Weekly Skepticism #8

Superman power source, COVID free ride over, U.S debt-a.k.a rich people stimulus (Luke Gromen), E.V. melt down continues, Berkshire $$$, New bull market in uranium and more....

The Sun’s Unexpected Surge: A Red Flag for the Coming Months

The sun, that blazing sphere around which our world spins, has been behaving far more aggressively this year than scientists had anticipated. This surge in solar activity could spell significant trouble in the months to come. The sun’s fluctuations impact our climate more profoundly than any other factor, and we've seen an uptick in seismic activity alongside these solar storms. The current solar cycle, expected to peak in the next year, shows no signs of slowing down.

To put it bluntly, the number of sunspots last month hit levels not seen since the early 2000s. August’s average sunspot count reached 215.5, a peak not seen since late 2001, according to the Solar Influences Data Analysis Center and SpaceWeather.com. July’s count was 196.5, and NOAA’s Space Weather Prediction Center noted that solar activity is at its highest since March 2001. This level of solar activity was unexpected.

Experts had forecasted a much lower number of sunspots for August, predicting that the solar maximum was imminent and might be even more intense than previously thought, possibly leading to powerful solar flares and coronal mass ejections.

Recent months have seen the number of sunspots climbing exponentially. We might hope for a break in September, but if the trend continues, we could face severe geomagnetic storms akin to those we saw in May.

In May 2024, Earth experienced its most intense geomagnetic storm in over two decades, with auroras visible much further south than usual, affecting places like Florida and Mexico. If we encounter another large sunspot near the September equinox, we might face an even stronger geomagnetic event.

The consequences of such storms are far-reaching. In May, farm equipment was notably disrupted. Ronald Rabon, a cotton farmer, reported that his equipment malfunctioned erratically due to solar magnetic disturbances. His GPS systems, crucial for accurate spraying, were knocked out of alignment, endangering his crops.

More severe geomagnetic storms could potentially disrupt power grids, take down the Internet, and create widespread societal issues.

This surge in solar activity also correlates with the extreme heat we've experienced this summer. According to Copernicus, the summer of 2024 was the hottest on record since 1940, and this intense heat is linked to the heightened solar activity.

Moreover, elevated solar activity often correlates with increased seismic activity. Recent seismic events in California, including a swarm of five earthquakes in just two days, highlight this connection. In the past week alone, California and Nevada have experienced over 900 earthquakes. This uptick in seismic activity is deeply concerning and is a trend I’ll be monitoring closely.

The seismic instability extends beyond the U.S. In Mexico, a massive earth crack that opened on September 6, 2024, swallowed four cows, stretching 3 kilometers long and 1.5 meters wide in some places. Such phenomena are alarmingly abnormal.

Meanwhile, space continues to be an active frontier. On September 15, an asteroid roughly the size of two football fields will pass within 620,000 miles of Earth—close in astronomical terms but not a threat.

We are witnessing unprecedented activity both on Earth and in space. While this asteroid won’t impact us, the signs of increased solar and seismic activity suggest that we should brace ourselves for more dramatic events ahead. It’s only a matter of time before these developments become impossible to ignore.

EV Semi Prices Must Plummet 30-50% to Rival Diesel: New Study Reveals

It’s no secret that emission-free trucking still isn’t hitting the mark in terms of cost efficiency. Despite high-profile, token purchases from companies like Pepsi, who flaunt a handful of EV semis, the bulk of their logistics remain firmly entrenched in diesel territory.

A new report from Reuters lays bare the financial chasm that separates electric trucks from their diesel counterparts. According to a McKinsey study, the price of emission-free trucks needs to fall by up to 50% to make them competitive with diesel models.

At present, electric and hydrogen-powered heavy trucks make up less than 2% of the EU’s freight fleet. To hit the EU’s climate targets, this figure needs to soar to 40% of new sales by 2030. However, the production costs of electric trucks are currently 2.5 to 3 times higher than their diesel equivalents. This significant cost disparity has left logistics companies reluctant to embrace these greener alternatives, making the EU’s ambitious goals look increasingly unattainable.

