The Strained Ties Between

How Dunkelflaute of Germany is effecting The EU's last oil juggernaut

"Improved cross-border energy network connectivity is susceptible to the yet untested risk of a lack of solidarity between Member States in the event of a structural supply crisis." Mario Damen, Strategic Foresight and Capabilities Unit, European Parliamentary Research Service

In the heart of Europe’s energy crisis lies a tale of two nations caught between the promises of green energy and the harsh realities of energy security. Germany, the continent’s largest economy and a self-declared renewable energy pioneer, faces an existential threat from the very green revolution it championed. Meanwhile, Norway, long regarded as Europe’s clean-energy powerhouse, finds itself in a precarious balancing act: on one side, the pressure to meet Europe’s climate goals, and on the other, the preservation of its oil and gas legacy.

The growing interdependence between Germany and Norway, particularly in energy exports, is becoming increasingly fraught. The rising energy prices in both countries, driven by external pressures, serve as stark reminders that Europe’s renewable energy dream is not as foolproof as it once seemed. As Germany struggles with coal resurgences and Norway’s energy prices skyrocket, the fragile nature of Europe’s energy ambitions becomes all too apparent.

Germany’s renewable energy transition—its Energiewende—was once seen as the shining model for the future. Massive investments were made into wind and solar power, with the goal of achieving a green energy utopia. However, the reality has proven more challenging than anticipated. Germany’s reliance on intermittent energy sources like wind and solar has left the country vulnerable to fluctuations in supply. And when the wind doesn’t blow and the sun doesn’t shine, the lights begin to flicker.

In the winter of 2025, this vulnerability became evident as Germany faced a severe energy shortage. The infamous "Dunkelflaute," a period of low renewable energy generation during cloudy and windless conditions, struck hard. On February 5, 2025, Germany’s electricity grid struggled to meet demand as renewable generation dropped to an alarming 5 GW, well below the peak levels seen in December 2023. As a result, coal, once thought to be on the way out, made an unwelcome return to fill the energy gap, reaching 8.1 GW of generation. This was the highest level of coal usage since February 2024.

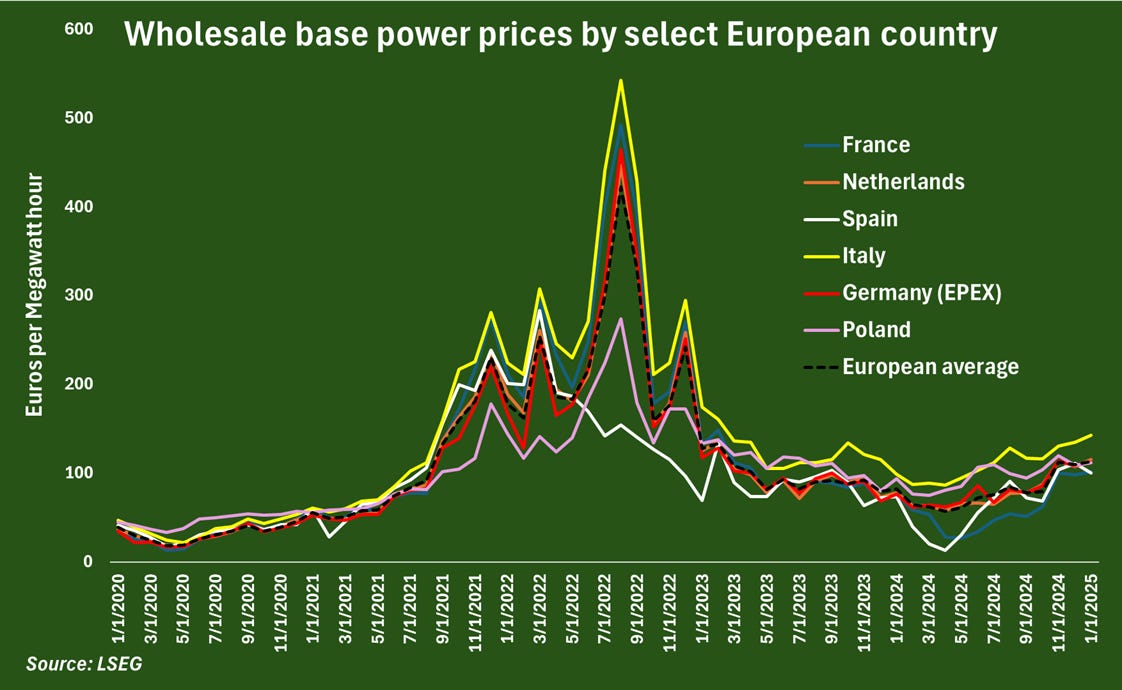

Germany’s energy crisis is exacerbated by its position as a key European hub for electricity trading. While Germany is forced to import electricity during these shortages, it also exports power to countries like the UK and France when its renewable resources are abundant. This makes Germany’s energy grid highly interconnected but also fragile. When Germany’s domestic supply runs low, neighboring countries feel the impact, leading to soaring electricity prices across Europe.

The rise of coal usage, despite Germany’s ambitious green goals, signals the failure of the renewable energy strategy to fully replace fossil fuels. While natural gas, often referred to as a "bridge fuel," continues to play a pivotal role in the country’s energy mix. In fact, the future of Germany’s energy policy is now at a crossroads: continue down the path of green energy at the expense of grid stability or invest in more robust energy solutions to complement intermittent renewable sources.

As Germany’s green energy experiment faces growing pains, Norway’s position as Europe’s energy supplier becomes more crucial than ever. The country, which generates roughly 90% of its electricity from hydropower, has long been Europe’s renewable energy lifeline. However, this role is increasingly putting Norway in the hot seat, as both domestic and European energy needs rise sharply.

Norway’s vast hydropower resources have helped power neighboring countries like the UK and Germany for years. But the growing dependence on Norwegian energy is not without its challenges. During the winter months, when renewables are scarce, Norway’s energy reserves are in high demand, and the country faces the difficult decision of whether to keep power for its own citizens or continue to export to Europe.

In 2024, Norway exported around 9 terawatt-hours (TWh) of electricity to the UK, a significant amount given that the UK’s domestic generation capacity from renewables was underperforming. Germany also relied heavily on Norwegian electricity, with over 14 TWh crossing the border. However, this increasing demand has come with consequences. As Norway depletes its hydropower reserves, domestic electricity prices have surged, putting a strain on households and businesses alike.

The political fallout has been significant, with growing dissatisfaction among Norwegians over rising energy costs. In response to public pressure, the Norwegian government has introduced measures such as electricity price freezes and calls for more stringent energy export regulations. Yet, this is a delicate balancing act: Norway’s economy remains highly dependent on its oil and gas exports, and the political pushback against energy exports threatens to undermine the country’s relationships with its European neighbors.

While the energy dynamics between Germany and Norway remain complex, one area where Norway has been making significant strides is the electrification of its oil and gas sector. Norway has been at the forefront of transforming its energy-intensive oil and gas operations, integrating renewable energy sources to reduce emissions and improve sustainability.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.