Starting this week, I'll be launching my Weekly Skepticism series—brief, informed takes on a variety of topics. I'll be making this format accessible to all, while my detailed sector-specific articles will now be available exclusively to paid subscribers. With that said, let's dive in!

I began with the President Debates, which was a pain to watch, with Mr. Trump outperforming President Biden. I was agnostic, given that the political agenda is already set, signs are clear that Republicans will maintain two branches of government. More than likely the White House and the Senate, while the Democrats will take the house. Given the poor performance of House Republicans to rally behind past and current leadership, the House will be up for grabs. People always seems surprised between the changing of the guards, but it is a feature of the American political system design to have counter balance to never allow for central control. However given recent patterns in decision making, I can concluded whole wholeheartedly that regardless of the outcome, very few things change-especially domestically.

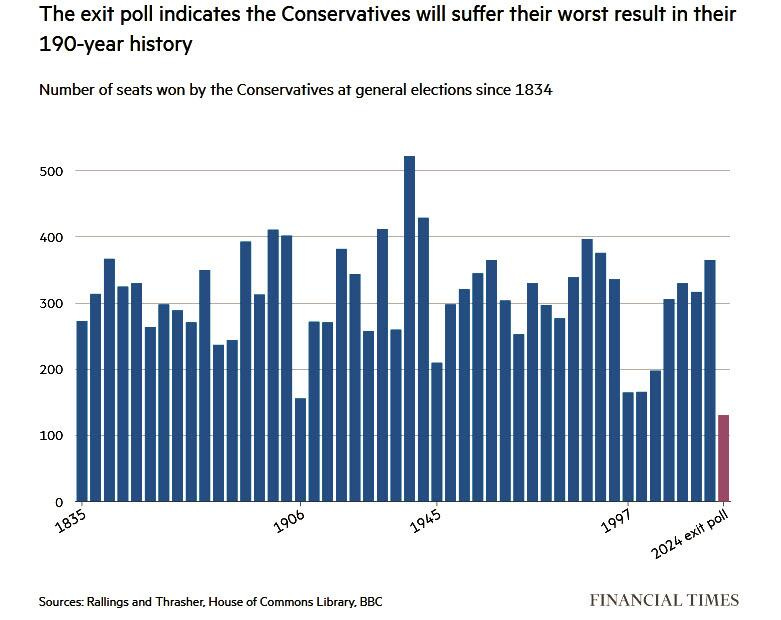

On the other side of the pond the conservative party-Tories-were crushed In Landslide UK Election. The real story here is Farage's Reform Party. The Labour Party's triumph in the UK election, as predicted by exit polls, has redrawn the country's political landscape dramatically. After 14 years of Conservative rule marred by internal strife, Labour under Keir Starmer secured an overwhelming victory, clinching 412 out of 650 seats in the House of Commons. This represents Labour's most commanding win since Tony Blair's historic 1997 election, marking a remarkable comeback less than five years after suffering a resounding defeat.

In stark contrast, the Conservative Party suffered its worst-ever electoral performance, managing to secure only 121 seats. Despite Labour's landslide in terms of seats, the victory was tempered by the fact that it was achieved with the backing of just 34% of voters—the lowest winning share in electoral history. The populist Reform UK party, led by Brexit advocate Nigel Farage, played a pivotal role by siphoning significant portions of the right-wing Conservative vote nationwide, though they secured only 4 seats themselves.

The emergence of Reform UK, heralded as the UK's most successful populist party, signals a critical shift in the nation's political trajectory. The party's rise underscores the imperative for traditional parties to address the concerns and grievances of Reform voters in future policy-making and electoral strategies. These concerns are multifaceted, encompassing economic disparities, the cost of living crisis, and a perceived neglect of national pride and identity by the Conservative Party.

Looking ahead, the evolving dynamics between Reform UK and the Conservatives pose intriguing questions. Will they converge into a new right-wing entity that amalgamates traditional conservative values with Reform's populist agenda? Alternatively, will Reform mature into a fully-fledged political force with coherent policies and a robust organizational structure by the next election cycle?

The unfolding political scenario in the UK promises to be riveting, with profound implications for the future course of governance and electoral dynamics in the country and as Doomberg points out-shout out Doomberg-the parties are one and the same, much like in America.

