Weekly Skepticism #6

Energy overload, More faulty temperature data, Natural gas continues it's stimulus, Health concerns could be inflammation, U.K. energy policy turning it into the new Germany!

Met Office Declares Record-Breaking Heat at Station Adjoining Major Heat-Generating Substation

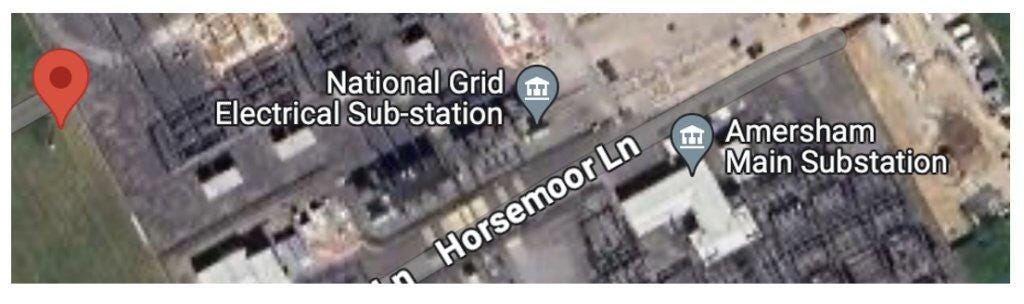

Earlier this month, the Met Office reported the hottest day of the year in the U.K., with temperatures soaring to 34.8ºC in Cambridge. According to the Met Office, this marks only the eleventh occurrence of such high temperatures since 1961, with six of these instances happening in the past decade. However, what was conspicuously omitted from this narrative is that the Cambridge weather station, located at the National Institute for Agricultural Botany (NIAB), is just a stone's throw from a colossal heat-emitting electricity substation complex.

Electricity substations are notorious for their intense heat emissions, and there's even discussion about capturing this heat for commercial use. The Cambridge station at Histon recently underwent a £5 million upgrade, which included the addition of a third heat-pumping transformer. It’s hard to imagine a more problematic location for an accurate temperature measurement than one adjacent to such a significant heat source—besides perhaps airports and solar farms.

Cambridge NIAB frequently features in the Met Office's local temperature records. Last year, it recorded the highest September temperature in the eastern region since 1949. Despite the World Meteorological Organization (WMO) rating Cambridge NIAB as a pristine Class 1 site with no temperature 'uncertainties', the Google Earth view raises questions about the validity of this rating.

WMO guidelines stipulate that any heat source near a Class 1 site must be at least 100 meters away. However, a Google map indicates that the actual distance between the Histon substation and the Met station marker might be considerably less, potentially affecting the accuracy of temperature readings. The recent addition of a third transformer at Histon only exacerbates this issue.

Electricity substations emit vast amounts of heat, with plans in place to harness this byproduct for hot water and space heating. As Nathan Sanders from SSE Energy Solutions pointed out, “Electric power transformers generate enormous amounts of heat which is currently wasted.”

Not entirely wasted, some might argue. This heat contributes to the rising temperatures used by the Met Office to fuel climate alarmism. Their network of temperature stations includes a high proportion of Class 4 and 5 sites, which can have measurement errors of up to 5ºC. Notably, around 80% of the 380 stations in the network are rated Class 4 or 5. Despite this, the Met Office claims to measure temperatures with extraordinary precision.

Ray Sanders, a citizen journalist, has spotlighted the discrepancies at Cambridge NIAB. His findings, featured in Paul Homewood’s blog, reveal systemic issues with the Met Office’s temperature stations. Earlier this year, a Freedom of Information request exposed that many stations are unreliable, but mainstream media largely ignore this controversy. Instead, the flawed data continues to support the Net Zero agenda.

Similar issues plague other Met Office locations. The Bingley No 2 site, operational since 1972, is just meters from a major city substation and has a Class 4 rating. Amersham, a newer site established in 2015, is also located close to a main substation and is rated Class 4. An FOI request shows that over 80% of the 113 stations established in the past 30 years are in Classes 4 or 5, with a staggering 81% of the stations opened in the last decade falling into these unreliable categories.

