The battle for graphite

The nation behaves well if it treats the natural resources as an assets which in turn must be turned over to the next generation increased; and not imparied in value. Theodore Roosevelt

Italian chemist Alessandro Volta is a name that escapes the mind of most people. He is credited with the creation on the first electrical battery dub the voltaic pile, patented in 1799. The Volta pile consisted of a stack of copper and zinc plates, separated by brine-soaked paper disks, that could produce a steady current for a considerable length of time. And while the Volta pile lead to a series of other discoveries—electrolysis by William Nicholson and Anthony Carlisle (1800), the discovery or isolation of the chemical elements sodium (1807), potassium (1807), calcium (1808), boron (1808), barium (1808), strontium (1808), and magnesium (1808) by Humphry Davy—his discovery was more suited for experiments given it’s voltages fluctuations and duration. To be fair, the concept of a battery was know since ancient times when Thales of Miletus experiment with static electricity, dubbed Triboelectric effect.

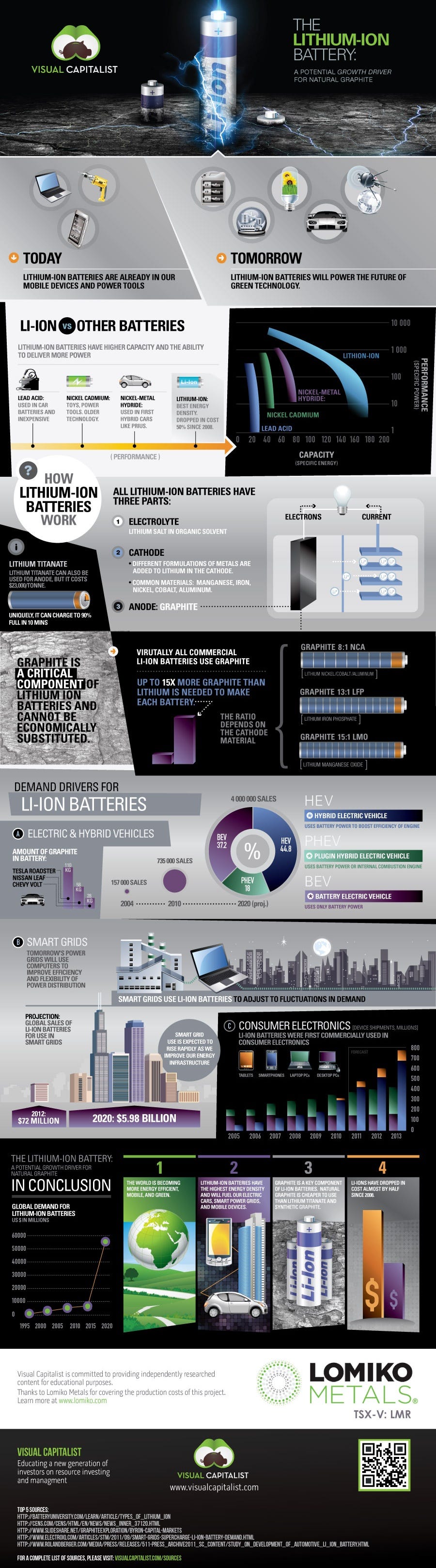

It was British John Frederic Daniell, a British chemist and meteorologist invention the Daniell Cell, the first practical source of electricity, that became an industry standard. Know as a wet cell these cells used liquid electrolytes which were prone to leakage and spills so while invenvative, they were not useful in portable appilcations. There largestest appilcation were electrical telegraph networks. But it was The Leclanché cell invented and patented by the French scientist Georges Leclanché in 1866—using a paste instead of a liquid—that gave rise to the dry cell battery that is wildly used today making portable electrical devices practical. While both similar in appearnce—having a cathode, an anode, and electrolyte—they differ in operations However, they are used in very different ways. Voltaic cells convert chemical energy to electrical energy by means of an oxidation-reduction reaction while electrolytic cells convert electrical energy to chemical energy, so they are the opposite of voltaic cells. They require an input of electrical energy to cause an oxidation-reduction reaction. The next evaluation of battery techonogly came with the lithium-ion battery demonstrated by Stanley Whittinghan and his colleagues at Exxon—much too the chagrin of the enviormentalist. And it is these batteries that are used in many of the current items we use today from hand tools, medical devices, generators, phones, and EVs.

Lithum-ion batteries differs not in their anathomy—comprising of a cathode, an anode, and electrolyte—but in their composition. A suprising fact is that a lithum-ion contants little lithum in it relative to materials that makes up the battery. Materials in a typical EV battery contains: 18.9% aluminum, 15.7% nickle, 10.8% copper, 10.8% steel, 5.4% manganese, 4.3% cobalt, 3.2% lithum, 2.7% iron, & 28.1% graphite which gives any country that control grahphite virtual control of the EV market.

