The Mar-a-Lago Accord

How the United States and the New Global Gold Standard Will Shape the Future

“There was a sense that if we didn’t act, the imbalances in the system would force a correction in a much more disruptive way.” Paul Volcker

In 2008, the global financial system teetered on the brink of collapse, triggering unprecedented measures that permanently reshaped the world’s financial architecture. From the ashes of the subprime mortgage crisis, a new form of economic thinking emerged — one that redefined risk and forced global institutions to reconsider what truly constituted a “safe asset.” Out of this reckoning, the Basel III Accords were born.

Finalized in 2010 by the Basel Committee on Banking Supervision, the Basel III Accords represented a crucial step in reining in risk-taking by global banks and enhancing financial stability. Among its many technical provisions, one quietly significant change was the improved treatment of physical gold under liquidity regulations. Gold was formally reclassified as a zero-risk Tier 1 asset, certain provisions allowed banks to count unencumbered physical gold more favorably toward liquidity requirements. This subtle shift elevated gold’s stature as a legitimate financial reserve.

Few could have predicted how this development would ripple through the global financial system—particularly for the United States. Gold’s more favorable regulatory treatment meant that financial institutions could hold physical gold—as opposed to paper derivatives—without facing the capital penalties applied to other risk-weighted assets. This allowed greater economic flexibility, giving governments and institutions a more stable form of reserve that could be used to balance growing fiscal deficits.

Effectively, this opened a new avenue for the U.S. to pursue aggressive fiscal policy without the same debt-related risks, enjoying some of the benefits of a quasi “gold-backed” financial posture—without abandoning the fiat system.

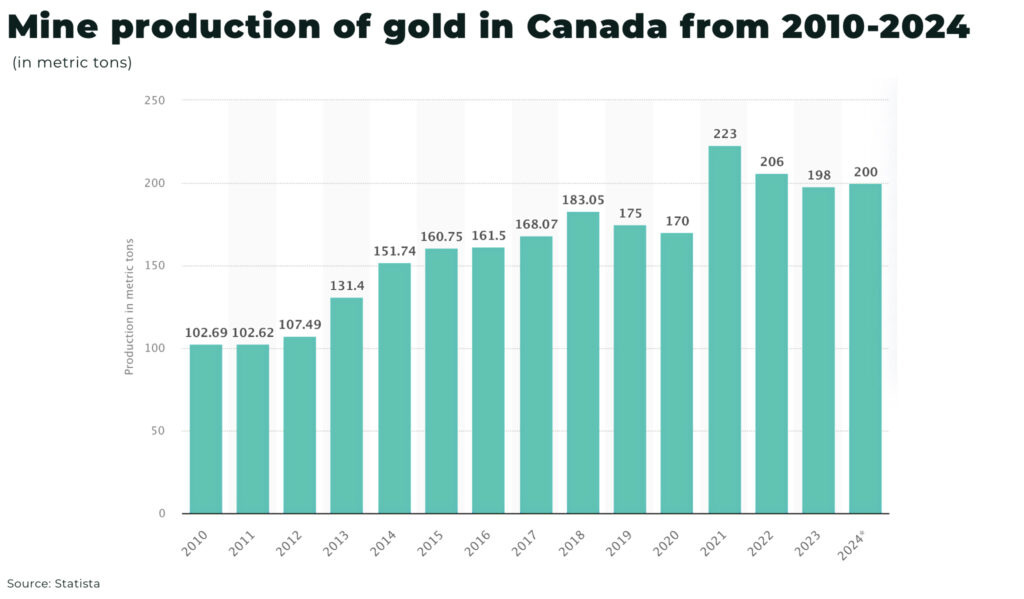

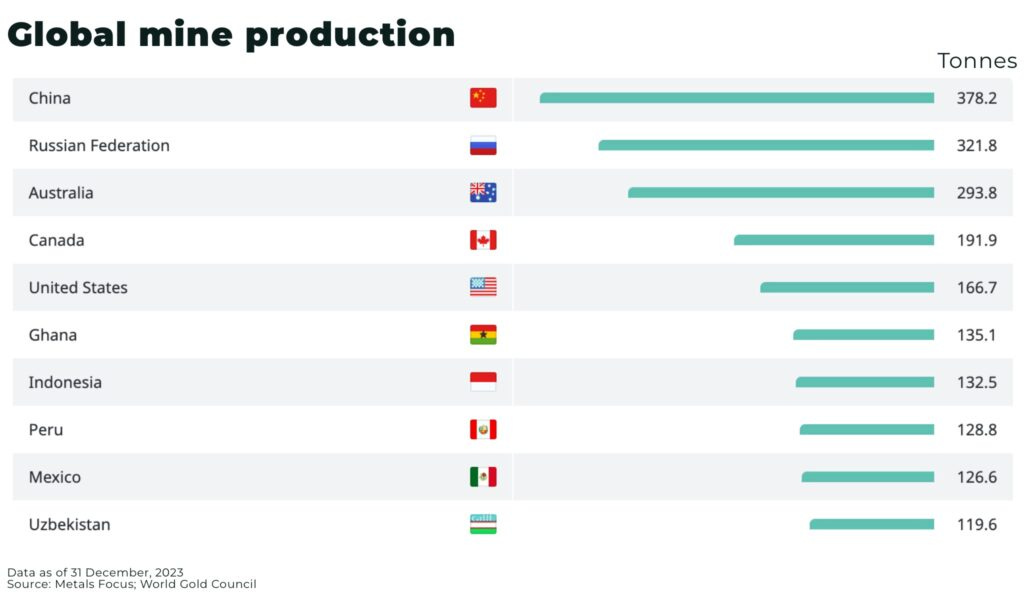

The United States was not the only country positioned to benefit. Canada—now the world’s fourth-largest gold producer—has seen its gold production surge by 32% over the past decade. With abundant reserves, a favorable regulatory environment, and a politically stable mining industry, Canada is emerging as a strategic player in the global gold supply chain.

Its geographic and political alignment with the U.S. only enhances this advantage. As central banks across the world, including the U.S. Federal Reserve, diversify their holdings to hedge against fiat currency volatility, Canada’s prominence as a gold supplier is becoming more critical.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.