The EU Battery and NATO secret weapon

This unique country has found itself at the cross road of energy and global security

Imagine provided by YouTube

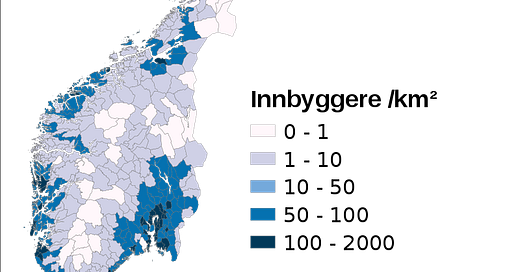

Norway, a land of breathtaking natural beauty and sparse population, home to approximately 5.5 million people, boasts vast expanses covering about 217,479.917 square miles, roughly comparable to Japan's land area. However, its rugged, mountainous terrain and Arctic location present formidable challenges, making life in Norway harsh, rugged, and cold. The limited topsoil resulting from its mountainous topography and short growing seasons have historically hindered large-scale agriculture, contributing to the country's relatively low population density.

Norway population density courtesy of wiki

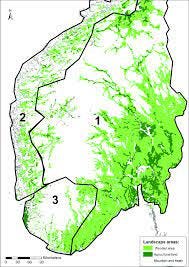

Norway’s arable land courtesy of researchgate.net

Contrary to misconceptions, Norway has long been a wealthy nation, even before the discovery of oil in the late 1960s. Its challenging landscape, while unsuitable for agriculture, has played a significant role in shaping its economy and trade dynamic

The intricate network of fjords-creating the second longest coast line in the world at 83,281 km, second only to Canada’s with 202,080 km-along Norway's western coast, while historically presenting obstacles to travel and trade, has also facilitated maritime connections between settlements and enabled the exploitation of timber resources from the interior. Long before railroads, Norway was a lumber power house-pun intended-able to take advantage of it’s fjords by transporting it’s lumber down it’s western coast accessing it’s skilled labor. Several interesting situations developed out of this:

A specialize merchant fleet. Today Norway is the 4th largest marine merchant fleet in the world.

Cooperatives: the settlements along it’s western coast each specialized along the timber and ship building value chain each having to trust each other as it was in their economic interest. Thus cooperatives dominated Norway’s economy for centuries with cooperatives in agriculture, lumber, shipping, insurance, & banking.

Forced decentralization: because of it’s topography and cooperatives wealth was much more distributed as compared to the rest of Europe.

Before the start of WW2 Norway was one of the wealthiest countries in Europe on a GDP per capita basis.

Hydropower: Norway's abundance of rivers, coupled with advancements in hydroelectric power generation, has allowed it to harness its vast hydro resources for cheap electricity production. As a result, hydroelectric power constitutes 95% of Norway's electrical output, facilitating rapid industrialization.

Dutch gas=Norwegian Oil

Very little thought was given to oil & gas being discovered in North Sea given it’s recent geological history, a few thousand years ago since the last ice age-good old climate-change. That all change with the discovery of the Groningen gas field in the Netherlands in 1959, Europe’s largest continental gas field and 11th largest in the world. With renewed interest in the North Sea potential, exploration concession were licensed to Phillips Petroleum Company in 1962. Phillips gifted the Ekofisk oil field in 1969, production followed a few years later in 1971, one of largest offshore oil field ever discovered before or since.

https://www.norskpetroleum.no/en/framework/norways-petroleum-history/

Norway quickly applied it’s lesson from it’s hydro generation buildout experience and applied it to the growing oil & gas industry. To incentive FDI Norway took half ownership in every oil & gas with plans on a future date of ownership transfer to the Norwegian state owned company, in this case Statoil (now called Equinor the 10th largest O&G in the world). This transfer of knowledge and technology combined with Norway’s ship builder expertise gave Norway the upper hand when it comes to offshore projects which shows given that Equinor produces roughly 70% of the NCS oil & gas. With 8.1 billions barrel of proven oil reverse (20th globally) and 1,600Km of natural gas (21st globally) Norway has the largest oil & gas reverse in Europe outside of Russia and more than many OPEC nations like Congo (1.811 BOE), Equatorial Guinea (1.1 BOE), & Gabon ( 2 BOE). Given it’s close proximity to the European continent, Norway was an immediate relief to the EU during the European Energy crisis. In 2021 Norway had eleven underground pipeline contenting the U.K. and Europe to it’s gas fields. Prior to Russia’s invasion into the Ukraine, Russia supplied 40% of natural gas and 25% of it’s oil while Norway supplied 25% and 9.4% respectively and with oil and gas comprising 21% of the countries GDP and 51% of it’s exports, Norway effective became a Petrostate. Many tend to overlook Norway’s role in the oil & gas market given it’s reverses position, that would unwise. Despite being the 13th largest oil producer and the 9th largest natural gas producer, Norway is an export powerhouse ranking 8th in oil (behind Kuwait) at 1.56 millions bpd and 4th in natural gas behind the United States, Russia, & Qatar-the big three. And unlike many other Petrostate that became autocracy Norway avoided this fate due giving Europe a democratic Petrostate.

