The Spanish Dollar

The Spanish Emprie was once one history's largest empries with colonies Eurpoe, Africa, South/North America, & Asia. It's nick name was “the empire on which the sun never sets” because somewhere in the world the empire economy was running.

Minted 1497 with content 25.563 g (0.8219 ozt) fine silver. It was widely used as the first international currency because of its uniformity in standard and milling characteristics. Some countries countermarked the Spanish dollar so it could be used as their local currency. Dissemination of Hispanic-American coinage". Encyclopædia Britannica. Retrieved 7 February 2012.

The Spanish Dollar was circulated so much in the North American Colonies that by 1581 the colonists gave the Spanish Peso, piece of eight, the term dollar. The United States Dollar was introduced with the Coinage Act of 1792 and was pedged to the Peso at 371.25 grains = 0.7735 troy ounces = 24.0566 g.

By far the leading specie coin circulating in America was the Spanish silver dollar, defined as consisting of 387 grains of pure silver. The dollar was divided into "pieces of eight," or "bits," each consisting of one-eighth of a dollar. Spanish dollars came into the North American colonies through lucrative trade with the West Indies. The Spanish silver dollar had been the world's outstanding coin since the early 16th century, and was spread partially by dint of the vast silver output of the Spanish colonies in Latin America. More important, however, was that the Spanish dollar, from the 16th to the 19th century, was relatively the most stable and least debased coin in the Western world. https://en.m.wikipedia.org/wiki/Murray_Rothbard

Due to British Mercentail economic policies, which caused a shortage of currency, the Spanish dollar was the best option.

Down Under

The newly founded colony of Southwale, founded in 1788, found itself short supply of species because merchant vessels would take coinage out the country. To remedy this, then Governor Lachlan Macquarie circulated a 💷10,000 pound of Spanish dollars bounty from the British government. Currency was badly needed that the Governor doubled the money supply by punching a hole in the center. The punched center came to be called the dump while the outer rim the holy dollar. This served as both an inflationary Act, as the money supplied doubled l, and a form of capital control as the punch coins were no good to anyone outside the island country.

The Orient

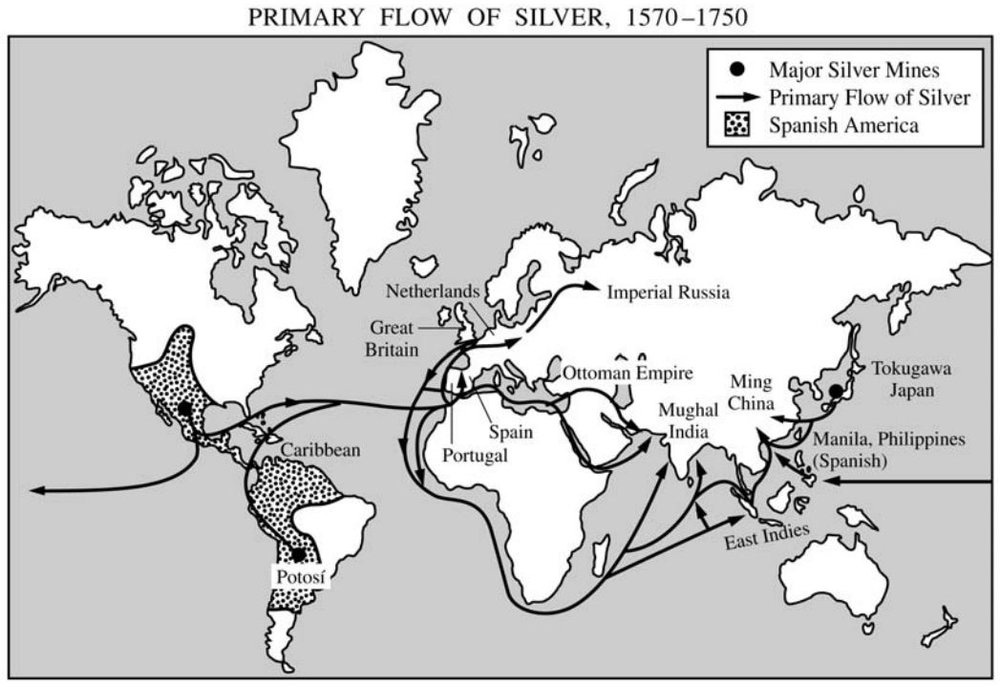

Trade between The Spanish East Indies, colloquially know as Spanish Phillipines, andChina, along with piracy, and since silver was the only commodity China would accept, the Spanish dollar was heavily circulated. The trading between China and The Spanish Emprie help facilitate the global silver trade making The Manila galleon the vanguard of globalization.

Image provided freemanpeida

While the 30 Years War (1618-1648) and the War of Spanish Succession (1701-1714) which left the Spanish Empire weakend and a second rate power, that did not weakend the usage of the currency.

Thomas Jefferson supported basing the US dollar on the Spanish dollar. In his “Notes on Coinage,” he wrote,[1]

“Notes on the establishment of a Money Unit, and of a Coinage for the United States.

In fixing the Unit of money, these circumstances are of principal importance.

I. That it be of convenient size to be applied as a measure to the common money transactions of life.

II. That it’s parts and multiples be in an easy proportion to each other, so as to facilitate the money arithmetic.

III. That the Unit and it’s parts, or divisions be so nearly of the value of some of the known coins as that they may be of easy adoption for the people.

The Spanish Dollar seems to fulfil all these conditions.”

As we can see a reserve currency does not simply go away. It will continue to be in usage until a better unit of measurement, standard, and purity comes along.

Inmgae provided by Homiton Mobley

The United States dollar has been the reserve currency since The Bertton Woods agreement of 1944, which established finanical and commerical terms of the largest trading nations: United States, Western Europe, Australia, & Japan, and has range from a high of 72.93% in 1965 to a low of 47.14% in 1990.

This is where we are at today:

Source: International Monetary Fund

The doom and gloom that we hear in the ether are overblown. The reality is demand for dollars is huge. In 2016, the Eurodollar market size was estimated at around $13.833 trillion.[12] Rise and fall of Eurodollar system

This fundamental imbalance between deficits and balance of payments came to be known as Triffin paradox or Brent Johnson’s “Dollar Milkshake Theory”. The point is that this a known and understood feature of the system! So in order for the United States to remain the base of the globalized economy, then our fiscal books are always going to take the hit! When we hear about decline of USD market that is compared mostly to it’s closest competitor The Euro, which has averaged a little over 21% since it’s introduction. Theses are the two most important currency blocs and while both will lose market share as people look to diversity their economic, geopolotical, & currency risk, out of the two the USD still looks like the best mare at a slaughterhouse.

Taking advantage of the situation should be the number one prority for people if they are truly worried about the decline of the USD. Regradless of where it’s heading their will be time that it will be overvauled compared to other currencies and you can take your overvauled USD and purchase overseas assets. Importantly because USD has the reserve status it will always enjoy favorable interest rates, which is a function of The Fed controlling short-term rates following the business cycle and investors control of the long-term rate(demand). You can arbitrage the interest rate by buying USD when rates and high, locking in income and potential capital gains, or borrowing when interest are low, in essence have a risk free short on USD.

Understanding the situation will give you knowledge, knowledge which help you be better prepared.