GM Slashes 1,000 Tech Jobs as it Reverses Pandemic Hiring Surge

General Motors is now unwinding its pandemic-era hiring spree, which had the company adding thousands of engineers and software developers to turbocharge its electric vehicle (EV) and connected-car ambitions. As the EV market hits a speed bump, consumer enthusiasm cools, and recession jitters kick in, GM is preparing to hit the brakes on at least 1,000 tech jobs to streamline its operations.

According to CNBC, GM’s latest cost-cutting measure will trim around 1,000 positions from its software and services division globally, with about 600 of those cuts happening at its tech campus near Detroit. This move comes just five months after the company's software chief, Mike Abbott, bowed out citing ‘health reasons,’ which some might speculate was just code for ‘I can’t deal with this anymore.’

In a move that might be described as “too little, too late,” GM promoted two former Apple executives, Baris Cetinok and Dave Richardson, in June to steer its electric, autonomous, and connected vehicles. Both executives were recruited under Abbott's tenure, making them the latest hires who now get to navigate the turbulent waters of a slowing EV market.

A GM spokesperson had this to say about the layoffs: “As we build GM’s future, we must simplify for speed and excellence, make bold choices, and prioritize investments that will have the greatest impact.” In other words, they’re simplifying by cutting a thousand jobs and hoping that fewer cooks in the kitchen will help them cook up a brighter future.

These layoffs represent about 1.3% of GM’s global salaried workforce of 76,000, including around 53,000 in the U.S. It seems GM’s new strategy is to cut jobs with the same enthusiasm they once used to hire them.

Earlier this year, in a bid to reduce staff without resorting to a virtual game of musical chairs, GM offered buyouts to about 5,000 salaried workers. The company is gunning for $2 billion in cost cuts over the next few years, following a previous round of trimming that saw hundreds of executive and salaried positions disappear faster than a Tesla off the lot.

As GM tightens its belt amid an industry-wide downturn, concerns about the cooling EV market grow. With interest rates sky-high and both new and used car prices sticking like gum to your shoe, consumer affordability is becoming a major roadblock.

GM’s stock is a far cry from its pandemic highs, and it’s becoming clear that only a significant cut in interest rates might just jump-start the struggling EV market. Until then, GM’s strategy seems to be “drive carefully and hope for the best.”

Inflammation: The Body's Fire That Can Go Rogue

Imagine inflammation as the body's equivalent of a fire drill. It’s crucial for battling the bad guys—bacteria, viruses, and the occasional rogue Lego piece. But when that fire gets out of control, it turns from a helpful blaze into an all-consuming bonfire. If you’re not careful, it can end up burning down your metaphorical house, too.

A recent study in Frontiers in Medicine revealed that nearly 35% of U.S. adults have systemic inflammation. Even among the supposedly “healthy” folks, about 15% are sporting a constant low-grade smolder. It’s like having a background buzz of static noise you can’t quite get rid of, except it’s in your body and, you know, could lead to some serious health issues.

Dr. Frank A. Orlando from UF Health warns that chronic inflammation is the backstage pass to some heavyweight diseases like heart disease, cancer, and diabetes. It’s as if inflammation is the VIP guest that shows up uninvited and wreaks havoc on your body’s otherwise orderly party.

When Your Body’s Fire Burns Out of Control

Here’s the deal: we need inflammation—it's like having a fire extinguisher ready when the house catches fire. It helps us repair damage and fend off infections. But if the fire doesn’t get turned off after the emergency, it keeps burning, and that’s when trouble starts.

Chronic inflammation, defined as lasting more than three months, can lead to a lineup of nasty health conditions. Imagine inflammation as a relentless DJ at a party, spinning tracks that lead to heart disease, cancer, depression, and more. According to Nature Medicine, inflammation-related diseases are so prevalent that they account for over 50% of deaths. Talk about a high death rate from a seemingly invisible culprit!

In a twist you didn’t see coming, scientists now view atherosclerosis—not as a cholesterol hoedown—but as a condition driven by chronic inflammation. This fire’s side effect? It helps form and rupture those pesky atherosclerotic plaques.