In a decisive 6-3 ruling that reflects deep ideological divisions, the Supreme Court has dealt a significant blow to the longstanding 'Chevron Deference', a principle in administrative law that allowed federal agencies wide discretion in interpreting ambiguous statutes through rulemaking. This landmark decision marks a pivotal shift in the balance of power between agencies and the judiciary.

Critics, particularly conservatives and Republican policymakers, have long contended that Chevron contributed to the unchecked expansion of government authority, granting unelected regulators excessive influence to shape policy beyond the original intent of Congress. This ruling underscores the Supreme Court's escalating scrutiny of regulatory agency powers in recent years.

The ruling is being hailed as a victory by conservative and anti-regulatory advocates who view it as a critical step in reining in what they perceive as governmental overreach by the "administrative state".

Chief Justice Roberts, writing for the majority, criticized Chevron as incompatible with the Administrative Procedure Act, arguing that courts are better suited than agencies to resolve statutory ambiguities which I endorse.

Beyond its legal ramifications, this ruling is expected to reshape American governance and policy-making for years to come. As legal challenges to regulatory frameworks unfold in lower courts, the broader implications of this decision on issues ranging from environmental to economic regulation will remain subjects of intense debate and scrutiny. The outcome will be more energy!

In addition to its pivotal ruling on Chevron Deference, the Supreme Court recently made another significant decision that has profound implications for environmental policy. The Court blocked a key component of the Biden administration's environmental strategy aimed at reducing ozone pollution drifting into downwind states from power plants and industrial sources.

This decision, reached by a narrow 5-4 vote split along gender lines, temporarily halts the implementation of the Environmental Protection Agency's (EPA) "good neighbor" rule. This rule, vigorously contested by upwind states, industry groups, and companies such as Kinder Morgan, was intended to impose stringent emissions requirements on power plants and pipelines across 11 states. These regulations aimed to curb smog-causing pollutants that adversely affect neighboring states' air quality.

Critics, including Ohio, Indiana, and West Virginia, argued that the rule would impose substantial costs and threaten the reliability of the electricity grid by forcing premature retirements of power generators. In contrast, the Biden administration and supporting states, led by New York, emphasized the rule's public health benefits and its role in protecting communities from harmful emissions.

The Supreme Court's decision to halt the rule underscores ongoing legal disputes over federal environmental policies and the balance between regulatory oversight and economic considerations. As the case moves to the federal appeals court in Washington for further deliberation, the future of this pivotal environmental regulation remains uncertain, with potential ramifications for air quality standards and industrial emissions control nationwide.

This development highlights the intersection of judicial review and environmental governance, shaping the landscape of environmental policy under the Biden administration and beyond. It seems the court is becoming the advocate for American energy.

