"If you own a pipeline, you’ve got a business that gets paid regardless of the price of oil or gas. You get paid for transporting it, not for the price of it."

– Warren Buffett

ExxonMobil made waves with its $4.9 billion all-stock acquisition of Denbury Inc., bringing its CO₂ assets in the Permian Basin under its control. On paper, it seems like a strategic masterstroke—an oil giant positioning itself to take over the Carbon Capture and Storage (CCS) landscape. But don’t get carried away thinking this is a green energy revolution. Long before Exxon dipped its toes into CO₂ sequestration, CCS had already made itself at home in the Permian.

The SACROC oil field, located in Scurry County, Texas, is one of the most notable oil fields in the Permian Basin. It has gained global recognition not only for its substantial oil production but also for its pioneering role in Enhanced Oil Recovery (EOR) using carbon dioxide (CO₂). The story of SACROC’s development and its adoption of CO₂ injections is one of innovation in both oil extraction and environmental management.

SACROC, the oil field that’s been thrust into the spotlight as the ultimate example of Enhanced Oil Recovery (EOR) using carbon dioxide (CO₂). For decades, this field has been the darling of the carbon capture community. The story goes that CO₂ can both boost oil production and sequester carbon, and SACROC is the proof. But before we get too carried away with this narrative, let’s inject—pun intended—a dose of reality into this rosy picture.

Sure, CO₂ EOR has worked wonders at SACROC, but if you think that means the entire oil industry is about to switch to a CO₂-powered future, you’re sorely mistaken. SACROC is special—and that’s where the story starts to get complicated.

SACROC’s story begins way back in 1953. At the time, it was just another oil field—nothing spectacular, but it was doing its job. By the late 1960s, however, it was showing signs of wear. The pressure in the reservoir was dropping, and its production was steadily declining. If SACROC didn’t get a new plan, it would be just another aged field in the rearview mirror of history.

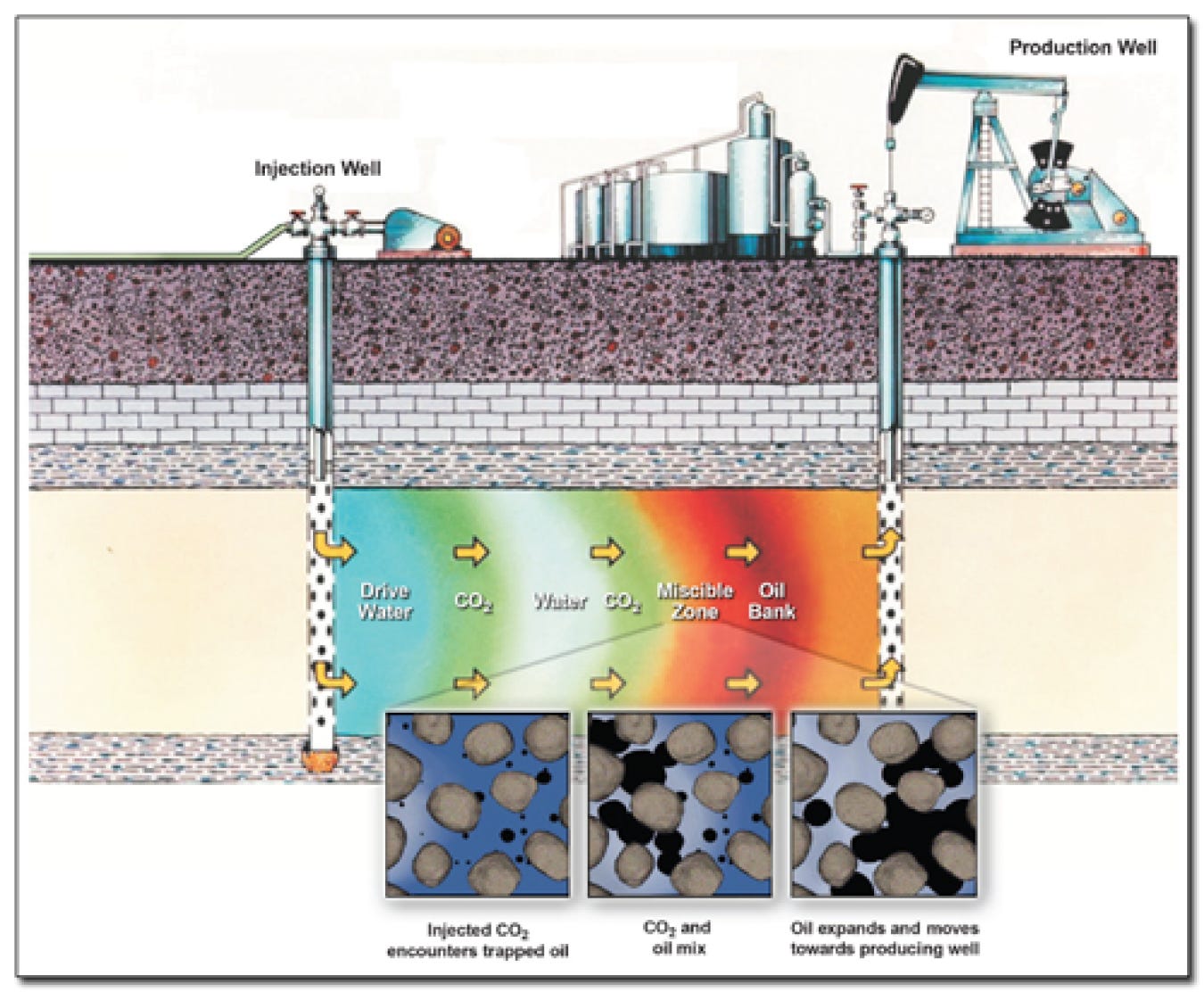

Enter CO₂ injection in 1972—the ultimate plot twist. Suddenly, SACROC became the shining beacon of CO₂'s potential to resurrect old oil fields. The magic was simple: CO₂ injection raised the pressure in the reservoir, reducing the viscosity of the oil, and voila, oil production surged from 12,000 barrels per day to 50,000 barrels per day at its peak.

Great story, right? CO₂ breathing new life into a declining field, saving it from extinction. But hold on. Before you start imagining that this is the future of oil recovery everywhere, let’s be clear: SACROC isn’t typical. Most oil fields don’t have the luxury of natural CO₂ sitting underneath them, ready to be tapped. So while SACROC is impressive, it’s not necessarily a blueprint for the entire industry.

Now, let’s get into the weeds of CO₂ itself. There are two primary types of CO₂ at play here: natural CO₂ and post-combustion CO₂. And before you think all CO₂ is the same, let me tell you right now: they’re as different as night and day.

Natural CO₂ is the holy grail of CO₂. It’s the CO₂ you want if you’re serious about CCS. Here’s why:

Source: Natural CO₂ is found deep underground, often in the same geological formations as oil or natural gas. It’s naturally occurring, so no need for a refinery. Just pump it out, and you’re good to go.

Purity: When we talk about purity, we mean pure. Natural CO₂ is typically 95% CO₂ or more. It's the premium product of CO₂, and it’s ready to be injected directly into oil fields.

Cost: Because it’s so pure and easy to access, natural CO₂ is the cheapest and most efficient option. It’s the kind of CO₂ that makes oil fields like SACROC possible without breaking the bank.

But here’s the catch: natural CO₂ isn’t something you can just grab whenever you need it. It’s rare, and finding new sources is getting tougher by the day. So if you’re lucky enough to have access to it, great. But for the vast majority of the oil industry? Good luck.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.