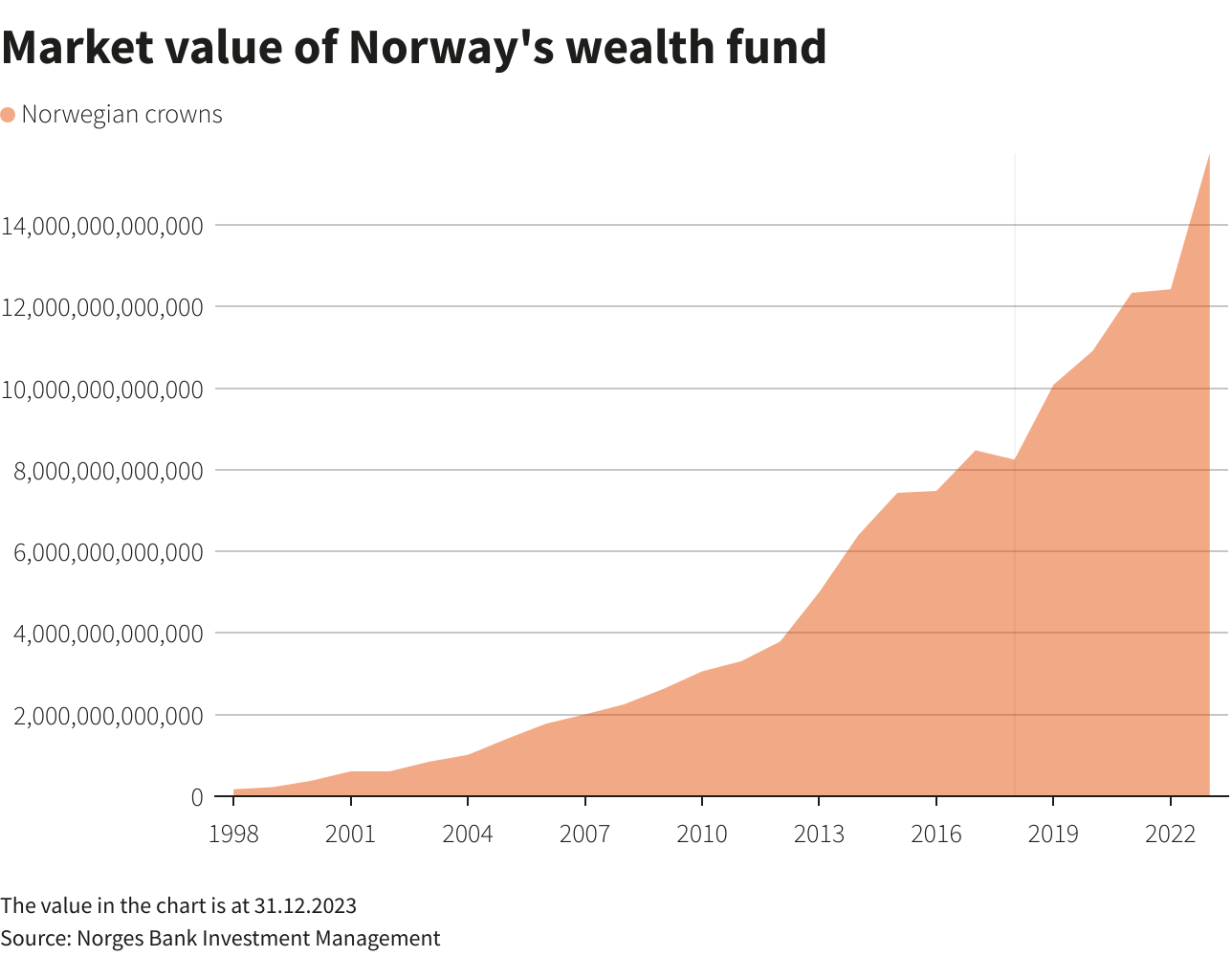

Every Norwegian is a millionaire

The Government Pension Fund Global, also known as the Oil Fund, was born out the oil crash of the 1980s established in 1990 a way to reduce the Norwegian economy from the ebbs and flows (volatility) of the oil market. Surplus revenues from the national oil company Equinor along with taxes & license on the oil & gas industry would be invested into for the benefit of the Norwegian people while allowing Norway economy to maintain it’s direct tie to the oil & gas industry without the negative consequences of Dutch dieses-a phenomenon experienced by it’s neighbor The Netherlands when it discovered the Groningen gas field. Rules were put in place for funds operation, withdrawals, and spending with no more than 3% of the funds assets being able to be withdrawn in any single year. It’s so well balanced, it looks like something straight of Benjamin Graham’s working papers–historically 63.6% in equities, 35.5% in fixed income, and the remainder in real estate. With the Norwegian oil & gas continuously growing along with other compounding factors like global economy growth, reinvested dividends & interest, along with a cap in spending, the Oil Fund now stills at $1.6 trillion dollars.