McKinsey proposes that electric trucks should ideally be no more than 30% pricier than diesel models, a shift that hinges on major breakthroughs in battery technology.

The Reuters article also underscores that a 25% reduction in charging costs and the establishment of 900,000 private charging stations by 2035—requiring a $20 billion investment—are crucial to the EU’s carbon dioxide reduction strategy. On top of that, European truck manufacturers are facing stiff competition from Chinese companies, who have seized 20% of the bus market with their more affordable offerings.

A McKinsey study co-author noted, “I don’t think it’s impossible for electric trucks to reach this level over time.”

Earlier this year, we highlighted the plummeting demand for electric semis. “The economics just don’t work for most companies,” said Ryder CEO Robert Sanchez in May.

Ryder’s experience reflects the broader struggles of state and federal governments as they attempt to shift truckers away from diesel rigs to zero-emissions vehicles. The report suggests that substantial advancements in battery weight, range, and charging times are crucial for electric trucks to compete effectively in the cost-sensitive freight sector.

Rakesh Aneja, head of eMobility at Daimler Truck North America, echoed these sentiments to the Wall Street Journal: “Quite frankly, demand has not been as strong as we would like.”

We're Practically Giving Them Away": EV Lease Prices Crash to $20 Per Month

Thanks to a labyrinth of tax incentive loopholes, EV lease prices have plunged to an eye-watering low of just $20 per month in some regions. This dramatic shift has seen leasing become the preferred route for many buyers, as the cost of purchasing new EVs remains prohibitively high, according to a recent Bloomberg report.

In the first quarter of 2024, average monthly payments for new vehicles in the U.S. climbed to $735, while lease payments dropped to $595, according to Experian data. This trend has led to a significant rise in EV leases, which now make up 32% of EV transactions—an increase from 11% a year ago, as noted by Cox Automotive. Leasing an EV is now, on average, $88 cheaper per month compared to financing a new electric vehicle.

Bloomberg attributes the drop in lease payments to a combination of cooling demand, aggressive automaker incentives, and changes to the $7,500 federal tax credit. The Inflation Reduction Act of 2022 tightened tax breaks for EV purchases, disqualifying many models from these benefits. However, a loophole allows leased EVs to qualify as commercial vehicles, enabling automakers to apply the tax credit to leases and substantially reduce monthly payments.

Manufacturers benefit from the tax credit on leased EVs and often pass these savings on to consumers in the form of rebates or discounts. This has resulted in some jaw-dropping lease deals. For instance, in Colorado, 2025 Nissan Leafs were offered for as low as $20 a month in July, driven by both federal tax credits and state incentives.

At Koons Kia in Virginia, Finance Director Ramon Nawabi notes that high purchase prices have dampened interest in EVs. Some EV6 SUVs have been sitting on the lot for over six months, prompting Kia to offer discounted leases on top of the $7,500 tax credit. “In a sense, we’re just giving them away,” Nawabi told Bloomberg.

In the first quarter of 2024, BMW led the EV leasing market with 89% of its EVs leased, followed closely by Audi at 87%, according to Cox. Tesla, the largest U.S. EV manufacturer, only leased 24% of its vehicles. Tesla’s leases are less appealing due to the lack of lease-to-purchase options and the fact that many Tesla models qualify for the full $7,500 tax credit when purchased outright.

In addition to these developments, Robert Bryce has been a standout voice in shedding light on the broader implications of the EV market’s turmoil. His insightful analyses on the EV “massacre” offer crucial context and depth to understanding these market shifts. You can read more about his findings on his Substack.

In summary, as automakers scramble to move inventory amid shifting incentives, the cost of leasing an EV has reached unprecedented lows, making them an increasingly attractive option for consumers navigating a turbulent market.

Buffett’s Vice Chairman Sells Over Half of His Berkshire Shares: A Major Move

Ajit Jain, Warren Buffett’s right-hand man and Vice Chairman of Insurance Operations at Berkshire Hathaway, has made a dramatic move by offloading more than half of his Berkshire Class A shares. Jain’s recent sale of $139 million worth of stock represents a significant reduction in his holdings.

