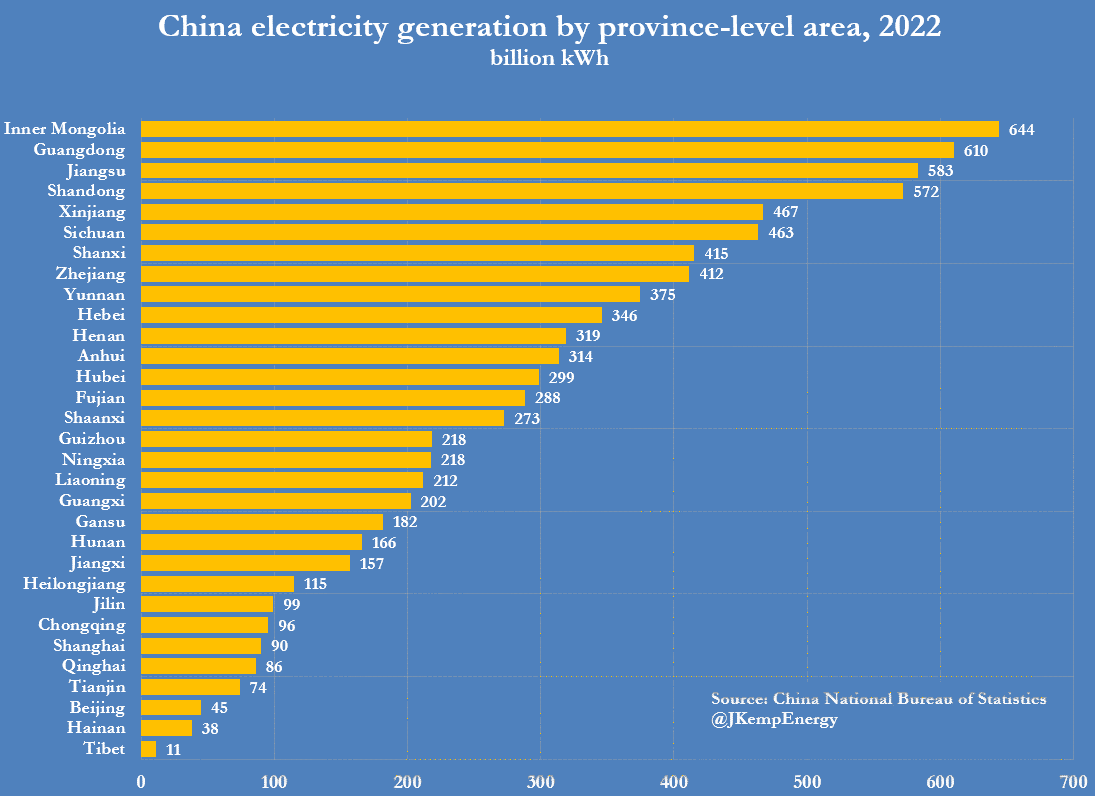

For decades, China has facilitated large-scale west-to-east electricity transfers from surplus-generating inland regions to high-demand coastal zones in the east and south. In 2022, ten eastern and southern provincial-level areas (Liaoning, Hebei, Beijing, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, and Guangdong) accounted for 50% of national electricity consumption but only 40% of generation.

Conversely, six less densely populated northern and western regions (Inner Mongolia, Xinjiang, Shanxi, Shaanxi, Gansu, and Ningxia) contributed 25% of national generation but consumed just 18%.

China Regional Electricity Transfers

In response, China's State Grid Corporation has developed an extensive network of ultra-high voltage transmission lines to transfer electricity thousands of kilometers from surplus-producing regions in the west and north to deficit areas in the east and south. This initiative has positioned China as a global leader in ultra-high voltage transmission technology, minimizing transmission losses and exporting expertise worldwide.

Energy Abundance in Inner Asia

China's northern and western regions, characterized by sparse populations and substantial energy reserves—historically coal-centric but increasingly diverse with gas and renewables—house the country's primary coal deposits. These regions have become major sources of locally consumed electricity for heavy industry, with surplus power transmitted east and south.

In 2022, Inner Mongolia, Shanxi, Shaanxi, and Xinjiang alone accounted for 81% of coal mine production and a quarter of all thermal generation, according to NBS data.

Interestingly, these arid northern plains and deserts, also optimal sites for extensive wind and solar projects, collectively contributed 42% of China's wind and solar generation last year.

