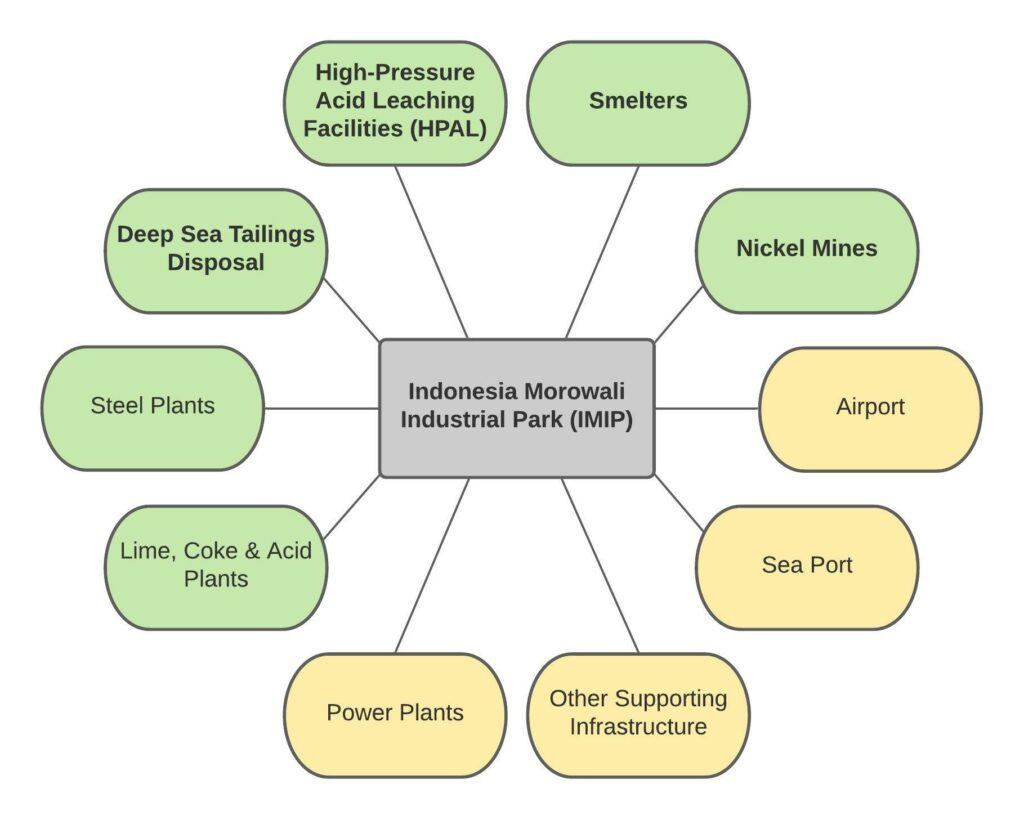

The Indonesia Morowali Industrial Park is a sprawling industrail project located in Central Sulawesi. Part of Maritime Silk Road (MSR) of China’s Belt and Road Initiative— it’s largest share holder is Tsingshan Holding Group, culprit of the 2022 nickel squeeze—IMIP is desgin to be a self sustaing city:

The IMIP compound spans 2,000 hectares and contains worker housing and a hotel for executive visitors; lime, coke, and acid plants; seaports; an airport with a 1,800-metre runway; and its own telecommunications network. The park has two HPAL facilities under construction and 11 smelters consisting of 40 lines, producing nickel pig iron (NPI), ferrochrome, and stainless steel. There are also at least two nearby nickel mines supplying the project, including the Hengjaya mine. The People’s Map

With 22% of the world’s total nickel reserves—according to The United States Geological Service—at 21 million tonnes and 15% of the world’s known laterite Indonesia is unquiely poistion to benefit from the demand of battery metals needed to meet the growing demand for batteries. While the Nickel reserves only makes Indonesia an ideal place for a project like IMIP, Indonesia true benefits comes from two other advantages.

Imagine by AheadoftheHeard

Location in the middle of the Strait of Malacca gives Indonesia, and hence IMIP, access to one of the most important shipping lanes in the world carrying about 25% of the world's traded goods, including oil, Chinese manufactured products, coal, palm oil and Indonesia coffee. Suffice to say any country with direct access to the strait and any country with access to resources will be the beneficiary of internatinoal investment like China’s Belt and Road Initiative.