According to a regulatory filing on Wednesday, Jain sold 200 Class A shares at approximately $695,418 each. This transaction leaves him with just 166 shares, of which 61 are directly owned. This is the most substantial cut in Jain’s holdings since he joined Berkshire in 1986.

As CNBC points out, the motivation behind Jain’s sales remains unclear, but it’s evident he capitalized on Berkshire’s recent high valuation. The conglomerate’s stock traded above $700,000, pushing its market capitalization to $1 trillion by the end of August.

David Kass, a finance professor at the University of Maryland, suggests that Jain’s move might indicate he sees Berkshire as fully valued. “This appears to be a signal that Ajit views Berkshire as being fully valued,” Kass remarked.

The timing of Jain’s sale aligns with a broader slowdown in Berkshire’s share buybacks and the liquidation of major stock holdings, such as Apple and Bank of America. In the second quarter, Berkshire repurchased only $345 million worth of its own shares, a stark decrease from the $2 billion repurchased in each of the previous two quarters.

Bill Stone, CIO at Glenview Trust Co. and a Berkshire shareholder, commented, “At over 1.6 times book value, it is probably around Buffett’s conservative estimate of intrinsic value. I don’t expect many, if any, stock repurchases from Berkshire around these levels.”

Jain, who was born in India, has been a pivotal figure at Berkshire since joining in 1986, overseeing the conglomerate’s insurance operations, including GEICO. He played a key role in expanding into reinsurance and recently spearheaded a turnaround at GEICO. In 2018, he was appointed Vice Chairman of Insurance Operations and joined Berkshire’s board of directors.

Buffett has long lauded Jain, even suggesting in 2017 that Jain has created more value for Berkshire than he himself has. “Ajit has created tens of billions of value for Berkshire shareholders,” Buffett wrote in his annual letter. “If there were ever to be another Ajit and you could swap me for him, don’t hesitate. Make the trade!”

In 2018, Jain and Greg Abel were named Vice Chairmen, with Abel positioned as Buffett’s eventual successor. Now, with Jain’s recent sale and his 73 years, speculation mounts about his future role in the firm as Buffett, at 94, approaches retirement. The latest move suggests Jain might be preparing for his departure.

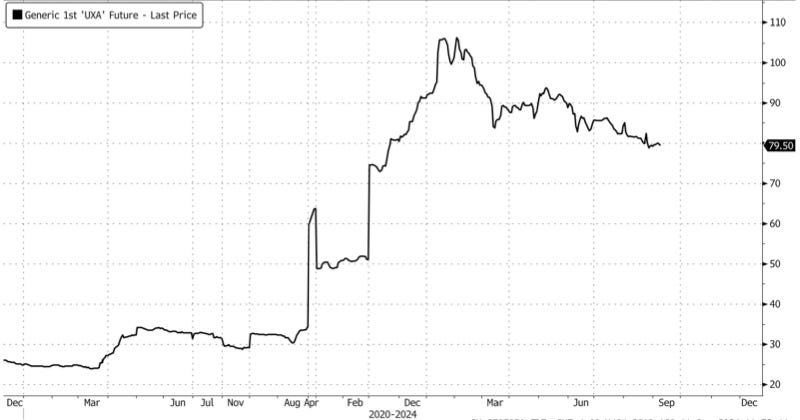

Uranium Stocks Soar as Putin Mulls Export Restrictions on Strategic Commodities

Uranium stocks are on fire as the trading day kicks off following Russian President Vladimir Putin’s latest move: a call for his government to consider imposing restrictions on exports of key raw materials, including uranium. This comes in retaliation for the relentless barrage of Western sanctions.

Putin, in his characteristic blend of braggadocio and subtle threat, declared, "Russia leads the world in reserves of several critical resources—natural gas, gold, and diamonds. Mikhail Vladimirovich [Prime Minister Mishustin], I urge you to explore potential restrictions on our exports of certain strategic goods, including uranium, titanium, and nickel. Make sure, however, that these measures do not harm our own interests," as reported by the Russian news agency Interfax.