However, the rapid addition of wind and solar capacity in regions already saturated with coal-fired power risks overloading the transmission system. During peak wind and solar generation periods, insufficient local demand and inadequate long-distance transmission capacity hinder the redistribution of surplus electricity eastward and southward.

Expansion of Transmission and Strategic Planning

In 2016, the utilization rate for new energy sources plummeted to a record low of 84%, prompting the central government to launch the "Clean Energy Absorption Action Plan" aimed at mitigating renewable resource wastage. The initiative focused on enhancing local distribution, inter-provincial transmission capabilities, and energy trading to minimize curtailment of new energy generation.

By 2023, wind power utilization had soared to an impressive 97.3%, with solar close behind at 98%, as reported by the state-run Xinhua news agency.

Despite these gains, rapid renewable capacity expansion has rekindled concerns over curtailment, with wind utilization dropping to 96.1% and solar to 96% in the initial five months of 2024. This decline prompted a warning from the National New Energy Consumption Monitoring and Early Warning Center ("Addressing Challenges in New Energy Consumption", Xinhua, July 1, 2024).

The response is expected to prioritize enhanced integration of renewables at the local level and bolstered transmission capacity for surplus power across provincial borders. Recent government policy statements underscore the imperative of closer coordination between provinces in both generation and transmission sectors to achieve more extensive renewables integration.

Striving for a Unified National System

Reflecting the issue's critical importance, China's Communist Party Politburo convened a special study session on new energy technology and energy security on February 29, 2024. The session, attended by top central and regional leaders, emphasized enhancing "the grid's capacity to integrate, distribute, and regulate clean energy" ("Xi Stresses High-Quality Development of New Energy", CPC International Department, March 2, 2024).

