Internal Affairs

The U.S. embarking on a New Monroe Doctrine and OPEC will be it's first Victim

"The American continents... are henceforth not to be considered as subjects for future colonization by any foreign powers." Monroe

Cancer Can LinkedIn

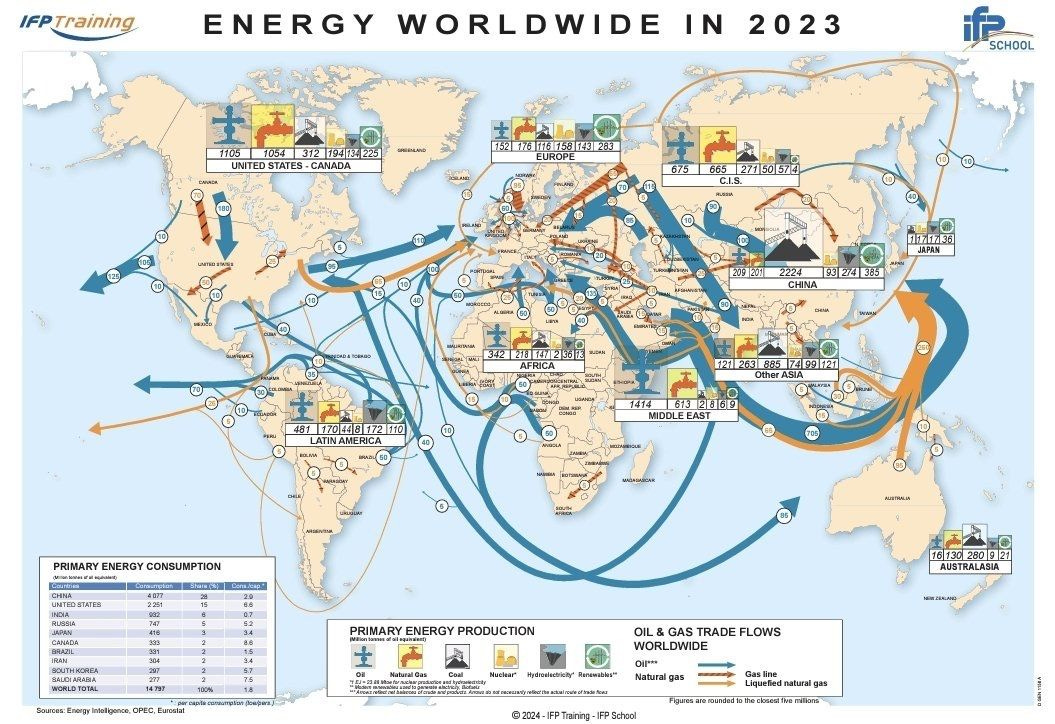

The global energy landscape is on the brink of a monumental shift. In a world where OPEC and the Middle East have long been the dominant players in the oil market, a new coalition is rising in the Americas. This coalition, driven by the United States, Canada, and key South American nations like Brazil, Argentina, and Guyana, is poised to challenge OPEC’s dominance and reshape global energy dynamics. The geopolitical upheavals in both North and South America—marked by the return of Donald Trump to the U.S. presidency, the resignation of Canadian Prime Minister Justin Trudeau, and the growing influence of conservative leader Pierre Poilievre in Canada—are setting the stage for a new energy alliance.