The Russian leader's remarks signal a potential tightening of global supply chains for uranium and other crucial commodities. "Some countries are stockpiling strategic reserves and implementing various measures," Putin continued. "If it does not adversely affect us, we might consider restricting exports, not just of the goods I mentioned but possibly others as well."

This move is in direct response to the sweeping sanctions imposed by the US, UK, and EU following Russia’s invasion of Ukraine. These sanctions were intended to cripple the Russian economy and undermine its war efforts, but the strategy backfired as China swooped in as a major buyer of Russian commodities.

In reaction, the Kremlin has ramped up its military budget by a staggering 70% this year, surpassing $100 billion—a post-Soviet record. Meanwhile, Western nations are now bracing for the impact of potential Russian trade restrictions, which could send prices for nickel, palladium, and uranium soaring.

In the wake of Putin’s announcement, uranium stocks like Cameco (CCJ), Uranium Energy Corp (UEC), Global X Uranium ETF (URA), and North Shore Global Uranium Mining ETF (URNM) surged between 5% and 7%.

Adding to the bullish sentiment, Kazatomprom, the world’s largest uranium producer, recently announced it will trim its 2025 production forecast due to escalating supply chain issues.

The market is bracing for a possible supply crunch, and it seems uranium prices are poised for another sharp increase as we head into 2025. The tight supply narrative, combined with geopolitical tensions, is setting the stage for a significant price spike in the uranium market.

Another Season of Shutdown Theater: Republicans Already Caving

Welcome to yet another season of shutdown theater, with the deadline of October 1st looming before the political circus really gets underway. This time, the drama is centered around a proposed six-month funding stopgap, also known as a Continuing Resolution (CR), tied to the contentious SAVE Act—a bill that demands proof of citizenship for voter registration.

On Wednesday, House Speaker Mike Johnson (R-LA) yanked a funding bill off the House floor just hours before an anticipated vote. This move came after a rising number of Republicans pledged to torpedo the measure due to the inclusion of the SAVE Act.

Democrats, ever the picture of consistency, are pushing for a "clean" funding bill to keep the government open until December—conveniently after the elections—without any mention of the SAVE Act.

Donald Trump, ever the provocateur, is calling on Johnson and the Republicans to grow a backbone and let the government shut down if they can’t secure the SAVE Act. "We are going to put the SAVE Act and the CR together, and we’re going to move that through the process. And I am resolved to that; we’re not looking at any other alternative," Johnson declared before he pulled the bill. "You know how I operate: You do the right thing and you let the chips fall where they may." Classic Johnson bravado.

But the moment Johnson withdrew the bill, he pivoted to a more subdued tone: "We’re in the consensus-building business here in Congress with small majorities. We’re having thoughtful conversations, family conversations, within the Republican conference, and I believe we’ll get there."

Of course, this is the same Republican Party that folded like a cheap suit after the 2020 election instead of rallying behind Trump on claims of election fraud. Now, facing off against Democrats and some of their own party members over the SAVE Act, they seem ready to crumble once again.

Adding to the chaos, at least seven Republicans have declared they’ll vote against the CR outright, arguing it merely kicks the can down the road. Johnson faces a grim mathematical reality: With their razor-thin majority, House Republicans can only afford four GOP defections if all lawmakers vote. Rep. Joe Wilson (R-S.C.) was hospitalized after collapsing at an event, and with seven other Republicans publicly against the CR, Johnson's leadership is on shaky ground.

Sources told NBC News that leadership anticipated as many as 15 GOP no votes if the vote had been held on Wednesday. Notable opponents include Reps. Cory Mills of Florida, Jim Banks of Indiana, Matt Rosendale of Montana, Andy Biggs of Arizona, and Tim Burchett of Tennessee.

Burchett, ever the fiscal hawk, slammed CRs as "terrible legislating" and cited fiscal irresponsibility as the biggest threat to the country. "We are going off a fiscal cliff, and every time we do this, we just kick that can further down the road."