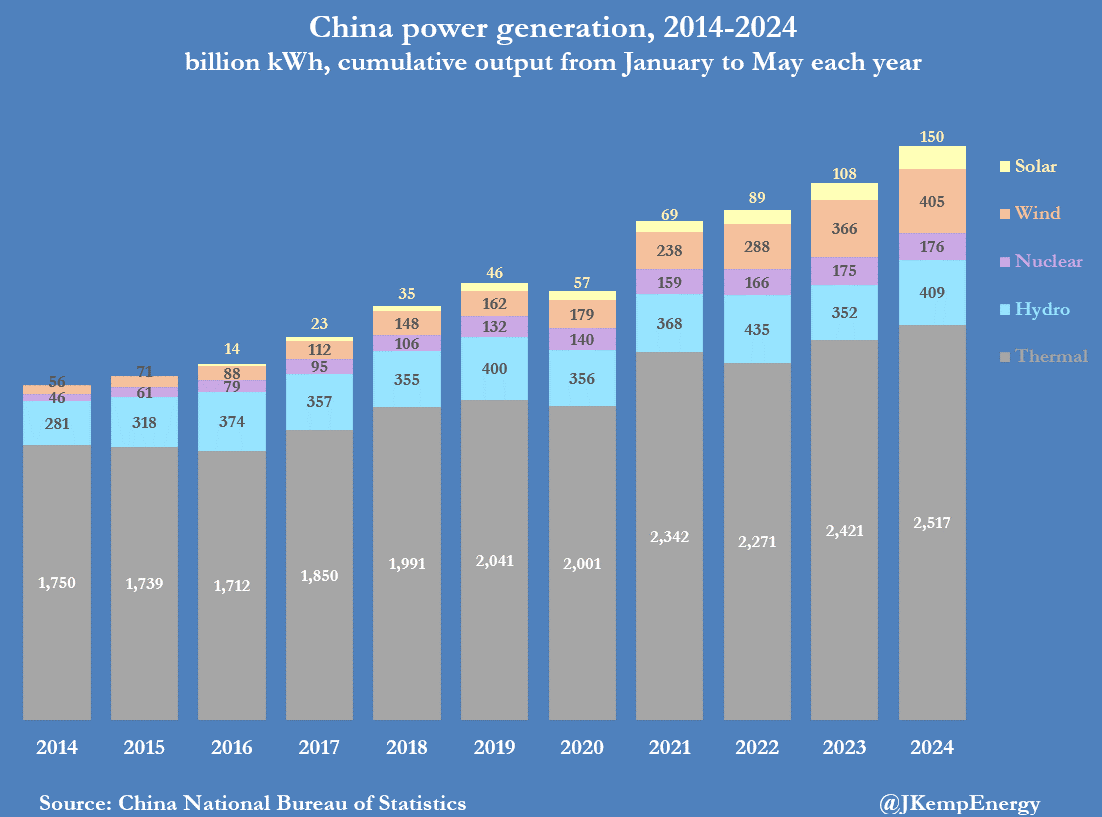

China's ultra-high voltage transmission network stands as a remarkable engineering achievement, likely to serve as a model for other nations grappling with increased renewable energy integration into their grids. This infrastructure advancement has facilitated significant penetration of intermittent renewables and hydropower into the national energy system, enhancing overall reliability and performance. As a result, wind and solar sources accounted for 15% of total generation in the first five months of 2024, up from 7% in the same period in 2019.

However, challenges remain in consolidating China's fragmented provincial-level utilities into a cohesive national grid that efficiently manages diverse energy priorities. Achieving higher renewables penetration targets will necessitate even closer cooperation and integration across broader geographical areas and energy sectors.

Climate-change to lower emissions

Hydropower Rebound Poised to Curtail Fossil Fuel Expansion.

After a slump in 2023, global hydropower production has surged this year, buoyed by ample rainfall in key hydropower-producing nations.

The recovery in hydropower output from last year’s lows is expected to displace some fossil fuel consumption in electricity generation.

In 2023, energy-related emissions reached a new high as coal use escalated in major developing markets hit by reduced hydropower production, as reported earlier this year by the International Energy Agency (IEA).

Coal-fired electricity generation accounted for more than 65% of the emissions increase in 2023, largely due to a global shortfall in hydropower caused by drought conditions.

Countries like China and India, heavily reliant on coal, intensified their coal power generation to compensate for the diminished hydroelectric output caused by below-average rainfall, depleting major river water levels and reservoir capacities.

The decline in hydropower production and its substitution with coal resulted in an estimated increase of around 170 million tons in emissions last year, according to the IEA's calculations.

"Without this effect, emissions from the global electricity sector would have declined in 2023," the IEA stated in its report.

This year, substantial rainfall and sufficient reservoir levels in China have driven a significant rise in Chinese hydropower production, with this strong performance anticipated to continue into the summer months due to favorable rainfall forecasts.

China, boasting the world's largest hydropower capacity at 425 GW, including the monumental Three Gorges Dam, leads the global hydropower sector.

Meanwhile, in Brazil, another key hydropower market, hydropower output achieved a new milestone of 206 billion kWh in the initial five months of 2024.

Biden Administration Accelerates Land Acquisition for Energy Agenda

Energy is essential—not just the fuel for our daily lives, but the backbone of our economy. From powering homes to fueling agriculture and industry, reliable electricity is crucial. However, the Biden administration's ambitious climate agenda is threatening this reliability.

Recently, the Department of Energy (DOE) unveiled plans for 10 National Interest Electric Transmission Corridors (NIETCs) aimed at modernizing the nation’s grid. These corridors, which could span up to 100 miles wide, are intended to expedite the construction of mega-transmission projects, bypassing state regulations and empowering federal oversight through the Federal Energy Regulatory Commission (FERC).

One of these corridors, the proposed "Midwest-Plains" NIETC, includes the Grain Belt Express (GBE), a high-voltage transmission line stretching from Kansas to the Indiana border. Despite objections from groups like the Missouri Farm Bureau (MOFB), which advocate for landowner rights, GBE has gained approval to proceed, and now stands to expand its footprint across Missouri.

This initiative is part of a broader push by the Biden administration to reshape the energy landscape. By phasing out traditional energy sources like coal and natural gas in favor of intermittent renewables like wind and solar, the administration aims to reduce carbon emissions but risks destabilizing the grid in the process.

Financial incentives from recent legislation further incentivize investment in green energy, leading to the conversion of vast agricultural lands into solar farms and supporting infrastructure. This shift, while promoting renewable energy, threatens the productivity of some of our nation's most fertile farmland.

The Missouri Farm Bureau supports a diversified energy approach but warns against jeopardizing the reliability of our electrical grid. Unlike coal, natural gas, and nuclear power, which can be adjusted as needed, wind and solar power are subject to weather conditions, posing challenges to grid stability.

The Biden administration’s swift adoption of green energy policies, akin to elements of the Green New Deal, is encroaching on private property rights.

The integrity of our nation's energy security and the rights of property owners are at stake.

This week was full of attention grabbing news!