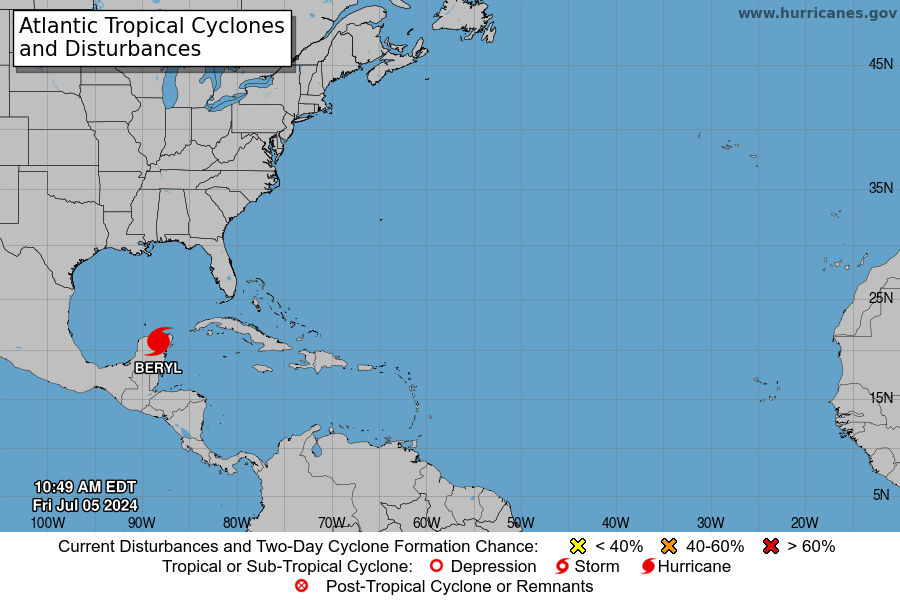

Hurricane season, spanning from June 1 to November 30, kicked off with Hurricane Beryl making landfall on Mexico’s Yucatan Peninsula as a Category 2 storm with wind speeds of 110 mph, initially seeming unremarkable. However, before reaching Mexico, Beryl rapidly intensified to a Category 5 hurricane. Given the media’s focus on climate change, questions arose about whether human activities contributed to this intensified storm.

Here's what the science says. Current research on hurricanes and tropical cyclones indicates varying levels of certainty regarding human influence:

Poleward Shift in Maximum Intensity Latitude: Observations in the northwest Pacific show a detectable poleward shift in the latitude of maximum intensity of tropical cyclones, attributed with medium confidence by IPCC AR6.

Increase in Category 3+ Intensity Estimates: Studies suggest a rise in the proportion of tropical cyclones reaching at least Category 3 intensity globally and in the Atlantic basin over the last four decades. While observed changes are detectable, attributing them confidently to anthropogenic causes remains a challenge.

Rapid Intensification Probability: Analyses indicate an increased likelihood of rapid intensification in the Atlantic, northwest Pacific, and globally from 1982 to 2017, potentially linked to anthropogenic factors, although this remains an emerging detectable change.

Atlantic Tropical Storm Frequency: Modeling studies suggest that the increase in Atlantic tropical storm frequency since the 1970s may be partly due to reduced aerosols from human activities and volcanic forcing. However, future projections from the same models anticipate a decrease in storm frequency as greenhouse gas concentrations rise.

Tropical Cyclone Propagation Speeds: While there is evidence of a slowdown in tropical cyclone propagation speeds over the continental U.S. over the past century, linking this to anthropogenic climate change remains uncertain.

U.S. Landfalling Hurricanes: There is no strong evidence for century-scale increasing trends in U.S. landfalling hurricanes or major hurricanes since the late 1800s, after accounting for changes in observation capabilities.

Extreme Tropical Cyclone Rainfall: IPCC AR6 reports high confidence in attributing increased extreme tropical cyclone rainfall to anthropogenic climate change, although global-scale trends remain unclear due to data limitations.

In conclusion, the complexities of natural variability, observational limitations, and regional differences underscores confidently attributing these changes solely to anthropogenic causes remains challenging. Or as I like to call it, it’s just normal.

We continue to see retreat from The Green New Scam, touted by many elites and embraced with fervor by climate alarmists, is showing signs of collapse. Whether driven by ignorance, ideological zeal, or greed stemming from vested interests in Green New Scam infrastructure, its supporters are increasingly facing scrutiny. Advocated by a cadre of elites ranging from media figures to politicians, its promises of curbing climate change through aggressive carbon reduction policies are proving untenable.

The core premise of the Green New Scam revolves around the belief that human-induced CO2 emissions are the primary driver of climate change. This narrative conveniently ignores scientific evidence that attributes climate fluctuations to natural phenomena like solar cycles, volcanic activity, and ocean currents.

Contrary to alarmist claims, historical data actually shows that increases in CO2 levels follow periods of global warming, not precede them.

A significant cohort of supporters behind the Green New Scam includes neo-Marxists who view climate action as a means to dismantle capitalist economies. By advocating policies that cripple industries and raise consumer costs, they seek to undermine economic stability, particularly in nations like the United States.

Another driving force behind the Green New Scam is the financial incentive for early investors in renewable energy technologies. These individuals stand to amass substantial wealth from government subsidies allocated to support green initiatives. Their profit margins remain insulated from the potential collapse of these ventures, demonstrating a blatant disregard for long-term environmental and economic consequences.

