“To be defeated is pardonable; to be surprised is unpardonable.” Napoleon Bonaparte

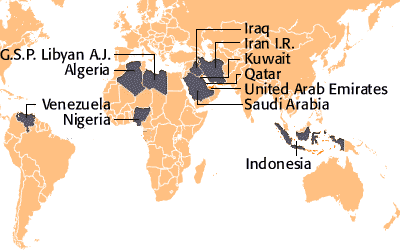

For decades, OPEC was the oil market’s unchallenged puppet master. A simple press release from Vienna could send prices soaring or plunging. Oil traders, economists, and world leaders watched monthly quota meetings like hawks, interpreting every word, gesture, and cough from ministers as market-moving gospel.

This week, in a move that reeked more of desperation than dominance, OPEC announced it would begin increasing oil production — a reversal of its recent posture of “voluntary cuts.” The message was clear: the cartel, particularly its de facto leader Saudi Arabia, is losing its grip.

How did we get here? The answer begins in a Texas shale patch and ends in the sun-scorched deserts of Neom.

The seeds of OPEC’s unraveling were planted by the U.S. shale revolution — a technological and geological breakthrough that turned America into the world’s largest oil producer in under a decade.

By 2014, a new type of oil supply entered the global market: fast-cycle, decentralized, privately-driven, and capex-lean. Horizontal drilling and fracking unleashed so much crude from shale that America didn’t just slash its imports — it started exporting.

This wasn’t just new oil — it was uncontrollable oil. Unlike the legacy producers of the Middle East, U.S. shale couldn’t be coerced, sanctioned, or easily negotiated with. OPEC suddenly faced a foe it couldn’t cartelize.

In 2014, Saudi Arabia — the cartel’s heavyweight — responded the way it always had: pump more, lower prices, bleed out the competition.

Oil collapsed from over $100 to under $30. It was a price war designed to bankrupt the shale cowboys.

Instead of collapsing, shale producers cut costs, innovated, and got leaner. Private equity doubled down. And soon, oilfields in North Dakota and West Texas were back online, faster and cheaper than ever.

The U.S. stopped needing Saudi oil — and Saudi Arabia never recovered its leverage.

The war failed. OPEC’s spare capacity became a liability. Instead of disciplining the market, they were now forced to act as swing producers in a world where the swing swung back.

As the limits of oil-based influence became painfully clear, Saudi Arabia unveiled Vision 2030 — a sweeping plan to modernize its economy, reduce dependence on hydrocarbons, and transform itself into an industrial and technological powerhouse.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.