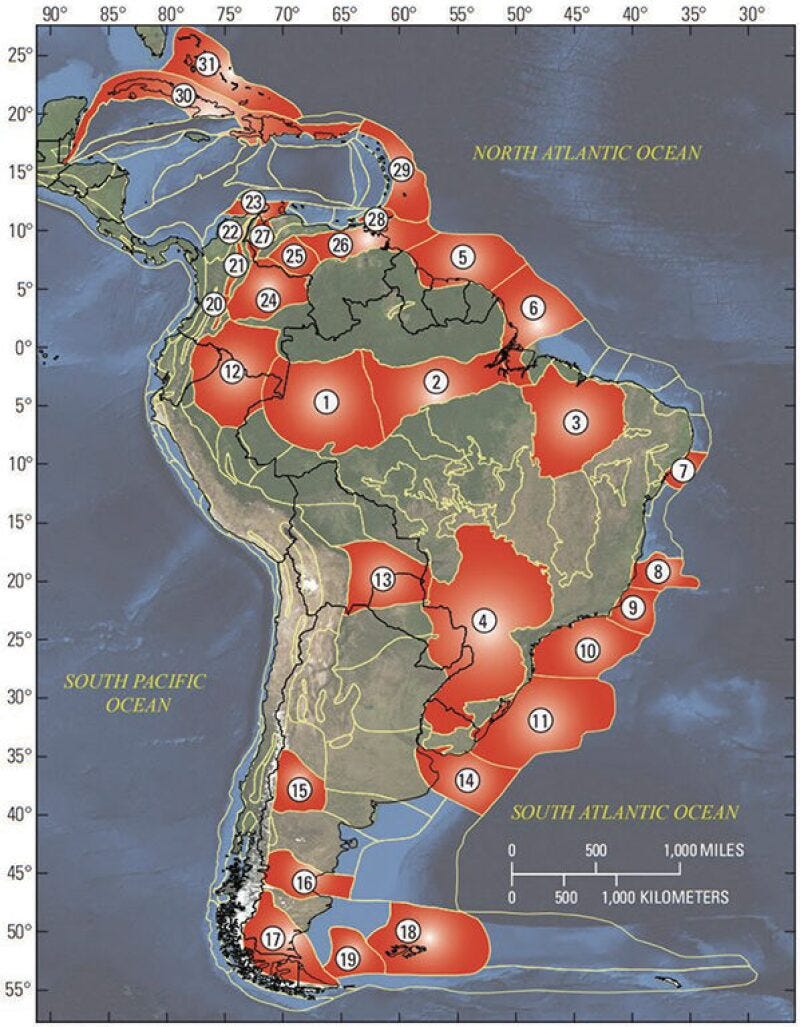

As these political changes unfold, the oil and gas resources in the Americas are expanding at a rapid pace. With increasing production from Guyana’s offshore fields, Brazil’s pre-salt oil discoveries, and Argentina’s shale boom, the Americas are positioning themselves to become a dominant force in the global energy market. These developments, combined with North American political shifts, offer a stark contrast to the region’s traditional reliance on Middle Eastern oil.

In the United States, the political winds are shifting dramatically. The return of Donald Trump to the White House promises a renewed focus on energy independence and pro-fossil fuel policies. Trump's first administration was marked by a commitment to deregulation, the expansion of U.S. oil production, and the loosening of environmental restrictions. With Trump’s return to the presidency, the U.S. is likely to strengthen its energy posture, pushing for greater domestic production, reduced reliance on foreign oil, and a continued effort to cement itself as the world’s leading energy exporter.

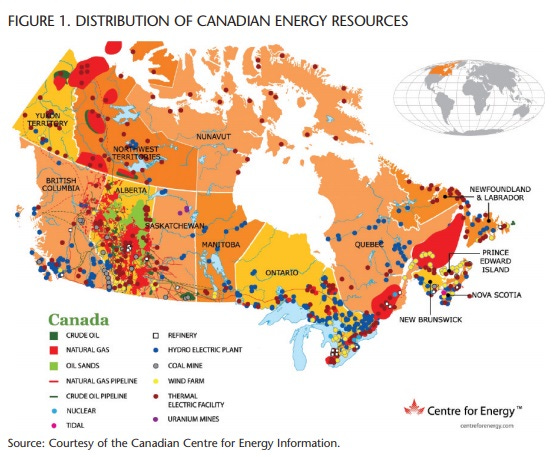

This shift in U.S. policy aligns with growing energy potential in neighboring Canada, where the resignation of Prime Minister Justin Trudeau has paved the way for Pierre Poilievre, leader of the Conservative Party, to take charge. Poilievre, who has gained significant traction in the polls, represents a hard right turn on energy policy, emphasizing increased oil and gas production, the dismantling of carbon taxes, and a rollback of federal climate policies that limit the oil and gas sector’s growth. His leadership could bring much-needed political stability to Canada’s energy sector, fostering greater integration with U.S. policies and allowing the two nations to collaborate on a shared energy strategy.

The Americas’ energy resources—ranging from North American shale to South American deep-water reserves—are vast, varied, and increasingly accessible. The region holds some of the world’s largest and most promising energy reserves, and the capacity to increase both production and exports has never been greater.