Central to the Green New Scam's agenda is the promotion of electric vehicles (EVs) as a sustainable alternative to traditional combustion engines. However, recent revelations suggest otherwise. EVs, touted as emission-free, derive their power from electricity generated by fossil fuel-dependent power plants. Moreover, the environmental toll of producing EV batteries, which require minerals like lithium, cobalt, and nickel, further undermines their green credentials.

Consumer disillusionment is mounting, with surveys indicating a significant portion of EV owners expressing regret over their purchases. Issues like high upfront costs, limited driving range, and exorbitant battery replacement expenses underscore the impracticality of mass EV adoption.

Transitioning to a net-zero carbon economy demands an unprecedented overhaul of global energy infrastructure within a single generation. Yet, current trends suggest such a transformation is unfeasible. The sheer scale and speed required to decarbonize energy production exceed practical limits given existing technological and economic constraints.

The monumental task of scaling renewable energy sources like wind and solar faces formidable obstacles. Expanded infrastructure for renewable energy generation necessitates vast quantities of materials like copper, lithium, and rare earth elements. These resources, mined at significant environmental cost, underscore the ecological toll of transitioning to green technologies.

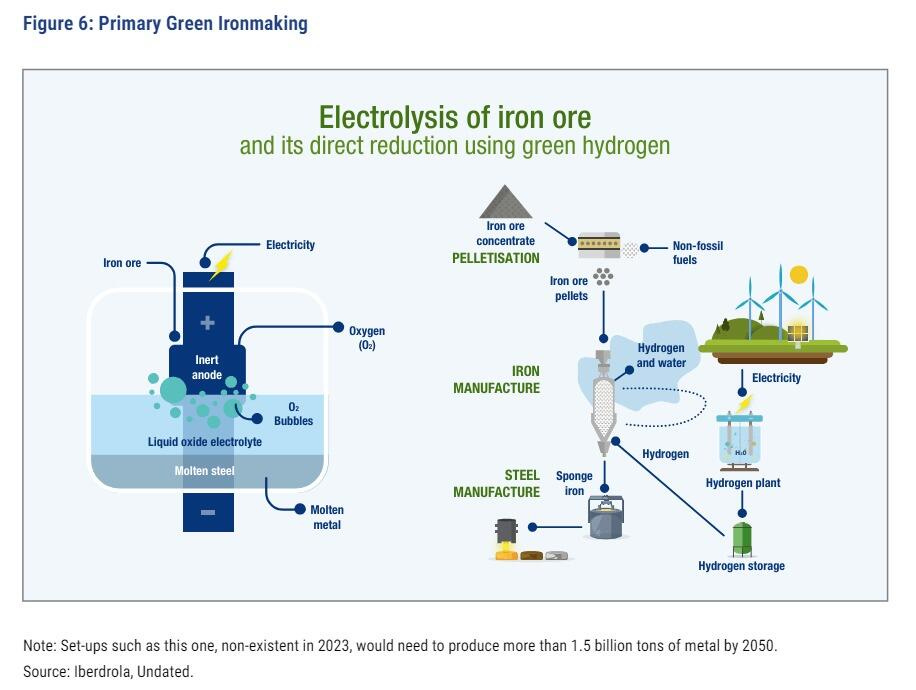

Projected costs for achieving global decarbonization by 2050 are staggering, far surpassing annual global GDP figures. Low-income nations lack the financial capacity to support such initiatives, highlighting stark disparities in global wealth distribution. Moreover, reliance on untested technologies like green hydrogen further complicates cost projections, risking massive economic instability.

In confronting the Green New Scam's narrative, it becomes clear that realistic solutions must transcend ideological fervor and wishful thinking.

