The Oil Boom that no-one cares about

A country that starts with the letter C quietly becoming and Oil and gas giant which has huge implications for global energy traded.

The Shaanxi Guesthouse, constructed by Chairman Mo's Communist Party to showcase China's industrial achievements over the West, included government-built steelworks, coal mines, power stations, and cement factories. It served as the venue for a meeting attended by 144 American and Chinese government officials and high-ranking oil executives in a vaulted meeting room.

This gathering of high-ranking trade officials and titans of the oil and gas complex signaled to the world that China was preparing for another Great Leap Forward.

Given that reserves are a function of price and technology, I am certain estimates have changed.

While this may come as a surprise to many, China is one of the most resource-rich countries globally.

So great is China's appetite for commodities that it acts as a market maker for many of them.

This appetite feeds its manufacturing resources and, by extension, the world's goods that China is so well-known for.

China's leaders have taken massive steps to insulate its economy and people from these externalities.

From the Belt and Road Initiative (B.R.I), direct investment in extraction, and the utilization of its massive coal reserves (currently ranked 4th in the world at 138,819 million tons), China's resource abundance is a crucial aspect.

This situation is not lost on Chinese leaders, as evidenced by the continued build-out of coal plants.

While many people are familiar with China’s 5-year plans, fewer people are familiar with China’s 7-year exploration plan and production plan.

After reaching a high of 70% import dependency for oil in 2018, Chinese leaders needed to correct this. They ordered its National Oil Companies (N.O.C.) to ramp up domestic spending and increase production, making China less dependent on imports.

China now produces 4.3 million barrels.

China is now the 5th largest oil-producing nation, only behind the US, Saudi Arabia, Russia, and Canada, and ahead of OPEC nations, including Iraq, Iran, Venezuela, Libya, Ecuador, Algeria, Kuwait, Nigeria, the United Arab Emirates, and Angola.

This situation prompted China to try importing American technology to unlock its massive shale gas reserves, estimated by the U.S. Energy Information Administration (EIA) in 2013 to be approximately 1,115 trillion cubic feet (Tcf), the largest in the world.

While China has sizable reserves, accessing those reserves is an issue for China, which is why China has tried to import American technology. However, replicating the American Shale Revolution is much easier said than done.

Unlike in the U.S., the development of shale resources in China is much more difficult due to more complex geography and a lack of adequate infrastructure in remote mountainous regions where most of the Chinese shale resources lie. Drilling for shale in China requires deeper wells, while fracturing is also tricky because of the mountain terrain and geological constraints.

China faced the realization that it could not replicate America’s success in shale and turned its attention to the South China Sea. The South China Sea geological structure is very similar to other offshore fields, making accessing those reserves more obtainable.

The South China Sea holds an estimated 190 trillion cubic feet of natural gas and 11 billion barrels of oil in proved and probable reserves, with much more potentially undiscovered. This bounty of accessible resources, along with China’s geopolitical weakness of overreliance on the Strait of Malacca (dubbed the Strait of Malacca Dilemma by President Hu Jintao) for its energy, has galvanized China to expand its territorial claims—building artificial islands and military bases in the region using a nine-dash line theory that an international court rejected more than eight years ago.

The geopolitical and economic ramifications of China's ambition should not be overstated. China’s territorial push into the China Sea has antagonized Brunei, Indonesia, Malaysia, the Philippines, Taiwan, and Vietnam Exclusive Economic Zone—defined as 200 nautical miles (370 km) off a country’s shore. An Exclusive Economic Zone, as per the U.N. Law of the Sea, gives a country control over any economic activity within this zone. By China extending its claim to the entirety of the China Sea, China would be in control of all economic activity and all resources in the region, shutting down the economies of neighboring countries. Many, especially in Washington, would undoubtedly see this as an act of war, fodder that many warmongers in D.C. will exploit.

China, like most Asian nations, is completely dependent on The Strait of Malacca. 20% of global maritime trade and 60% of China’s trade flows are moved through the Strait and the South China Sea, making it the most important sea line for the Chinese economy. Measured in dollars ($5.3 trillion, with $1.2 trillion U.S. bound), worth of trade flows through the Strait of Malacca.

“Certain powers have all along encroached on and tried to control navigation through the [Malacca] Strait,” said President Hu Jintao.

In a dispute between the United States and Beijing, this weakness will be greatly exploited. This fear of a war of attrition has forced China into an all-encompassing energy approach—a hedge against its greatest Achilles' heel. The development of the bilateral relationship between Russia and China is a manifestation of this, helping Russia avoid economic sanctions while giving China access to Russia's energy resources, cementing supply.

