The Riddle of Steel

The secret of steel has always carried with it a mystery. You must learn its riddle, Conan. You must learn its discipline. For no one - no one in this world can you trust. Conan the Barbarian

In the opening scene of Conan The Barbarian a young Conan sits on top of a mountain given a riddle to ponder by his father. The riddle—consisting of mythology of his people—lays out the fundamental relationship of human experience with steel. The earliest known production of steel is seen in pieces of ironware excavated from an archaeological site in Anatolia (Kaman-Kalehöyük) and are nearly 4,000 years old, dating from 1800 BC and has play a vital role of shaping our societies ever since. From skyscrapers to cars, construction products, refrigerators, washing machines, cargo ships, & surgical scalpels steel is everywhere. Steel is often seen as economic indicator because of the critical role played in infrastructural and overall economic development.

The modern day steel industry can be trace to two men an American William Kelly and Brit name Sir Henry Bessemer. William Kelly and Henry Bessemer both patented what became know as the Bessemer process for two different reasons. Kelly initial goal was to reduce the amount of fuel required for iron and steel making, because of the immense amount of timber required to make the charcoal, reducing cost for his products while Sir Bessemer invention was inspired by a conversation with Napoleon III in 1854 pertaining to the steel required for better artillery.

Image from "Discoveries & Inventions of the Nineteenth Century" by R. Routledge, published 1900

Kelly's bankruptcy

Kelly suffered bankruptcy in the panic of 1857 forcing him sell his patent for a 5% royalty. His patent along with Bessemer’s was licensed to Cambria Iron works, and Bessemer name became the name of the process greatly reducing the cost of steel and quailty setting up the industrialization of America.

From Steel to Magnetics

The same principle that keeps a magnet on your refrigerator is the same principle that helps creates electricity. The pulling and pushing of electrons creates a magnetic field and that field

Image prodived by Wiki

It was this observation that lead a English Metallurgist named Sir Robert Abbott Hadfield 1st Baronet to create silicon electrical steel in 1866. The magenta properties of silicon steel aids in the free flowing of electrons. This feature resulted in silicon steel being used in electrical generation— from lamination cores in transformers to the stator and rotor of electric motors—and it is an important part of governments plan to electrify their societies to meet “net-zero” commitments. And it is these commitments that is creating a demand that can not be meet with current supply. Let’s drop the anvil and go thru some details.

Weak link in the supply “chain”

The forecasted deficits in supply from key commodities—copper, lithium, cobalt, and nickel—are well known, but few have heard of the deficits in electrical steel. We have already since how the automotive industry handled it’s last shortage crisis. The semiconductor shortage brought on by the onslaught of the Covid-19 endemic saw the curtailment production of 9.3 millions cars to date. We see how a shortage of one input can have destructive affects on an industry.

EV sales growth puts to questions about the future availability of electrical steel needed to produce electric motors to meet the electrification targets set by governments and the original equipment manufacturers (OEMs) around the globe.

Major investment set to address this expected shortage of capacity have been announced for the next three to fours years, however questions still remain as whether or not these investments will be able to meet the specific grade and regional requirements of the EV market.

Out of the 2 billion metric ton steel trade, electrical steel is a tiny fractional estimated by IHS Markit to account for only 1%. Given electrical steel magnetic properties and given it’s small percentage make of up of steel trade, any deficit or disruption is going to be an important factor if EVs are going to replace ICEs.

There are two types of electrical steel non-oriented (NO) and grain-oriented (GO) electrical steel. Rotating electrical machines—think motors & rotors—use (NO) while static equipment—transformers—use (GO). With this higher demand for (NO) global production exceeded (GO) in 2019 and this dynamic will be something governments, carmakers, & OMEs are going to have too content with. An average car has 35-45 low-power motors while some can have up to 100 like a Mercedes S-call and each motor require can require different (NO) grades. Hybrid batteries used USD10 while plug in EVs need anywhere USD60-USD150, colloquially known as xEV grade, and it’s this xEV grades where capacity constraints are emerging.

Who Gets the Steel?

The current capacity for (NO) has been sufficient so far, however it is the increase demand from the automotive sector coupled with OEMs' drive for electrification on an outdated aging grid that will cause logistical issues of this steel alloy.

Of the 11 million tons of (NO) produced in 2020, 456,000 tons where for the the automotive sector. With 456,000 tons as the base line here is why supply crunch is likely to occur:

A cartel: There is only 14 players in the manufacturing of xEV-grade (NO) with high barriers to entry and only 5 that offer broad products. Capital intensive business that requires know-how, labor, patent protection, & OEMs relationships. The players in the field are going to protect their interest.

Geopolitical: Asia in home to 88% of manufacturing with China, Japan, & South Korea it’s top producer. This put America in the same position it is in with respect to rare earth metals, relying on other countries.

Ability to change suppliers is limited: Quality of finished products impacts to efficiency of motor ability's to deal with core loss (measurement of wasted heat). Most procurement program have one PPAP( Production Part Approval Process) mill.

Downstream: 20 motor core lamination stampers that sever the OEMs, five the can produce the pressers, & fewer than 10 tools shops that produces stamping die—most of the companies and family owned which lack the capital to scale up and have historically never been a supplier to the automotive industry.

How much xEV-grade NO is needed?

