The continent of Australia is a truly amazing land, separated from any other land mass and surrounded by water, it was left on it’s own to developed in a truly unique way. Because of it’s isolation and unique topography—tropical rainforests in the north-east, a desert in the center, tropical savannas in the north, & mountain ranges in the south-east—early European colonization efforts resulted in minor trading post in Cape York Peninsula founded by Dutch navigator Willem Janszoon in February 1606 and later a penal colony on it's Eastern half founded by Captain James Cook in 1770 which facilitated the first wave of decent population growth for Australia.

The second wave came from the 1850 gold rush forever interlinking Australia economic prosperity to mining. Here is a list of commodities commonly mined: coal, lithum, iron ore, bauxite, gold, manganese, lead, zinc, cobalt, uranium; salt; cooper, nickel, tin, phosphate; natural gas, and sulfur. That is to say the entrie periodic table is found and mined in Australia. It is this bounty of natural resources and it's close proximity to the largest consumer of natural resources China that gave Australia over 25 years of economic growth without a recession a truly remarkable feat. For the most part Australia seemed to escape Dutch disease, as it's service, tourism, & agricultural sectors tagged along for the ride, however, mining is still it’s main economic engine.

With the global push to electrify most economicies to reduce emissions which will require endless amount of industrial minerals, Australia—with it's abundance of mineral wealth, close proximity to Asia, & traded relations with world powers—should benefit. However, Australia has and achilles heel and that achilles heel is diesel and it lack of the fuel is a concern for the world “transition” plans.

Let’s take a dig in-pun intended-exploer how this happen. Oil was first discovered in Australia 1924 near Lakes Entrance, Victoria, it would not be till November 1953 that Australia saw it's first flowing well produced by West Australian Petroleum Pty Ltd (WAPET) in the Rough Range on the North West Cape. With the discovery of oil came the refiners to process the crude. The Lytton Refinery—constructed in the July 1965—was milestone for Australia, as it gave the nation its first wholly owned processing facility, allowing the country to benefit from their new found bounty. At it's apex, Australia had eight refineries allowing the country to domestically meet it's fuel demand. Fast forward today, with the closing of BP's Kwinana oil refinery in Perth and ExxonMobil's Altona oil refinery in Melbourne Australia will be left with only two refineries!

Viva Energy's refinery in Geelong will be one of Australia's last two remaining oil refineries.

As time went on and with it's oil resources largely depleted, Australia's older smaller refineries had to compete with newer, larger, more cost competitive refineries out of Asia. Making the Australia refinery complex unprofitable forcing the owners of these assets to call an audible turning their refineries into import terminals.

This development has caused an interesting dilemma for the Australian economy and the worlds goverments climate agenda. According to the World Bank Group Minerals for Climate Action report:

The production of minerals, such as graphite, lithum, & cobalt, could increase by nearly 500% by 2050, to meet the growing demand for clean energy technologies.