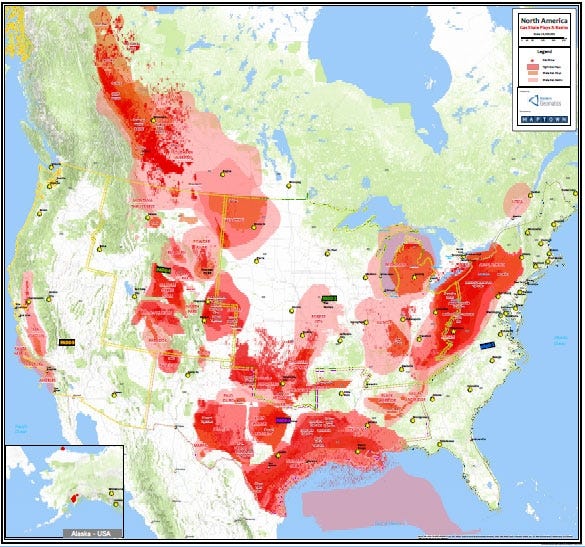

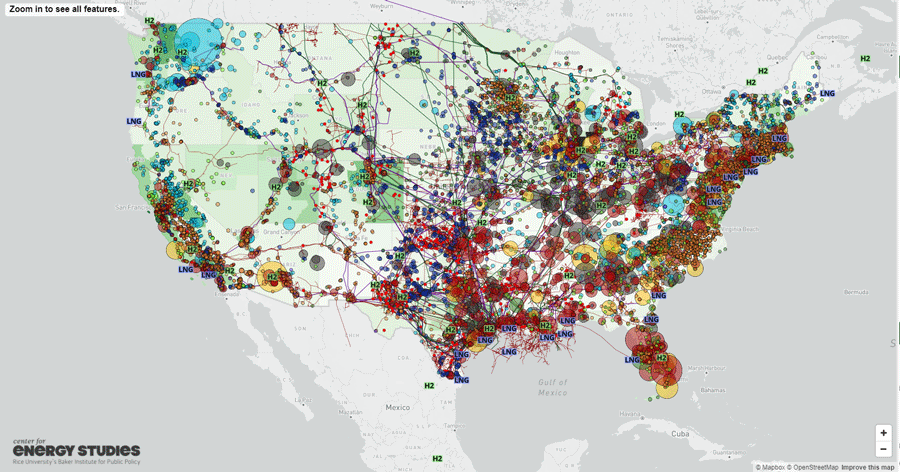

The U.S. is home to some of the largest and most productive shale oil fields in the world. The Permian Basin, located primarily in Texas and New Mexico, is by far the largest contributor to U.S. oil production. With output nearing 5 million barrels per day (bpd), the Permian Basin alone is one of the largest oil-producing regions globally, rivaling OPEC’s own oil giants. Additionally, the Bakken Formation in North Dakota and the Eagle Ford Shale in Texas further contribute to the U.S.’s position as the world’s largest oil producer.

The U.S. has also become a dominant player in liquefied natural gas (LNG) exports, with its coastal terminals providing an increasing share of the world’s LNG supply. With an extensive pipeline network, refining capacity, and export terminals, the U.S. is both a major producer and a key energy exporter, providing oil and natural gas to not just its allies but to global markets.