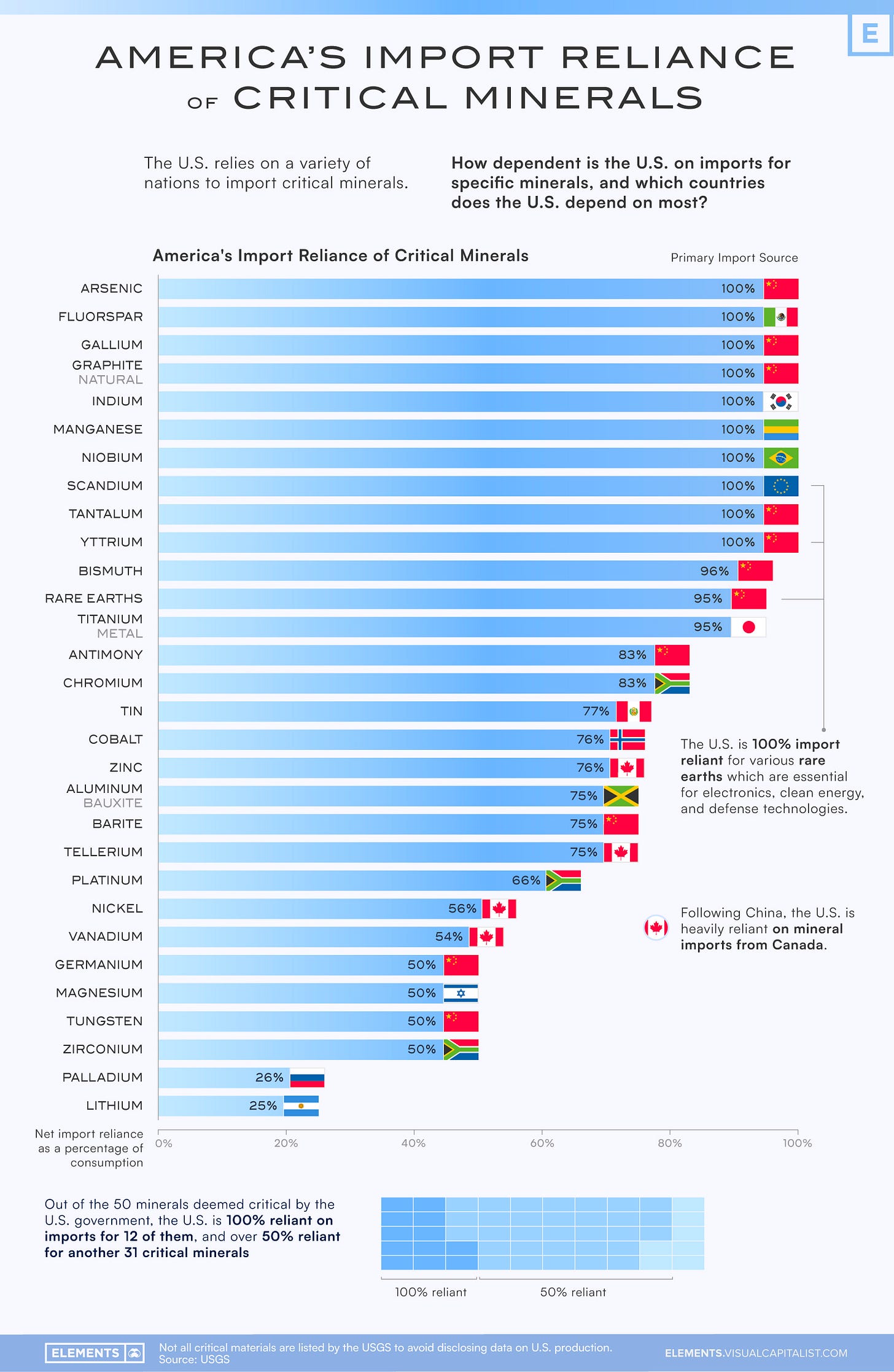

There are two types of graphite natural & synthetic and China is the leader in both graphite production. China has many advantages that make its an ideal for graphite production namely it's lack of enviormental regulations and it’s large coal fleet given China another choke point in the “renewables” manufacturing process as there are no economic alternatives for graphite.

The only emissions from natural graphite are those created during mining whereas synthetic graphite produces more than 3x Co2 and other harmful emissions owing to the production process, it requires heating coal to high temperature, which is energy intensive and costly. Fastmarkets.com

Of the 1.3 million metric tons of graphite production in 2022 China produce over 850,000 metric tons well ahead of the second largest producer Madagascar at 170,000 metric tons and the third largest producer Mozambique at 110,000 metric ton. With the global market value of graphite setting to double from $18 billion in 2018 to $27 billion 2025, China has position itself as the “Saudi Arabia” of battery material and processes with the power to retard the progress of any countries economic enviormental protectionist goals—via EVs and batteries—allowing her to force concession from her trading partners for her economic & political ambitions. We see this playing out now as China—for all intends and purposes—has banned the export of graphite in response to America’s advance chips & equipment sanctions and the EU's carbon board tax.

America is once again finding itself in the same position as it did with oil, over reliance on a single source, Saudi Arabia—e.i. OPEC—from the 1970s when oil imports were at 35% till the 2005 when oil imports were 60%.