The Good, the Bad, and the Anti-Inflammatory

For those looking for a quick fix, medications like NSAIDs (think ibuprofen and aspirin) are available, and the FDA even approved colchicine for heart disease in 2023. However, long-term use of these drugs can be as pleasant as drinking expired milk—there are risks like heart attacks, strokes, and stomach bleeds. Plus, they can mess with your gut flora and nutrient absorption, creating a vicious cycle of inflammation.

Dr. Peter Osborne points out that the real trouble lies in our modern lifestyle. We live in a world of fast food, sedentary behavior, and endless stress—like setting your house on fire, not because you want to, but because you’ve got a faulty stove.

The Diet Dilemma

Your diet plays a starring role in chronic inflammation. Processed foods are like the fire accelerants of the dietary world—loaded with additives and sugars that keep the flames stoked. A study from 2020 found that eating a pro-inflammatory diet could boost your risk of heart disease by 38% and cancer mortality by 41%. It's like signing up for a lifetime membership to the "Inflammation Club."

But don’t think you can just eat one anti-inflammatory blueberry and call it a day. The whole “eat healthy” thing is more about consistent good choices rather than a single superfood. And let’s not forget that some people are allergic to foods like blueberries, turning them into unintentional inflammation fuel.

Toxins: Not Just for the Environment

Your home might also be a hidden culprit. Synthetic chemicals, PFAS in drinking water, and even formaldehyde from new furniture can turn your living space into an inflammation factory. It’s like having a tiny fire starter in every room of your house.

The Sedentary Trap

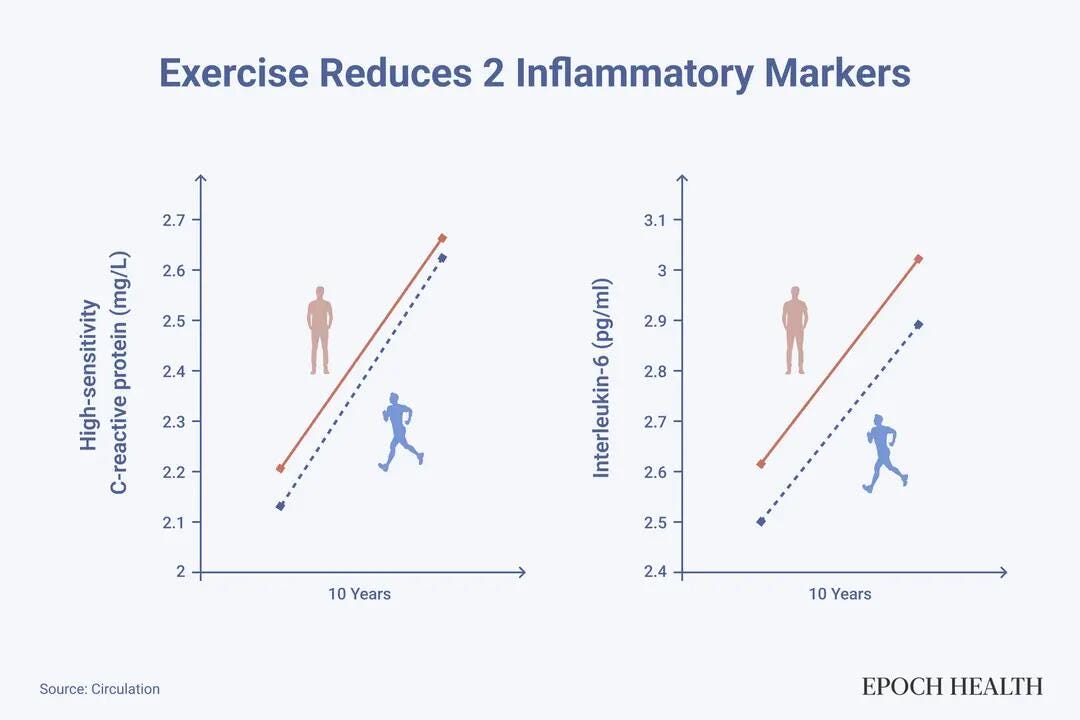

Sitting is the new smoking when it comes to inflammation. Prolonged sitting raises pro-inflammatory cytokines, while lack of exercise reduces muscle mass and ramps up fat, which in turn cranks up inflammation. So get moving, not just to keep your weight in check, but to keep those inflammatory markers down.