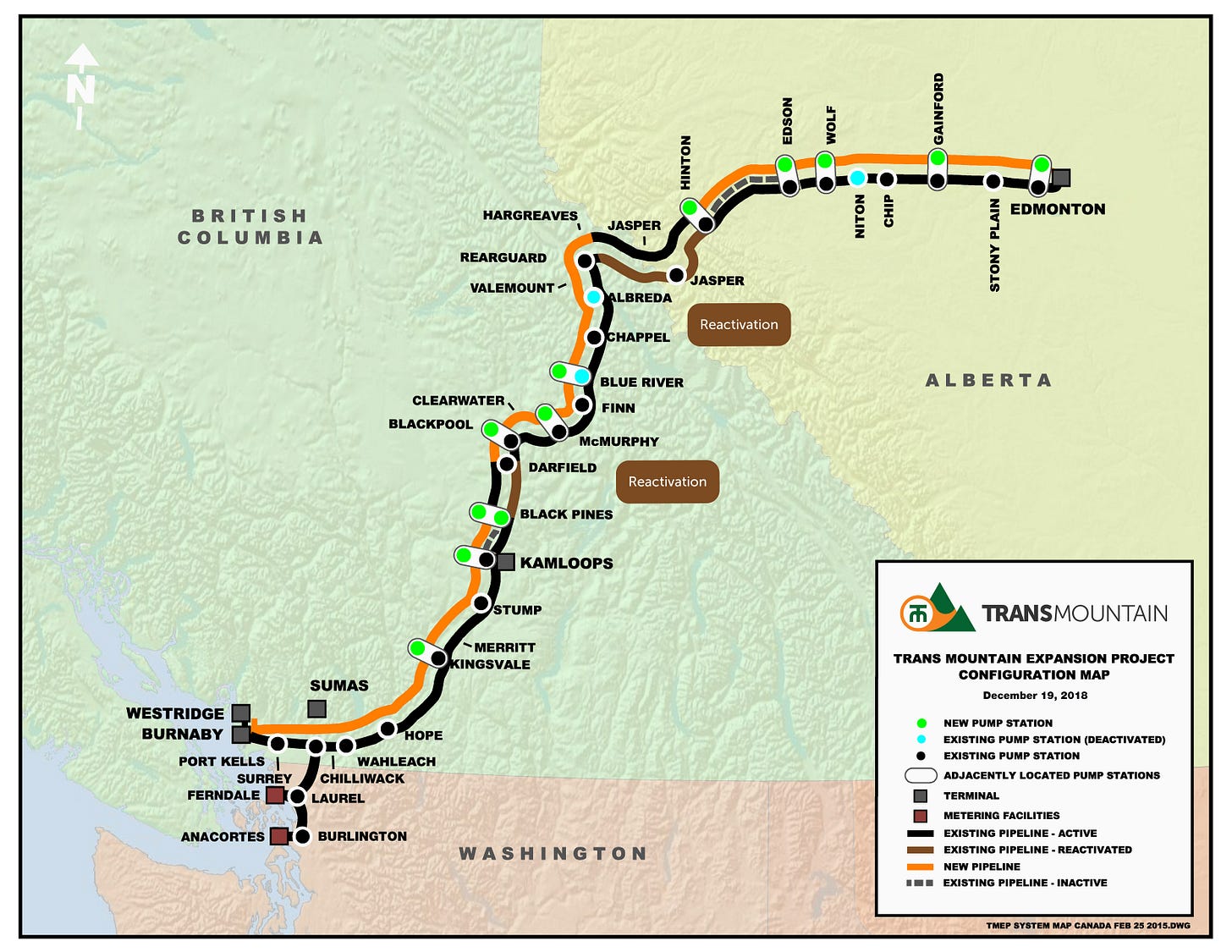

Canada, with its vast oil sands reserves in Alberta, stands as one of the world’s top producers of crude oil. The oil sands—estimated to hold approximately 170 billion barrels of recoverable oil—have long been a cornerstone of Canadian energy production. Alberta’s oil sands alone contain more oil than many OPEC nations, including Iraq, and are crucial to Canada’s energy future. With technological advancements in extraction methods, Alberta’s production continues to rise, and the newly completed Trans Mountain Expansion (TMX) pipeline will play a pivotal role in boosting exports to the U.S. West Coast and Asia.

The TMX project, which will increase the pipeline’s capacity to 890,000 bpd, is expected to be a game-changer for Alberta’s oil industry. The project will open new markets for Canadian crude oil, providing access to higher-paying Asian markets and reducing dependence on U.S. refineries. However, Alberta’s future is closely tied to political developments, particularly the outcome of the ongoing dispute with the federal government over emissions caps. The federal government’s climate policies threaten to constrain Alberta’s production, potentially putting a damper on the province’s growing export potential. With the resignation of Canadian Prime Minister Trudeau, these road blocks will subsided.

South America is experiencing a renaissance in oil production, with countries like Guyana, Brazil, and Argentina significantly increasing their output. These nations are poised to become integral parts of the Americas’ new energy bloc, providing crucial supplies to both regional and global markets.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.