Let’s put these numbers into perspective. The Oil Fund is the largest sovereign wealth fund in the world. It’s accumulative assets are larger then the GDP of Turkey, Spain, The Netherlands, Switzerland, Poland, Ireland, Sweden, Denmark, & Finland. It’s own’s 1.5% of the global stock market, making it a stock market whale. If the fund were to liquidate every Norwegian citizen would receive $275,000 dollars and with it’s conservative management and 3% cap on withdraws the fund could fund 20% of Norwegian government in perpetuity. The Fund also benefits Norway in two others ways that are rarely discussed, inflation and currency. While Norway is in Europe & a NATO member, Norway is not part of the EU or the Euro which makes controlling of it’s fiat a important issue for the government. Also and probably most important was and is inflation. The redirection and limited access of the funds capital has allowed Norway to escape the negative consequence of too much capital pouring into the country given it’s relative small population and markets, increase strength of non-reverse currency.

Air, Water, & Earth Bender

In addition to having the largest hydro potential in Europe the country has large wind potential as well. Norway’s coast and mountains that run along it’s spine are some of the windiest locations in a continent that has very poor wind resources. The same trade winds that bring moister to the country that feeds it’s hydro dams gives Norway it’s wind resources which already has the 17th largest installed wind capacity in the world, which puts Norway in a very quince position. With Norway using it’s hydro and wind resources to generator electricity for it’s domestic needs and as more aspect of the economy becomes electrified-the introduction of finical & tax incentives for EVs which accounted for 88% of new vehicles sold in 2022-the more Norway can reduce it’s usage of it’s oil & gas resources, making them available for export. Paradoxically, the greater use of it’s renewable resources in Norway, greater penetration of EV for example, the more oil & gas resources it’s frees up for exports allowing the country to fund it’s sovereign wealth funding further diversity it’s economy and protecting itself from foreign energy imports and supply chains. This systemically approach of harnessing it’s renewables resources for it’s domestic needs-offering political protection-while simultaneously selling it’s oil & gas resources aboard-funding their sovereign wealth fund for economic protection-has taken years of prudent planning and sound leadership to achieve. And it appears as Norway is about do the same thing in rare earth with a huge phosphate discovery in southern Norway!

In 2018 a company name Norge Mining announced the largest discovery of phosphate ever discovered at 70 billion which doubled the total global reserves at 71 billion. This one find can supply the entire global for the next 50 years, which uprooted Morocco as the global leader with reverses of 50 billion accounting for 70%. Up until this discovery it was Morocco along this China that denominated the phosphate market.

“When you find something of the magnitude in Europe, which is larger than all the other sources we know-it is significant,” founder and deputy CEO of Norge Mining, Michael Wurmser told news website Euractiv.

“We believe the phosphorus that we can produce will be important to the West-it provides autonomy,” he continued.

When people hear phosphate they naturally think fertilizers. Which is true phosphate is used as feedstock for fertilizers, and thus is important to global food chains, however phosphate is also used in solar panel and batteries for EVs via lithium-iron-phosphate batteries. Large deposits of critical raw materials titanium - used frequently for joint replacements and in building aeroplanes - and vanadium - used to strengthen steel - were also present, which are dominated by China with 36% of the world’s titanium and 53% of the world’s vanadium with Russia controlling 10%.

In affect Norway will be NATO’s-a.k.a the EU-hedge against foreign aggression, against both Russia and China. Given that China is response for 63% of rare-earth mining and 85% of all rare earth processing. China controls about 38% of proven rare-earth reverse while Russia controls 10% making countering weaponization of these resources a top priority for NATO. We saw this play out with the Russian invasion of Ukraine, in response NATO countries began shutting down Russian oil & gas imports to defund Russian’s war machine. As a result, NATO quickly had to find other sources to replace their 25% of Russian of oil imports and 45% of Russian natural gas imports and Norway with it’s largest oil & gas resources, friendly relations, and democratic intuitions, stepped right in to fill the void. Norway’s oil exports to NATO grew from 9.5% before the war to 13.3% after and it’s piped natural gas increased from 38.1% to 46.1% while it’s share of LNG went from 0% to 6.6%.

Recent discussion about building transmission line from Norway to NATO to take advantage of Norway’s hydro resources complemented by it’s growing wind power capacity along with it’s hydrocarbons, political stability, large pool of capital-via The Oil Fund, and geographic position-Norway, until Finland acceptance into NATO was the only NATO member that shared a boarder with the Kola Peninsula and serves as home to Russia’s Northern Fleet headquarters, which hosts Russia’s most advanced Arctic land, air, and naval assets, notably including its nuclear arsenal and second-strike capabilities-makes Norway probably the most important European country and an investing place to invest.

Disclaimer: This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I reverse the right to be wrong and will change my mind when the data changes. I may own or transact in any names mentioned in this piece at any time without warning. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Do not make decisions based on my opinions. Do your research! I do not guarantee the accuracy or completeness of the information provided in this page. I did my best to be honest about my disclosures but can’t guarantee I am right. As always I look forward to all opinions and critiques.

Great article would have benefited from proof reading however.

Actually I miss the point. So Norway has plenty of riches and just about nobody so they’re all very rich not because they work hard but because. I guess we all knew that by now, so what’s new? Not criticizing really, just trying to understand. It feels like an important part was left out, or that this is the first of a series of posts.