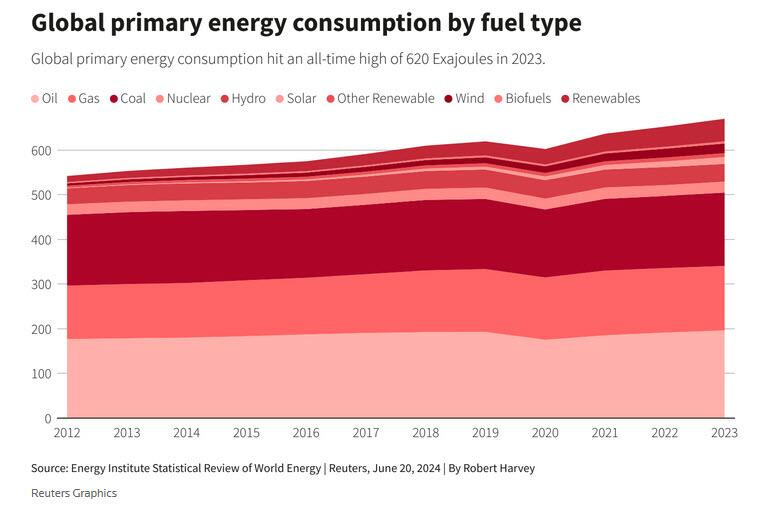

Amidst a backdrop of soaring global fossil fuel consumption, the 2023 Statistical Review of World Energy paints a grim picture amidst soaring global fossil fuel consumption, highlighting unprecedented levels of energy demand and emissions. Despite pledges for sustainability, fossil fuels maintained an overwhelming 81.5% share in the energy mix, underscoring the challenges in transitioning to cleaner energy sources. Renewable energy gains were overshadowed by continued fossil fuel growth

Global Consumption:

Global primary energy demand rose by 2% to 620 EJ in 2023.

Fossil fuel consumption increased by 1.5%, maintaining an 81.5% share of the energy mix.

Europe witnessed a historic drop below 70% in fossil fuel usage, signaling a potential shift in energy dynamics. This is because a slow down in economic activity, a.k.a demand.

Renewable energy generation surged to record highs, contributing significantly to global energy growth.

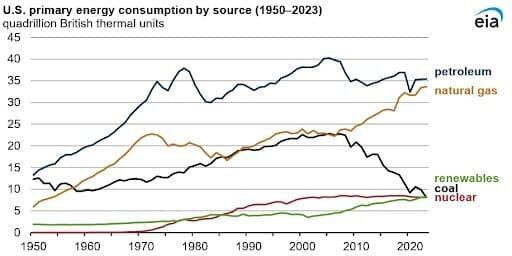

Energy consumption in the U.S. fell by 1% in 2023, driven primarily by a 17% decline in coal consumption.

Oil:

Global oil consumption surpassed 100 million barrels per day (bpd) for the first time.

Non-OPEC+ producers, led by the U.S., increased oil output by 9%.

China emerged as the world's largest refining capacity holder, although utilization rates lagged behind those in the U.S.

U.S. energy production rose by 4% in 2023, reaching nearly 103 quadrillion British thermal units (quads).

Crude oil production saw a 9% increase since 2022 and a 69% increase since 2013.

The U.S. became a net energy exporter in 2023, exceeding energy consumption by a record 9 quads, the largest surplus since 1949.

Global oil prices rebounded in mid-2023, with Brent crude reaching $86.60 per barrel and WTI climbing to $83.41 per barrel.

Natural Gas:

Global gas production and consumption remained stable.

The U.S. became the leading LNG supplier, with a 10% production increase.

Europe's gas demand declined by 7%, reflecting regional shifts in energy consumption.

Dry natural gas production increased by 4% in 2023 and has grown by 58% since 2013.

Natural gas production continued to rise despite lower prices, supported by its association with crude oil production, particularly in the Permian Basin.

U.S. natural gas futures dropped below $2.61/MMBtu following increased storage levels, though production remained strong due to recent price incentives.

Coal:

India boosted domestic coal production by 14.5% in June 2024 alone, aligning with efforts to reduce imports.

India's coal production reached 997.25 million tons in FY2023-2024, up by 11.65%.

Rising temperatures and economic growth drove electricity demand, prompting increased coal-fired power generation in India.

Renewables:

Renewable generation achieved record levels, driven by significant expansions in wind and solar capacities.

China led global renewable expansions, accounting for a majority of new capacity additions.

Renewable energy production grew by 1% year-over-year and has increased by 28% since 2013, contributing eight quads of energy.

Solar energy production recorded a notable 15% year-over-year growth in 2023, while wind production declined by 2%.

Emissions:

Despite a slight decline in fossil fuel share, CO2 emissions surpassed 40 gigatonnes in 2023 due to intensified emissions from oil and coal.

