"Resources are not fixed. They are dynamic, shaped by technology, economics, and human choice." Vaclav Smil

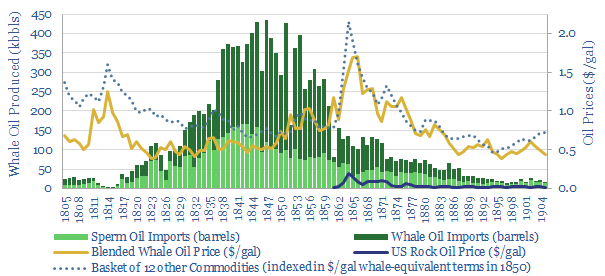

In the 19th century, whale oil lit the lamps of the world. By the 1850s, demand was insatiable, and New England’s whaling fleets scoured the oceans to meet it. Prices soared, and doomsayers warned of a looming crisis: whales were finite, and the model was unsustainable. Yet just as panic peaked, innovation struck. Petroleum emerged from Pennsylvania’s nascent oil fields, and kerosene—cheaper, more abundant—torched the whale oil market. By the 1870s, whaling collapsed, not from scarcity, but obsolescence. The lesson? Resource fears often underestimate human ingenuity.

Fast forward: today’s shale patch faces familiar cries of “peak oil.” But like whale oil’s demise, the data tells a different story—one of resilience, reinvention, and technological acceleration.

In shale, geology is destiny. Operators rank wells into three broad tiers based on geological quality and economic yield. Tier 1 wells are the elite: high-pressure, high-flow, low-decline machines that print hydrocarbons like a mint. But what exactly makes a well Tier 1—and why do these top performers upend the idea that America’s shale boom is on borrowed time?

The SEC defines proven reserves as those with a 90% recovery probability under current prices and technology—rules that implicitly shape tiering. Tier 1 wells sit in “sweet spots”: zones with high porosity, permeability, and pressure. These wells typically exceed 1,000 BOE/d in initial production (IP), with reservoir pressures above 5,000 psi and estimated ultimate recovery (EUR) often north of 500,000 barrels

.

Take the Permian Basin—America’s premier shale play. In 2023, average IP rates hit 1,359 BOE/d per rig, a 60% surge from 624 in 2019, even as the rig count dropped from 465 to 316. This isn’t depletion. It’s precision. Smarter drilling and better completions have turned Tier 2 rock into Tier 1 results. And thanks to a 2008 SEC rule change, companies can now classify shale oil as proven once extraction infrastructure is in place, unlocking billions in bookable assets.

To understand why Tier 1 wells rewrite the narrative, it helps to look under the hood.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.