China’s production and sourcing plans go beyond just the price. China imports roughly 11.8 million barrels per day (BPD) of oil—70% through the Strait of Malacca. The top five exporters for 2022 were Saudi Arabia at 17.8%, Russia at 16%, Iraq at 10.7%, UAE at 8.8%, and Oman at 8%. 2023 numbers haven’t been published yet, but every data point suggests Russia overtaking Saudi Arabia. Every $10+/- move translates to $118 million to the Chinese economy, increasing geopolitical risk, interest rates, and political stability at home.

A quick economic lesson for people: Trade deficits are a function of price. Even if the volume of imports decreases, your trade deficit could be worse because the items imported cost more. Any country facing this situation will be forced to take action with respect to its FX reserves, interest rates, capital flows, trade deals, etc. Each action carries with it consequences.

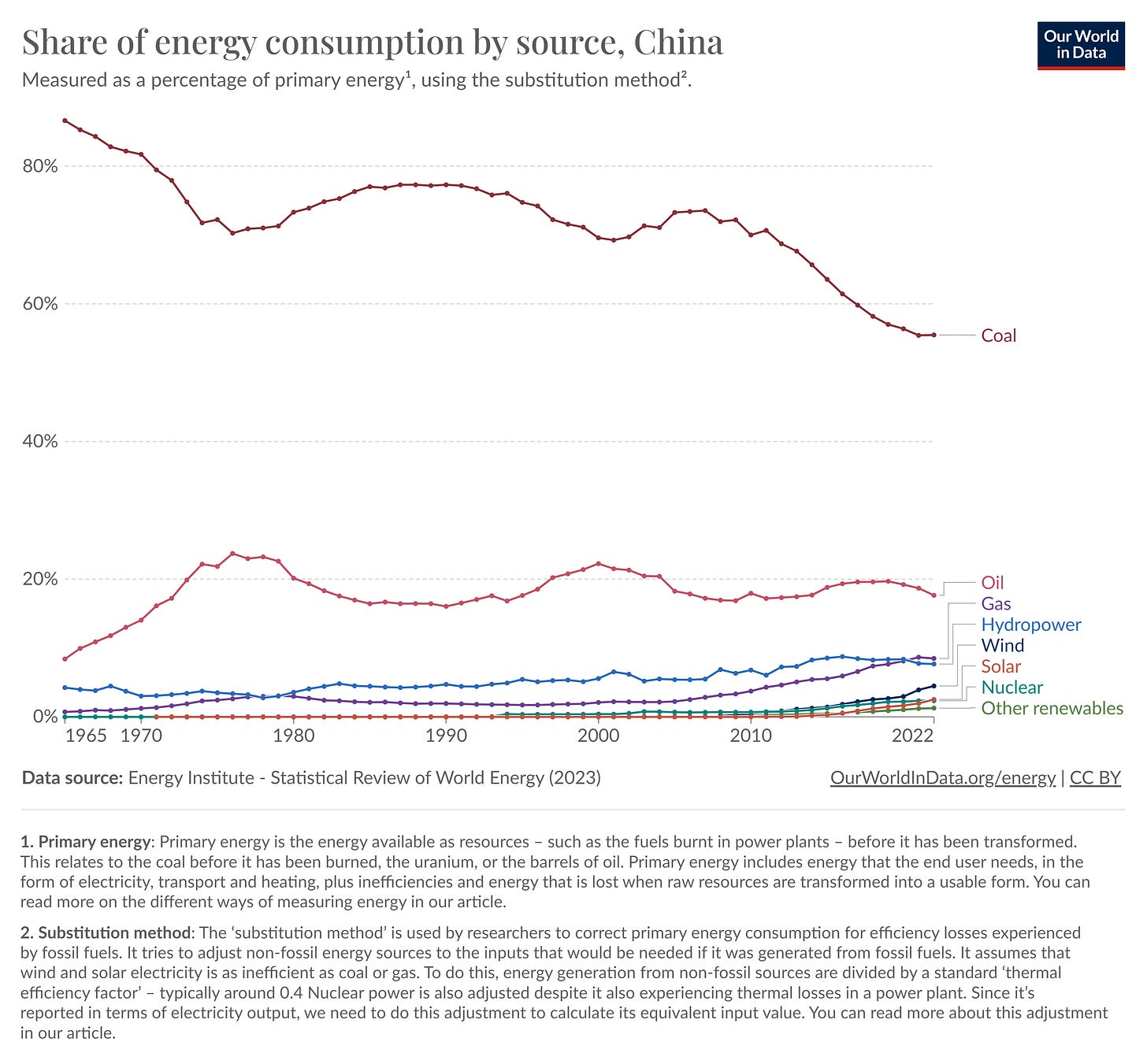

This translates to China’s government valuing domestic oil as a derivative of domestic GDP. Oil makes up barely 17.67% of China’s gross energy consumption while coal, the primary contributor, makes up more than 55.47% of gross energy supply. Compare that to the United States where oil makes up 37.69% and gas 33.08% of gross energy consumed respectively.