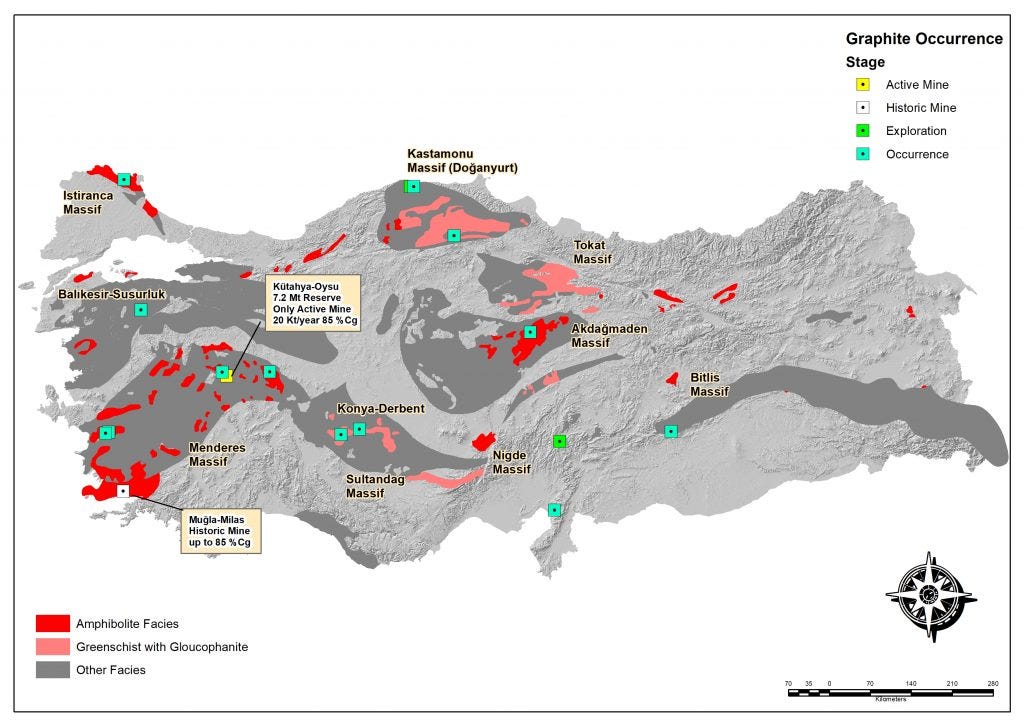

And so we find ourselves again back in the same position we always find ourseleves as a nation susceptible to outside influence because of short sight forgein and business policies. Another energy and industry choke point that we created ourseleves by offshoring important industry and vital processes to meet enivormental standards and wallstreet metrics. Can this be solved? We will find a solution? The short answer is no and the long answer is maybe. While China is the largest producer of natural and synthetic graphite, it is the third in reserves. Turkey, a NATO memeber, has the largest volume of graphite reserves in the world with 90 million metric tons of natural graphite in 2022. Turkey with it’s long coal mining and graphite history and it’s close proximity to NATO memebers makes it ideal for helping countries better geographically diversefity their supplies reducing their reliance on China.

Image provided by Eurogeologists

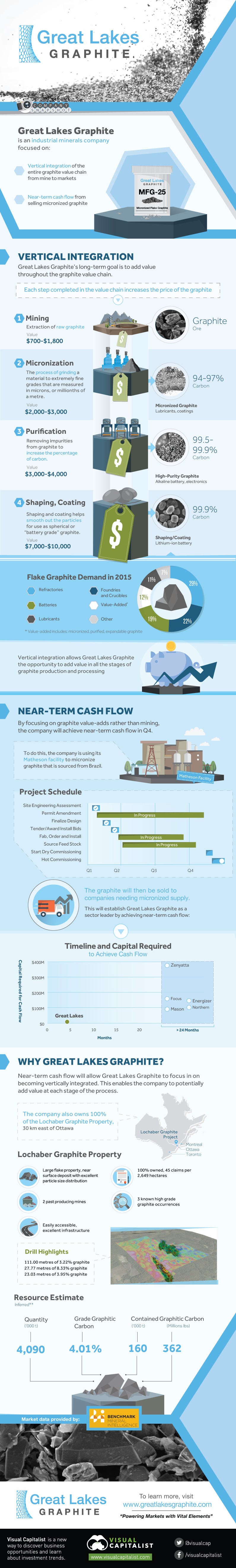

While Turkey looks promising, this is not the pancea however, Turkey’s contentious relationship with it’s NATO members over Kurds population, Russian & Iranian sanctions, plus the typ of graphite—tiny forms dissemeinated in inorganic materials—that Turkey has require costly separation process which are not deploy in Turkey facilities toady. There is a Candiana company Great Lakes Graphite focused on bring Candiana value added graphite to market and as 2023 has yet to be proven a viable business.

It remains to be seen how this will play out as there seems to be no alternative to the current situation but the status quo in the near term and only minor relife in the long term. Maybe pragmatism will take hold and countries will lower the push for EVs or the enivormental standards/regulations to allow for more graphite production, my hopes are not so high.

As with all publications this is not investment advice but merely observational insight. My opinons are my own design to give readers something to think about a guide not actions. Please seek a professional. I welcome any feedback so please reach out.