Mills, a military veteran and fiscal conservative, argues that the CR would weaken defense capabilities just as global threats are escalating. "Six months is an eternity in geopolitics," Mills said, emphasizing the need for swift responses to adversarial nations like China. "I’m a firm NO on bankrupting the nation and a YES on election integrity."

Rep. Thomas Massie (R-KY) shed light on the charade about to unfold over the next two weeks. As the shutdown theater continues, one thing is clear: Republicans are once again set to unravel under pressure.

Endgame: US Interest Payments Smash $1 Trillion for First Time, August Deficit Hits New Heights

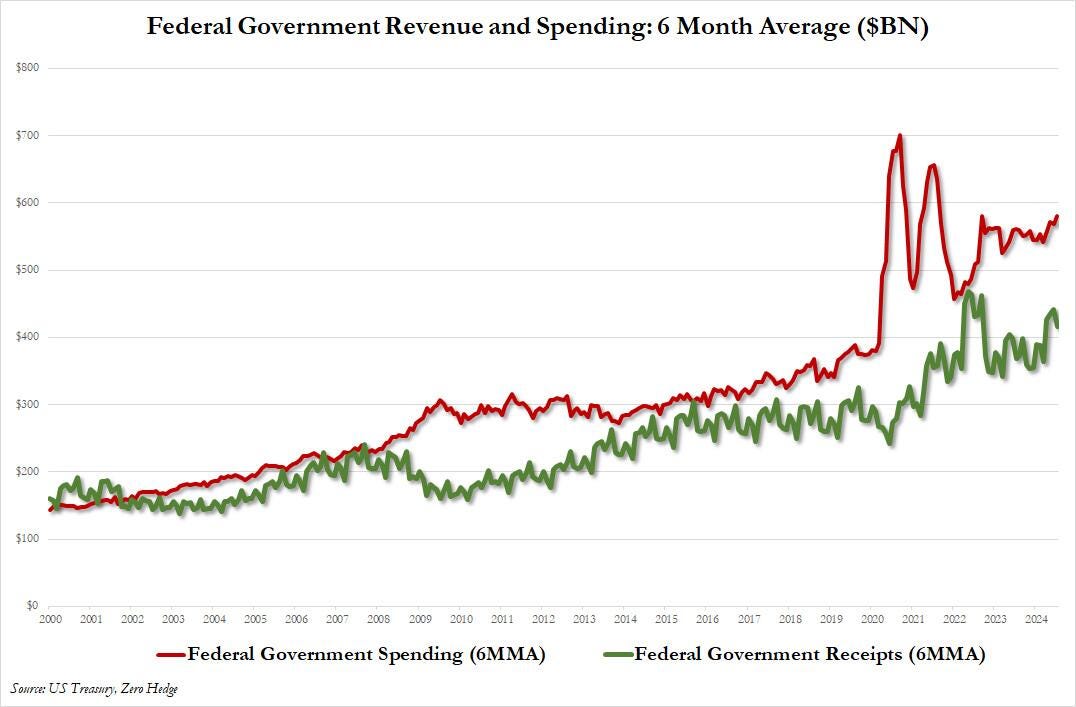

2024 was supposed to be the year of reckoning—the year when the US budget deficit would start to tame itself after the fiscal orgy of previous crises. The plan was to get a grip on spending and avoid another year of unsustainable deficits. Instead, the country has taken a turn for the worse, defying all expectations.

August saw the US budget deficit explode to an astronomical $380 billion—up over 50% from July’s already hefty $243 billion. This marks a staggering 66% increase from last August and nearly $100 billion above the median forecast of $292.5 billion. And, in true bureaucratic fashion, the Treasury chose to leak this alarming figure in the early hours, rather than the usual 2pm ET release time.

So, what led to this fiscal catastrophe? A blend of mind-boggling government spending and a desperate attempt to stimulate the economy ahead of the elections. Government expenditures surged to a record-shattering $686 billion in August—the highest monthly outlay since March 2023 and one of the largest in any month since the COVID crisis.