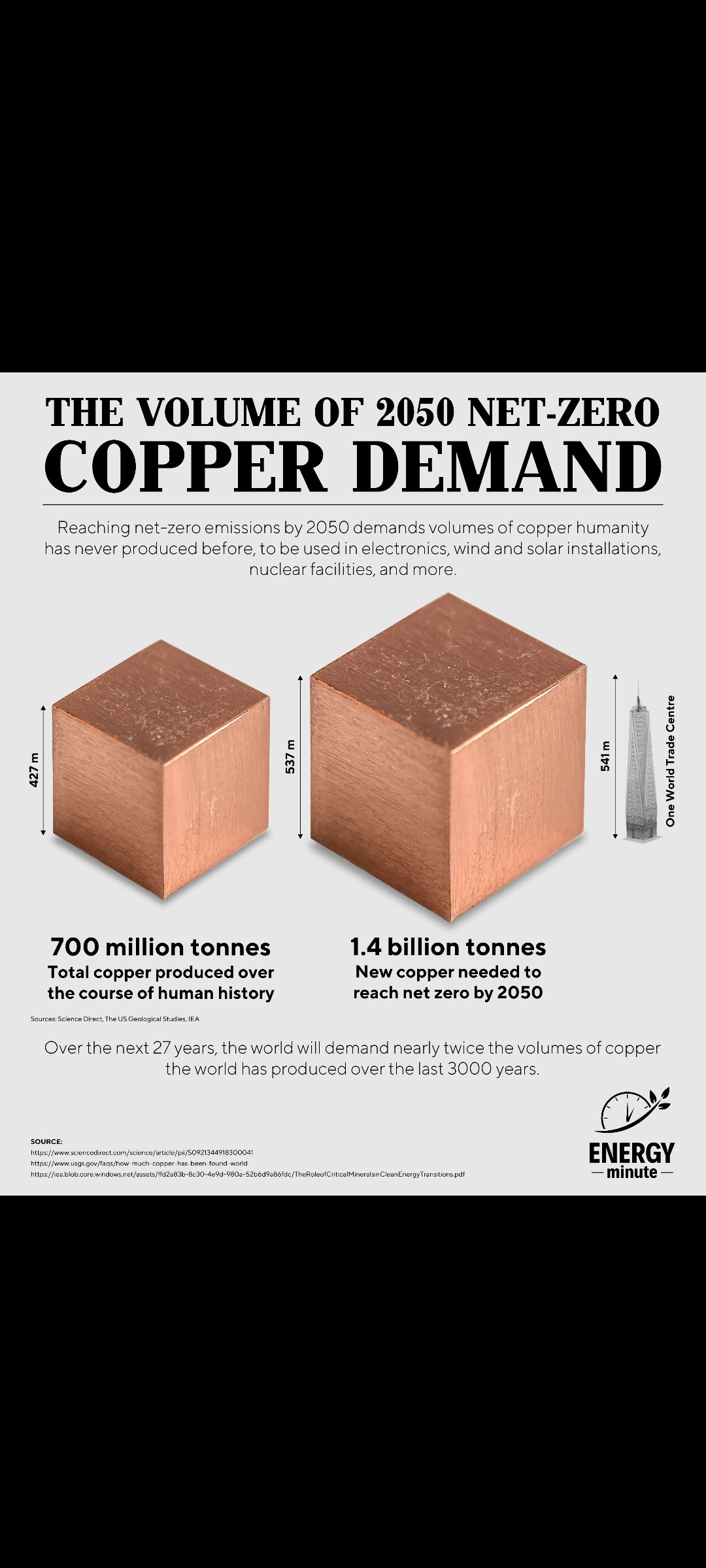

An estimated 3 billion tons of metals & minerals will be needed to meet the Paris Accord objective of keeping the world temperature at 2 degrees Celsius. To put this in perspective 700 million tonnes of Cu has been minned over the course of human history. 1.4 billion new tons of Cu will be needed to reach net-zero by 2050!

Needless to say, the energy transition will be mineral intensive and that means a lot more mining, which brings us back to Australia. By most standards Australia is a energy super power on par with Russia, Saudi Arabia, Venezuela, Canada, & the United States. But while Australia is blessed with a bounty of commodities, it's lack of diesel affects the world commodity complex. Mining-the the process of extracting valuable geological materials and minerals-is not only capital extensive but extremely energy intensive, and it is diesel that is the linchpin. Diesel generators account for approximately 72% of the energy used to run various facets of the mining industry. The large drills and shovels, as well as excavating machinery, all run on diesel generators. Many of these generators are in the form of huge land roving trucks that help to extract the minerals and other items and then transport them. In most cases, these gigantic generators can haul over 300 tons of material at one time. It is estimated that the mining sector utilizes nearly $7 billion worth of diesel-powered equipment alone.

Australia’s lack of domestic source diesel exposes itself, it's economy-with it’s economy & human capital centered around mining- to greater volatility, but also the world's ambitious to “net-zero” by 2050.