A study from the UK found that folks who exercised regularly had lower levels of inflammatory markers compared to couch potatoes. It’s as if muscles were the body’s natural anti-inflammatory agents—keep them strong, and you’re less likely to be on fire.

Stress: The Invisible Flame

Finally, stress is like the uninvited guest who keeps tossing logs onto the inflammation fire. It reduces immune cell sensitivity, leading to more inflammation. Stress also redirects your energy from maintaining body functions to handling immediate crises, which can further exacerbate inflammation. Think of stress as the annoying person at the party who just won’t stop fanning the flames.

The solution? Try to manage stress, find time to relax, and invest in your mental well-being. Meditation, relaxation exercises, and a supportive social circle can help douse the flames and keep inflammation at bay.

In conclusion, while inflammation is a necessary part of our immune system, letting it smolder unchecked can lead to a range of health problems. It’s about keeping the fire under control—manage your diet, exercise regularly, and don’t let stress throw more logs on the blaze. After all, you don’t want your body’s fire to turn from a helpful blaze into an out-of-control inferno.

North Sea Oil Producers Ready to Jump Ship as UK Tax Woes Drive Them to Norway

UK oil and gas producers, including Serica Energy, are eyeing greener pastures—specifically, Norway—as they consider relocating operations due to the UK’s increasingly unfriendly tax environment. The UK government’s latest moves to hike windfall profit taxes and strip away tax incentives have set off a scramble for safer havens.

This exodus threatens to hit the UK with a double whammy: job losses and a significant dip in energy security as it becomes more reliant on imported energy. Ironically, the UK is now facing a fate reminiscent of Germany’s recent struggles—a nation that once stood as a pillar of industrial might but now grapples with energy policy woes.

Once upon a time, the North Sea was the crown jewel of oil and gas production. But now, as hope dwindles faster than a tax break in a Labour budget, some of the UK’s biggest oil drillers are plotting their escape routes.

Serica Energy, a major player in the North Sea, is leading the charge. Chairman David Latin recently delivered a zinger that should send shivers down the spine of anyone concerned with the UK’s energy future. “The UK is now fiscally more unstable than almost anywhere else on the planet,” he told the Telegraph. “That means we are looking for new places to invest our money. And Norway is a place where potentially we could recreate our business model.”

Latin’s remarks are a not-so-subtle hint that the Labour government’s fixation on expanding wind and solar power—funded by oil and gas tax revenues—is driving the industry away. The plans to hike windfall profit taxes and yank tax incentives are likely to be the final straw for many.

Adding to the uncertainty, the shifting sands of future energy policies have left North Sea operators wary of sinking money into local production. “Policy uncertainty makes us hesitant to spend money quickly,” said Robert Fisher, chairman of Ping Petroleum, to the Financial Times. “If we invest and policies change, we’re back to square one. People are abandoning fields with significant reserves.”

As Latin’s comments suggest, those abandoning the British North Sea will likely find more hospitable climates for their investments. Meanwhile, the UK government will face a real challenge finding another industry it can squeeze so effectively. Labour’s ambitious plans for a green energy transition are shaping up to be a pricey affair—turns out, fast and ambitious costs a lot more than just ambitious.

In this new era of economic malaise, the UK seems to be stepping into Germany’s shoes. Once an industrial powerhouse, Germany has been struggling with high energy costs and diminished industrial competitiveness, largely due to its own aggressive green policies. Now, the UK is finding itself in a similar predicament, transitioning from a thriving energy hub to a precarious state with increased energy imports and escalating costs.

According to the Financial Times, tax revenue from the oil and gas sector, which hit nearly £10 billion last year, is expected to plummet to just over £2 billion by 2028. This shortfall threatens to undermine Labour’s Great British Energy—a state-backed effort to finance the energy transition.