When smoothing out these wild swings and looking at the 6-month moving average, we see it’s reached levels not seen since the pandemic.

On the revenue side, there's a slight glimmer of hope: receipts have rebounded, partly due to capital gains taxes fueled by the soaring stock market. However, this minor victory is overshadowed by the crushing reality of our debt situation.

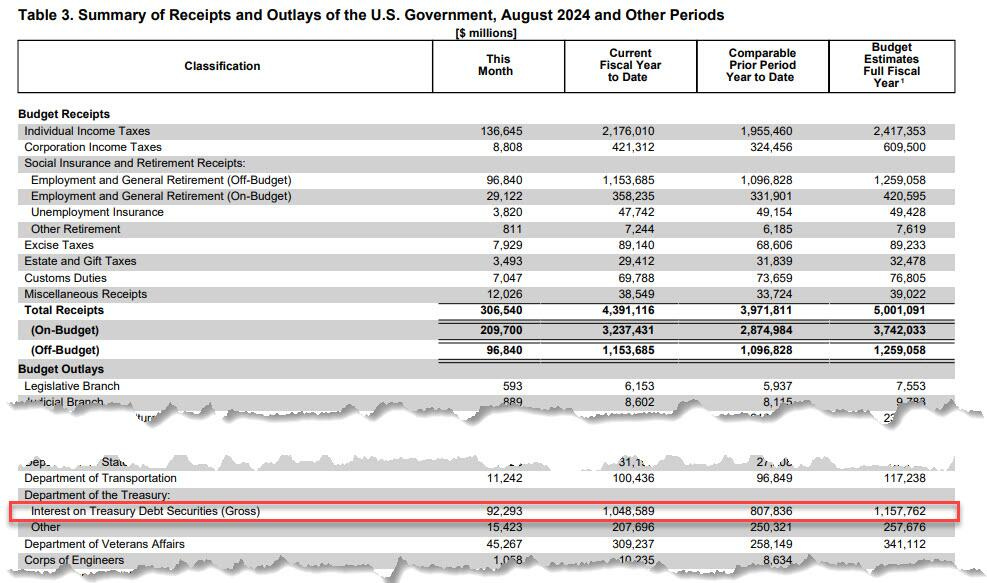

The US has now reached what can only be described as a Minsky Moment in debt interest payments. The amount spent on gross interest in August alone was $92.3 billion, pushing the cumulative total for Fiscal 2024—only 11 months in—over $1 trillion for the first time in history. Annualized, this figure approaches $1.2 trillion, edging ever closer to the Treasury’s own rounded estimate.

To put this in perspective, interest payments on US debt have now surpassed not just Defense spending but also Income Security, Health, Veterans Benefits, and Medicare. It has become the second-largest outlay of the federal government, trailing only Social Security, which clocks in around $1.5 trillion annually.

The kicker? We’re on track to hit a mind-bending $1.6 trillion in interest payments by year-end, potentially surpassing Social Security and becoming the largest single expenditure of the US government by late 2024 or early 2025.

In essence, the game is all but over. The house of cards is poised to collapse under the weight of its own debt. So, why would Trump—or anyone else for that matter—want to be in charge when the entire system is teetering on the brink? Maybe it’s time to let Kamala take the reins and watch the final act unfold.

Moderna's Post-Pandemic Plunge: Shares Sink as R&D Cuts Follow COVID Slump

The future is looking increasingly bleak for Moderna as it grapples with the fallout from the pandemic-era boom turning into a bust. The company has unveiled plans to slash $1.1 billion from its expenses by 2027 in a desperate bid to restore profitability. This move comes just over a month after investors were left underwhelmed by the company’s revised outlook on falling vaccine sales and a fading COVID business.

In a stark acknowledgment of its shifting landscape, Moderna announced it will embark on a major overhaul, trimming its R&D budget from an estimated $4.8 billion in 2024 to a range of $3.6 to $3.8 billion by 2027. The company is clearly struggling to pivot away from its COVID-centric strategy and aims to refocus its efforts.