China’s $77 billion NOC capital spent is aimed at boosting production to 6 million barrels per day at an annual investment of $38,500 per flowing barrel per day. Price per flowing barrel is a metric used to estimate the value of a company that produces oil and gas. This compares to approximately $36,000 per flowing barrel in the US Gulf of Mexico or between $45,000 and $65,000 per flowing barrel per day for US onshore transactions. But with all things remaining equal, apart from China increasing production and the benefit associated with an increasing domestic oil production complex, what will be the likely impact on the world? What are the consequences of an additional 1.7 million barrels per day of supply?

We saw what happened when the Biden Administration emptied out the Strategic Petroleum Reserve and dumped a million barrel of crude a day on the market. We saw lower gasoline prices between 17 cents to 42 cents per gallon, with an alternate approach suggesting a point estimate of 38 cents per gallon. China is concerned with hegemony, so its ability to project a strong blue-water navy across the globe without its secure supplies of oil is a concern and has to be remedied. An interruption in global supplies would place added pressure on China to extend its military to protect trade routes around the world, a similar situation to the United States as the global superpower.

Any deviation of domestic supplies to the military in a time of global shortages would have serious negative implications for the Chinese economy. Recall China’s 2021 energy crisis when, because of a series of political missteps, shortage of coal, and drought affecting hydrogeneration, China officials cut electricity to its industrial sector, sacrificing its economy in the short term to stave off social unrest.

This balancing act is something Chinese authorities will have to manage carefully because the oil and gas industry is cyclical. This cycle allows for the growth of the industry—investing, consolidating, and starving the industry of capital during low oil prices, and bringing new supply onto the market and raking in cash during times of high oil prices. Any disruption to this cycle will greatly diminish their public oil and gas champions' ability to be as effective as they can be. All of this is to say that for China, oil is worth much more than its price on the world market.

The $77 billion capital spending plan will be a boon for many western oil service companies doing business in China, including Schlumberger, Halliburton, Baker Hughes, NOV, etc., and traders—mostly European oil and gas companies—which will take advantage of hedging and volatility. If China’s plan comes to fruition, this will serve as a hedge for investors if a slowdown in the shale patch ever comes.

As always none of this is investment advice this is merely my opinion base on observe facts. There is a change I could be wrong and welcome comments-even if it is different. I will change my mind and narrative if the facts change and being that I can’t know every fact, my narrative will inevitably change.

Excellent article! China is serious country, serious about establishing energy security. The West is seemingly on a path of economic and cultural suicide pursuing the hopelessly unattainable idiocy of Net Zero and trying to power their modern societies with hopelessly intermittent, hopelessly non-dispatchable, hopelessly dilute, and hopelessly expensive, sunshine and breezes energies. But, even given those caveats--command, planned, central economies are never efficient from a societal overview...just witness the massive harm and impoverishment which Xi has inflicted on the Chinese nation with his moronic Covid lockdown policies. China has its real estate crisis, its massive debt crisis, vast overbuilding in its high speed rail network, massive youth unemployment, and a demographic implosion with its "centrally planned" one child policy. So...I don't have a great deal of hope that China can become a fracking powerhouse, though I hope they do. The world needs to consume massively more energy for human flourishing and hydrocarbon fuels are the only thing that works both at scale and affordability. Nothing else is even in the same universe.

The West really needs to focus on real issues, rather than trying to project, fantasize, and claim that anything they are doing to make nicer weather 80 years from now is anything other than idiocy- immoral, impoverishing, destructive idiocy Grid wind and grid solar are parasites, leeches, thieves, impoverishment vehicles, fraud, and manifestations of the capture of the police power of the state by the Climate Industrial Complex. Everyone is going to be truly worse off with these subsidy queens... and they will never change the weather.

A quibble... note grammatical errors below and some syntax recommendations. Thanks again for your article!

As always(,) none of this is investment advice(.) (T)his is merely my opinion base(d) on observe(d) facts. There is a chan(c)e I could be wrong and (I) welcome comments-even if (the viewpoint) is different (than mine). I will change my mind and narrative if the facts change and being that I can’t know every fact, my narrative will inevitably change.

Fascinating article and a new Must Read.

China is also feverishly building out a nuclear base-load infrastructure, much of it paid for by selling EVs and solar panels and other garbage produced using coal energy, to the West.