Since 2000, energy-related emissions have risen by 50%, highlighting the urgency of transitioning to cleaner energy sources.

These developments highlight significant shifts in energy dynamics, influenced by production gains, consumption patterns, and global market trends. In other words we are not running out of oil, we won’t run out of oil, & natural gas will be abundant and cheap thanks to the U.S.

In a separate development, the tech industry's demand for nuclear power to support AI data centers has emerged as a focal point. Major firms like Amazon are negotiating with utility companies, including Constellation Energy, to supply clean, reliable nuclear energy for new data centers. This initiative aims to enhance electricity reliability and support emission-cutting objectives, although concerns about resource diversion and potential consumer price impacts remain.

The discussion surrounding nuclear power's role in energy policy and market dynamics is gaining momentum, reflecting the evolving complexities of global energy transitions.

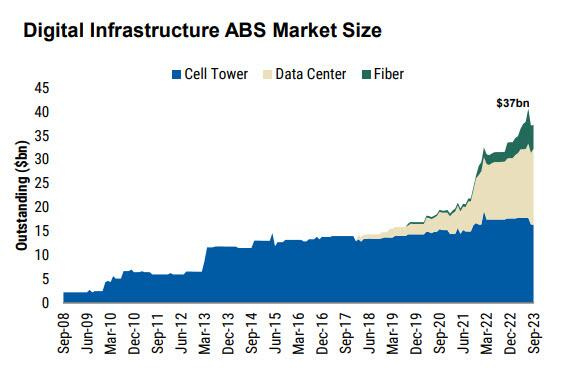

Furthermore, Blackstone Credit and Insurance’s global chief investment officer, Michael Zawadzki, highlighted significant developments in private credit markets. Speaking on Bloomberg Television, Zawadzki projected the private lending industry, currently valued at $1.7 trillion, to expand dramatically to $25 trillion.

The driving force behind this growth? "You’re financing the real economy — you’re not waiting for M&A transactions to happen,” Zawadzki said. “You’re financing consumers, you’re financing data centers, you’re financing energy transition. Huge growth capital expenditures, that’s what’s really driving the growth.”

As AI-driven technology diffusion takes center stage, credit markets, including asset-backed finance and infrastructure credit, are poised to play a pivotal role. This shift towards financing AI infrastructure, particularly data centers, highlights a new phase in global economic development, bridging technological innovation with financial capital.

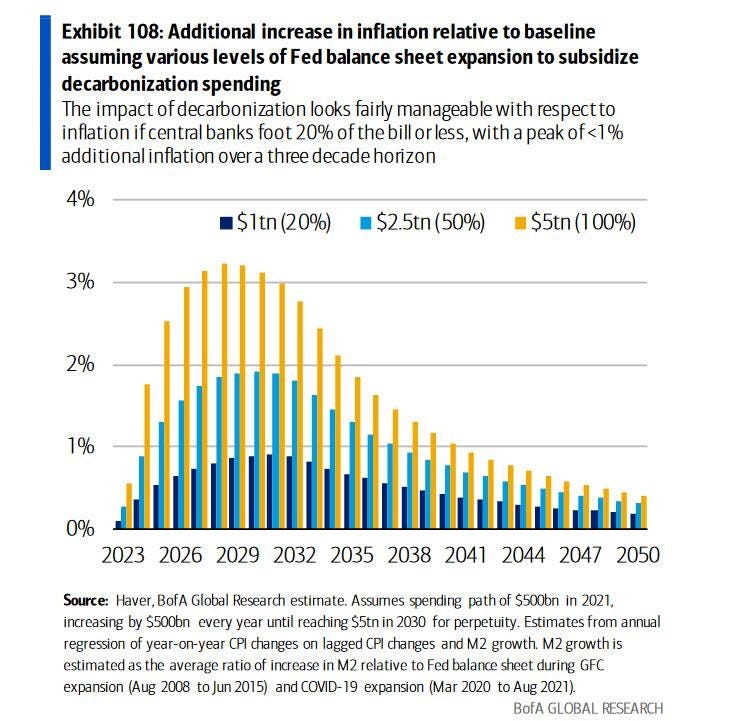

Several years ago, estimates suggested that funding the "Green New Deal" and combating climate change would require an astounding $150 trillion over three decades, equating to approximately $5 trillion annually. This ambitious plan was expected to necessitate continuous quantitative easing (QE) measures by central banks, potentially leading to significant inflation.