Key points from Moderna’s latest strategy include:

Aiming for ten product approvals by 2027.

Anticipating submission of a next-gen COVID vaccine and a flu/COVID combo vaccine for approval in 2024.

Positive Phase 3 results for an RSV vaccine targeting high-risk adults, with an sBLA submission expected in 2024.

Advancing its standalone flu vaccine and norovirus vaccine into pivotal Phase 3 studies.

Implementing stringent portfolio prioritization to achieve cost efficiencies.

Moderna plans to diversify its portfolio into oncology, rare diseases, and innovative non-respiratory vaccines in an effort to counteract its dwindling COVID vaccine revenues. CFO Jamey Mock admitted, "We hope that will settle out this year, but we have to brace ourselves just in case vaccination rates continue to go down." He emphasized that the R&D cuts were necessary to maintain financial discipline amid the high costs of later-stage trials.

In early August, Moderna reported its second consecutive quarterly loss and revised its sales forecast down to $3-$3.5 billion from the previous $4 billion. Analysts are growing increasingly skeptical about the company’s path to profitability. Jefferies analyst Michael Yee raised concerns about Moderna’s ability to meet profitability and cash burn targets, while Bloomberg Intelligence’s Sam Fazeli highlighted worries about the reduced sales guidance and lack of clarity on the potential success of its RSV vaccine.

The market has reacted with a sharp sell-off, sending Moderna shares plummeting 11% in premarket trading. The stock has now entered a bear market, having fallen significantly year-to-date. Current data shows that 25.6 million shares, or approximately 7.48%, are shorted, reflecting ongoing skepticism about Moderna’s future.

In the end, it seems Moderna might need another pandemic to clear the fog of uncertainty hanging over its prospects.

Judge Slaps CFTC for Overstepping: Kalshi's Election Bets Get the Green Light

In a surprising legal twist, a federal judge has partially ruled in favor of prediction market platform Kalshi, blocking the US Commodity Futures Trading Commission (CFTC) from shutting down its election-related betting markets.

On September 12, Judge Jia Cobb delivered a verdict from the US District Court for the District of Columbia, asserting that the CFTC had "exceeded its statutory authority" by attempting to halt Kalshi’s election contracts. The CFTC's concerns that betting on political races could disrupt markets and potentially jeopardize election integrity were dismissed by Cobb.

Judge Cobb’s ruling stated unequivocally, “Kalshi’s contracts do not involve unlawful activity or gaming. They involve elections, which are neither. While the CFTC's concern about the impact of such betting on public interest is noted, this Court has no reason to entertain that argument.”

So, elections aren’t ‘gaming’?

According to Cobb, any interference from the CFTC would require explicit Congressional authorization. The judge emphasized that Kalshi’s contracts do not constitute illegal activity under current federal or state laws.

“Kalshi’s event contracts merely ask buyers to predict whether a chamber of Congress will be controlled by a specific party in a given term. This involves elections and politics but does not fall under what any party in this litigation has labeled as unlawful or illegal,” Cobb stated.

It remains uncertain whether Kalshi will immediately resume offering bets on US congressional elections. With Election Day just 54 days away and early voting in Pennsylvania set to kick off on September 16, the timing is critical.

Judge Cobb had initially ruled on September 6, allowing Kalshi to proceed with election bets. However, the CFTC’s emergency motion led Cobb to stay that decision on September 9, leaving the case in limbo.

In the broader prediction market landscape, crypto platform Polymarket continues to offer contracts on the outcomes of US presidential elections, including bets on whether Democratic nominee Kamala Harris or Republican Donald Trump will win various states or the election outright. As of now, national polls and market data indicate a tight race.

Kalshi's future in the election betting space hangs in the balance, but for now, the judge’s ruling represents a significant blow to the CFTC's attempt to curb political market speculation.

Thanks for wrapping up the week with me. Before you dive into your weekend, remember: thinking is the first step to change. Consider joining The Monterey Skeptic to make a difference and shift perspectives. Like and share to spread the word.

Timely and interesting compilation, keep em rollin!