“If the government implements the kind of windfall taxes they’re talking about,” warned Stifel analyst Chris Wheaton, “we’re looking at a cliff edge in UK energy production. The industry will be taxed into uncompetitiveness, leading to a dramatic decline in investment, production, jobs, and a big hit to energy security.”

In other words, if North Sea oil and gas producers want to keep their operations alive, they’d be wise to look abroad. For Serica, Norway is the obvious choice. If Norway doesn’t pan out, they’ll keep searching, but one thing’s for sure: they won’t be supplying oil and gas to the UK. If others follow suit, the UK will face not only job losses but also an even greater dependence on imported energy. The UK’s new identity as the “new Germany” in the energy sector might be its most ironic export yet.

Texas Hits New Highs in Electricity Demand—And No, It’s Not Because of More Air Conditioners

Texas has officially become the land of bigger, hotter, and more energy-hungry everything, as it recently set an unofficial record for electricity use. This surge is thanks to Texans cranking up their air conditioning to full blast during the August heatwave, likely trying to avoid turning into human popsicles.

ERCOT, the state’s grid operator and the proud keeper of the “world’s largest power grid” title (we're talking big hats and even bigger power lines), hasn’t asked Texans to conserve energy this year. Maybe they’re holding out for the dramatic finale.

According to the Electric Reliability Council of Texas (ERCOT), the Lone Star State just used a record amount of electricity on Tuesday. The data is still warming up in the ERCOT offices, waiting for the final meter readings to make it official. Bloomberg chimed in, noting that this year’s heatwave has been downright mild compared to last summer, when Texans managed to break the electricity demand record a whopping 21 times.

Earlier this year, ERCOT forecasted that electricity demand in Texas could double in the next six years. This projection is less of a crystal ball moment and more of a “Hey, we need more power, and we need it fast!” call. According to the Texas Tribune, this prediction is driven by an explosion of new data centers and a population that’s growing faster than a teenager’s appetite for pizza.

ERCOT President Pablo Vegas laid out the situation to state legislators with the kind of enthusiasm usually reserved for sports teams: “We’re facing a whole new ball game of demand growth. We need to rethink our game plan to ensure we can keep the lights on and everyone cool.”

On the bright side, ERCOT seems to be better equipped this year to handle those electricity surges. According to the Houston Chronicle, ERCOT hasn’t had to make a call for energy conservation yet, which might be a victory lap for their planning team. “We expect to have adequate supply to meet demand today,” said ERCOT’s president on Tuesday, probably with a relieved sigh.

The executive added that recent upgrades to energy storage, solar, wind, and even a few new gas-powered resources have made a difference. This means Texans can enjoy their air conditioning without fear of blackouts—though it’s a safe bet that the next record-breaking heatwave might have everyone questioning if their energy bills will need their own record book.

So, while Texans continue to bask in their record-setting heat and energy use, ERCOT is busy making sure they don’t set any new records for blackouts. The energy dance continues, with everyone hoping the only thing breaking records is the air conditioning.

European Power Prices Go Negative as Renewable Energy Surges—Green Power Hits a Snag

Europe's energy markets are getting a taste of a new kind of financial flip, courtesy of an abundance of wind and solar power. On Wednesday, several European markets, including Germany, saw power prices dive below zero—a refreshing change if you’re an energy consumer but a bit of a head-scratcher if you’re an energy provider.

Germany, the poster child for wind energy, is experiencing an excess of the breezy stuff, with wind generation expected to hit a robust 22.7 gigawatts. This tidal wave of green electricity has led to a bit of a grid jam, causing power prices to drop into the negatives for six hours straight on Tuesday, according to Epex Spot SE. Negative pricing, you see, is what happens when there’s more electricity than people can use—like having a buffet with endless food and no guests.

The rapid rise of wind and solar power is giving Europe’s energy market a makeover. On days when the sun is shining and the wind is blowing like it’s trying to set a record, the grid can get overwhelmed with cheap, plentiful power. So cheap, in fact, that the prices turn negative. It’s like getting paid to take home a gallon of milk, but with kilowatts and a slightly more complex grid system.