Critics argued that the push for green initiatives served as a convenient excuse for excessive government spending, rather than a genuine concern for the environment, especially considering the disproportionate carbon footprint of the wealthiest individuals.

This narrative was crafted during a period characterized by low inflation and negative-yielding bonds, which posed challenges for inflating away global debt. However, the unforeseen arrival of the COVID-19 pandemic and subsequent fiscal responses led to unprecedented inflation, effectively altering the financial landscape.

As inflation rendered the need for massive climate-related expenditures less urgent, it created a void for the next major spending initiative that could justify trillions in QE-funded investments. This shift highlighted concerns about the allocation of taxpayer funds and the role of intermediaries in managing such vast sums of capital.

In the intricate dance of economic policy, the Federal Reserve's recent actions have taken center stage, wielding significant influence over financial markets and consumer behavior. Concurrently, the rise in interest payments on the federal debt has added a nuanced layer to the economic landscape, shaping everything from borrowing costs to inflationary pressures.

Over the past two years, the Federal Reserve has implemented robust measures to combat inflation, including substantial interest payments to banks and money market funds. This strategy, primarily through increased interest rates on reserves held at the Fed, aims to curb lending and manage liquidity. As of July 1, these payments totaled over $400 billion, reflecting the Fed's commitment to tightening credit conditions and reigning in inflationary pressures exacerbated by a 9% annual inflation rate peak in 2022.

The rationale behind these moves lies in the Fed's dual mandate: to foster maximum employment and maintain stable prices. By incentivizing banks to park funds at the Fed with lucrative interest rates—currently set at 5.4% annually—the central bank discourages excessive lending that could fuel inflation. This approach effectively reduces the amount of money circulating in the economy, thereby dampening demand and mitigating inflationary spikes.

However, alongside these monetary maneuvers, another factor looms large: the mounting interest payments on the federal debt. As the national debt climbs, so too does the cost of servicing it. The Federal Reserve's actions indirectly influence these interest payments, as higher rates set by the Fed can elevate government borrowing costs. This phenomenon has broader implications for economic stimulation:

1. Economic Dynamics: Increased government borrowing costs can ripple through the economy, affecting everything from consumer loans to corporate financing. Higher interest rates may attract investors seeking better returns on government debt, potentially boosting capital inflows into financial markets. Conversely, higher borrowing costs can also restrain consumer spending and business investment if credit becomes prohibitively expensive.

2. Inflationary Management: The interplay between rising federal debt interest payments and the Fed's monetary policy is crucial in managing inflation. While higher debt servicing costs could theoretically add to inflationary pressures, the Fed's efforts to tighten credit and moderate inflation through interest rate adjustments act as a counterbalance. This delicate balancing act aims to achieve price stability while supporting sustainable economic growth.

3. Policy Coordination: Effective coordination between fiscal policy (government spending and taxation) and monetary policy (Federal Reserve actions) becomes paramount in navigating these complexities. The alignment of these policies determines how effectively economic objectives—such as inflation control and economic stimulation—are achieved without unduly burdening the economy with unsustainable debt servicing costs.

In conclusion, the rise in interest payments on the federal debt, coupled with the Federal Reserve's decisive monetary policy responses, underscore the intricate relationship between fiscal health, monetary management, and economic stability. These dual forces shape the economic environment, influencing interest rates, investment decisions, and inflationary pressures. As policymakers navigate these challenges, the synergy between fiscal prudence and monetary flexibility will continue to define the path toward a resilient and balanced economy.

Really enjoyed your commentary on The Green New Scam.. Unfortunately it is exactly what is happening in my home country of Australia too, and 75%+ of the public seem to lap it up...

Australia is about 4 to 8 years behind Germany, in terms of being an energy basket case (and we have 2nd largest nat gas deposits and the best quality met coal in the world...)..

I feel history will judge these few decades harshly, RE the environmental extremism and energy policy.