Here Australia's commodity ranking list where the whole number is world ranking for resourse & the percentage is of world resources:

Antimony 6 7%

Bauxite 3 12%

Black Coal 4 10%

Brown Coal 2 23%

Cobalt 2 20%

Copper 2 11%

Gold 1 22%

Graphite 8 2%

Ilmenite 2 23%

Iron Ore 1 31%

Lead 1 40%

Lithium 2 29%

Magnesite 4 4%

Manganese Ore 4 9%

Molybdenum 6 2%

Nickel 1 23%

Phosphate 8 2%

Potash 12 1%

Rare Earths 6 3%

Rutile 1 63%

Silver 2 18%

Tin 4 12%

Tungsten 2 15%

Uranium 1 32%

The picture becomes quite clear the further out one zooms, without access to Australia's minerals & metals endowment the world will be unable to meet it's climate goals, without mining Australia economy fails, without diesel there is no mining, & without the oil & gas industry there is no diesel. Round and round we go, a never ending carousel wheel that few-much to the chagrin of thr E.S.G crowd-can appreciate.

Adding fuel to the fire-again pun intended-the world is currently experiencing a diesel shortage. We'll start by taking a look at the state of diesle in the United States. Given that the U.S. is the largest, most liquid, & transparent refiner, it’s the best barometer.

The U.S. has 25- day supply of diesel, as the nation's stockpiles of diesel and other distillate fuel oils are at 106 million barrels, the lowest for this time of year since 1982, reports the Economic Times.

There are four factors contributing to the U.S. inventory being below it’s five year average and by extension the world.

Spring & fall demand of farmers: 75% of all farm equipment & 20% of irrigation inputs-think seeds & fertilizer-use diesle.

Refinery maintenance

Refinery closure: U.S. refinery capacity is down because of the closure of profitability brought on by the Covid Pandemic

4. Cut off of 700,000 Rissian oil imports since the break out if the Ukranie war. These imports were mostly finished products and refinery inputs.

It is these two structural issues that are less likely to be alleviated anytime soon. As long as the economic attacks on Russian heavy crude & refined products exports continue-retaliation for the Ukranie invasion-taking supply offline and the economicies of political supported E.S.G continues, removing refinery capacity, the shortage is going to continue.

Refineries have little swiggle room for adaptation, as flexibility in shifting gasoline production to diesel production is relatively small amount, generally 5%. There has been some relief as U.S. industrial activity has slow down and by extension distillate demand. There are also imports from from Europe-ironically-as the refinery strike at ExxonMobil's Gravenchon-Port Jerome depot subsides and distillates works it's why thru the system. These relief valves are temporary in nature meaning a slight disruption will further exacerbate The current situation.

Will climate backpedaling continue?

Refine products are subjected to the same supply and demand features as other consumer products in the market. A tighter supply means higher prices and as higher prices work their way to thru the economy we'll see the political response. We have seen what happened in Germany, Nertherlands, Finland, U.K., Italy, and Austria when energy supplies were disrupted, they returned to COAL & WOOD, which retarded many European countries climate progress.

Keep in mind Europe is a net importer of commodities with very little in the way a primary production aside from COAL-lignite-in Germany & iron ore in Sweden and we saw how the global economic suffered as a result of energy being cut off. This will quickly escalate if one of the very few places with the resources, capacity, & regulatory regime-the other being Canada-necessary to provide the raw materials need to produce the energy need to run our morde economic. Suffice to say Australia is suffering it's own energy security crisis and this situation will force the same back pedaling that we saw in Europe. An unintended consequences of this shortsightedness is an increase in consumption of fossil fuels and high energy prices!

How to navigate

Thru the gift of the financial markets, there are a plethora of options one can take to reduce the negative consequences of political remedies. There are shorts, options, structured notes, structured index, currencies, futures, etc. Or a more sensible option is to own hard assets or the companies that produces the metal & minerals that Australia produces that are already in a deficit. There are listed lithum, cooper, iron ore, aluminum, silver, & gold miners and as the diesel crisis worsens who ever has access to those commodities will be sure to profit because remember with commodities you make your money on the price, not the volume.

As with sll of my post this is not intended to be investment advice, these are opinions at best, as I could and sometimes do get things wrong. Please seek professional when exploring this ideas. I welcome all feed back and look forward to hear from anyone.

Fascinating read about energy geopolitics Down Under.

Interesting read & quite a conundrum. Lot to consider