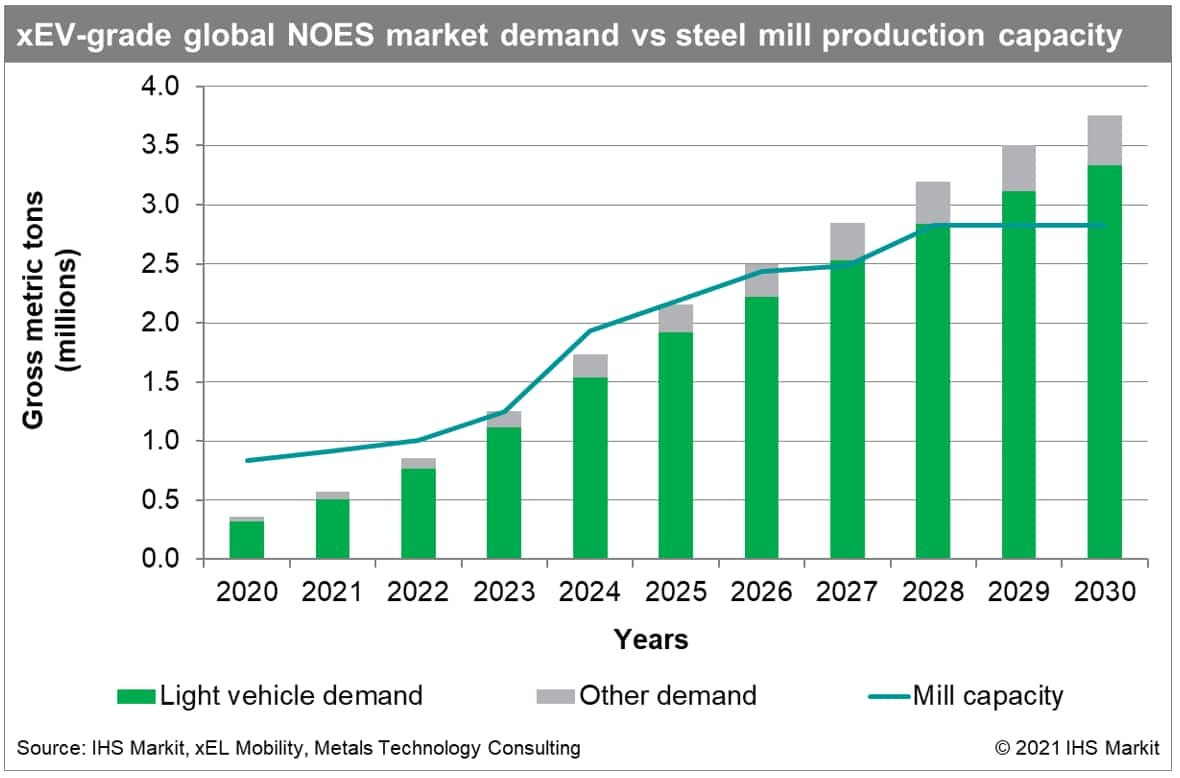

It is estimated that 4 millions tons, up from 320,000 in 2020, will be needed by 2033 to meet hybrid and EVs projections. Figures from Metals Technology Consulting puts the capacity wall at 2023 and without imminent investment, by 2025 it is highly unlikely that mills can accommodate the market. The situation becomes more bleak when considering that mills can only sustain 90% capity for an extend period of time.

Due to the exponential growth of electrified vehicles in the coming years, there remains a risk of electrical steel supply not meeting demand between 2023 and 2025. Despite projected capacity increases, a structural shortage of 61,000 tons is likely to occur in 2026. Without further major investments, this shortage could rise dramatically to 357,000 tons in 2027, culminating to a 927,000 tons shortage by 2030.

Regional differences?

Inadequate regional production deficits will be ameliorated by imports which comes with traffis that will increase cost and add to the supply conundrum.

Section 232 applies high duties, approaching 200%, on (NO) imported from seven non-EU countries and quota-based tariffs on NOES imported from the EU. U.S. Commerce Department

Who is filling the gaps? One the most important companies you never heard of.

Founded in 1847 Cleveland-Cliffs Cleveland-Cliffs manages and operates four iron ore mines in Minnesota and two mines in Michigan, and with access to the infrastructure of the Great Lakes, Cleveland-Cliffs is as fully vertical integrated as one can get. Years 2020, 2019 and 2018, the company sold 12 million, 19 million and 21 million long tons of iron ore product, respectively.

Indiana Harbor Works in 2022.

The company operates many fully-integrated steel mills and finishing facilities in Kentucky, Indiana, Illinois, Ohio, Michigan, Pennsylvania, West Virginia, and North Carolina. It has annual production capacity of approximately 23 million net tons of raw steel. Imagine and information detail from Cleveland-Cliffs website

This situation of increasing demand intersecting with supply deficits/constraints and with Cleveland-Cliffs is the ONLY DOMESTIC supplier and producer electrical steel, given it a monopoly on a vital resource!

Cleveland-Cliffs Inc. Chairman, President and CEO Lourenco Goncalves. Source: Cleveland-Cliffs Inc.

Lourenco Goncalves: When Cleveland-Cliffs acquired AK Steel in March of 2020, AK Steel, as a stand-alone company, was ready to walk away from electrical steel. It was ready to shut down Butler Works in Pennsylvania. Butler Works produces electrical steel, a type of steel used to make transformers. If AK Steel had done that as a stand-alone company, today the U.S. would not be able to produce any grain-oriented electrical steel for transformers or nonoriented electrical steel, among several other things. That was the scenario that I inherited at Cleveland-Cliffs, as far as electrical steel goes, when we acquired AK Steel. Then, I made the decision not to shut down Butler Works, and now Cleveland-Cliffs is the only producer of grain-oriented steel products in the U.S. S&P Global Insight

We will close the answer to the riddle of steel. Steel is a real assets with a multitude of applications that when mastered will be a boon of society and the companies control it will benefit froms it’s importance.

As always I look forward to any feedback. This is an observation and should not be taken as investment advice. Do your own research I could be wrong and sometimes am.