Of course, the flipside of this green energy bonanza is that when the wind stops blowing and the sun decides to nap, the grid can suffer from a bit of an energy diet. It’s a classic case of “too much of a good thing” followed by “not enough of a good thing.”

To smooth out these wild fluctuations, Europe will need to invest heavily in battery storage. Imagine it as the energy grid’s version of a savings account—storing up the excess power when there’s a windstorm or a solar fiesta, and then drawing on it when things get a little too quiet. This way, Europe can avoid those awkward moments when the grid’s power supply looks like a rollercoaster ride.

As Europe sails towards its green energy horizon, negative pricing is set to become more of a regular feature, highlighting the need for robust energy storage solutions. It’s all part of the grand plan to keep the lights on, the prices steady, and to ensure that the renewable revolution doesn’t turn into a series of awkward power price bloopers.

So while Europe is basking in the glow of its renewable success stories, it’s also learning to navigate the quirky side effects of a grid that’s finally getting what it wished for—just not always in the way it expected.

U.S. Gas Guzzlers Hit Record Highs as Power Plants Party on Cheap Fuel

U.S. electricity generators went on a gas-guzzling spree that would make even a Hummer blush. With natural gas prices hitting their lowest point in over 50 years, power plants have been running their least-efficient, gas-hungry machinery like it's going out of style.

The U.S. Energy Information Administration reports that between January and April, generators cranked out a staggering 1,334 billion kilowatt-hours (kWh)—a new record. That’s a 4% increase from the previous year and roughly the same compared to the last decade. It’s like the Super Bowl of electricity production, only with fewer touchdowns and more turbine whirs.

The real kicker? Two-thirds of this power boost came from gas-fired units, which belched out an extra 30 billion kWh. Solar farms pitched in with 13 billion kWh, making them the understated MVPs of the energy mix. Despite the massive uptick in power generation, the gas storage tanks are still bursting at the seams.

Generators’ appetite for gas was insatiable, gobbling up 213 billion cubic feet more than last year—making a total of 3,941 billion cubic feet (bcf). And despite this record-breaking consumption, gas inventories remained stubbornly high. At the end of April, they were 36% above the 10-year average, thanks to a winter so mild it could have been a summer’s day in Florida.

Gas prices for electricity producers plummeted to an average of just $2.05 per million British thermal units (BTUs) by April. When adjusted for inflation, this is the lowest price on record since data collection began in 1973. It’s a price drop that makes discount bin shopping look like a luxury experience.

The ultra-cheap fuel led to a renaissance of sorts for less efficient, single-cycle gas turbines and steam generators. Normally these units are the last to get invited to the energy party, only operating during peak demand. But with fuel prices this low, they’ve been working overtime, contributing a record-breaking 14% of their theoretical capacity in April—a notable increase from previous years. It’s like seeing the kid who never gets picked for dodgeball finally get their moment in the spotlight.

Despite this surge in gas-fired generation, the gas storage situation remains anything but normal. Recurring issues at the Freeport LNG export terminal haven’t helped, and even record-breaking gas generation hasn’t managed to clear out the inventory glut.

July saw gas generation peak again due to high temperatures and sluggish wind speeds, driving up electricity demand and pushing inventories to the second-highest level for that time of year. On July 19, gas stocks were 17% above the 10-year seasonal average, proving that even record-breaking energy consumption can’t seem to shrink the surplus.

Futures prices, after a slight bounce in May and June, have slumped back to their multi-decade lows. It’s a clear message to gas producers: drill less, and maybe, just maybe, you’ll avoid the next big price dive. For now, U.S. power plants are expected to keep their gas-hungry engines running at full tilt, smashing records and keeping inventories high until the end of winter 2024/25.

So, buckle up and enjoy the ride. It’s going to be a gas-powered summer with prices staying low and storage levels stubbornly high. The energy market may be in a holding pattern, but at least the power plants are partying like there’s no tomorrow.

.

Good stuff!