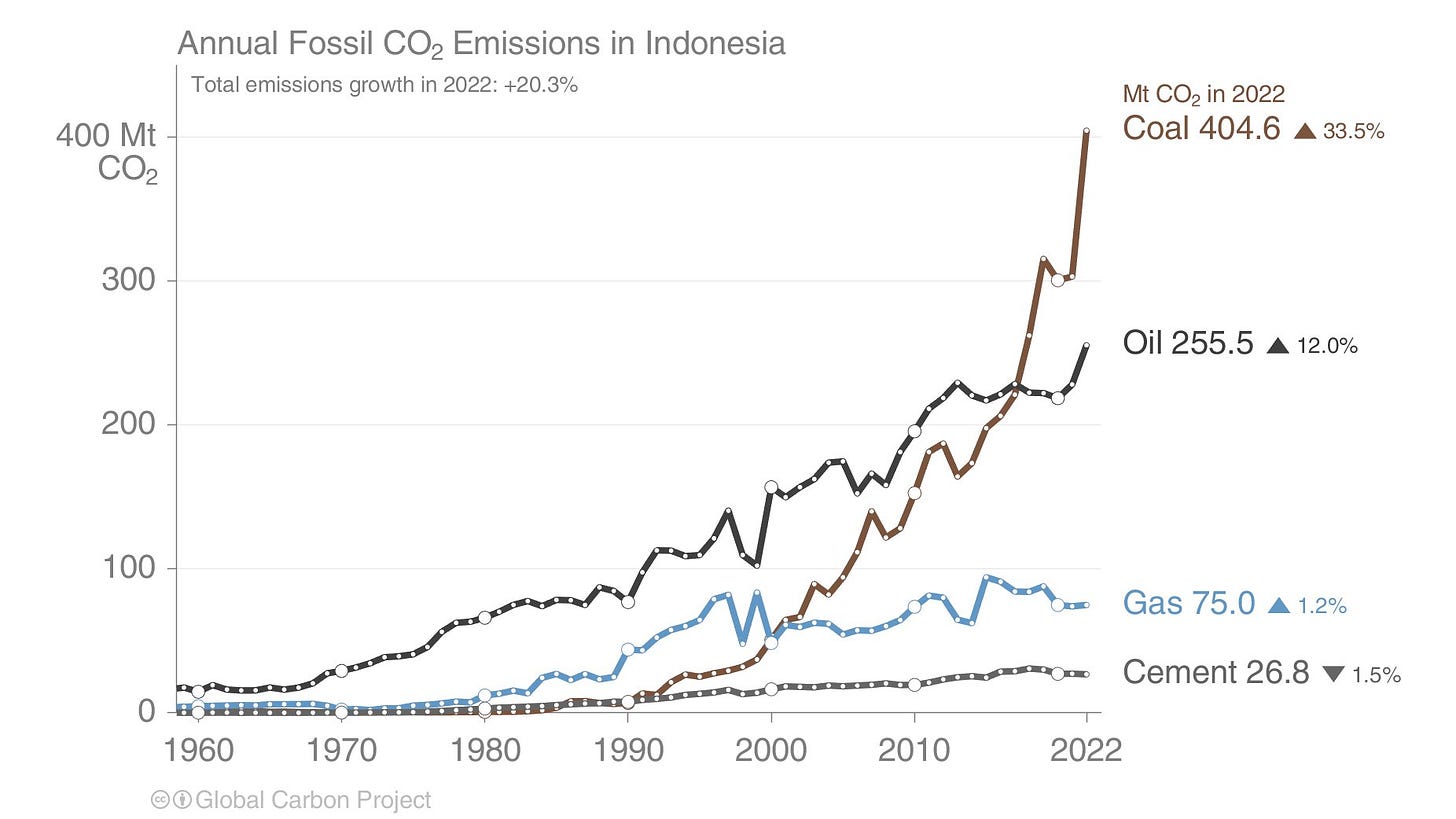

But what gives Indonesia it’s real advantage is it’s abundance of coal. See in 2022, according to offical data, Indonesia burned more coal in that year than any year before contributing to a 20% in it’s GHG.

In 2015, Indonesia’s President Joko Widodo annocunt a series of economic initiatives design to grow the Indonesian economy. At the heart of President Joko Widodo’s flagship program was the addition of 35 gigawatts (GW) to the national grid in a bid to power Indonesia’s economy.

Carrying resource nationalism policies of his predecessor, program entails the construction of hundreds of power plants the majority, 20 GW or 117 plant, will coal.

In 2015, when the 35 GW program was announced, Indonesia’s fleet of existing coal plants had a combined capacity of 25.4 GW. In 2022, that had increased by 60% to 40.6 GW, according to a 2023 report by Global Energy Monitor.

With a price cap of $70 per tonne for coal sales to power plants and a $90 per tonne cap for local cement and fertiliser companies discouraging other forms of power generations plus a series of export bans of copper, iron ore, lead, zinc, anode mud, & nickel ore to aid in downstream value chain creation have help coal growth.

“Coal consumption actually grew sharply in the two years before the pandemic, so the growth in 2022 is partly about recovery to Indonesia’s previous growth trajectory,” Andrew said. Robbie Andrew, a member of the Global Carbon Project

EVs Dream has Dirty Nickel Dilemma

While InoNickel deposits are found in primarily two types - sulphide and laterite. Suphide -located in Russia, Canada, and Australia are higher graded ores while the majority of Indoenisa deposits other hand are Laterirt. Laterirt deposits, unlike sulphide deposits, are lower-grade found closer to surface and requires additional energy-intensive processing to become battery-grade nickel.

“Although Indonesia produces around 40% of total nickel, little of this is currently used in the EV battery supply chain. The largest Class 1 battery grade nickel producers are Russia, Canada and Australia,” the IEA said.

You can see this reality in the country’s coal consumption

Held Captive by Coal

With Indonesian nickel production rising 60% in 2022, accounting for half of global production, and the energy-intensive natural of laterirt ores, it all but guarantees the continual use of coal! These captive coal plants are built specifically to serve the smelters, consuming 15% of the countries coal power output, and as a result these plant can’t be shut down without affecting the industries that they power. So in a twisted sense of irony coal is used to produce a metal that in turn will be used make batteries for EVs. Stated differently, under the guise of“climate-change” & enivormental concerns Indonesia is exporting coal in the form of nickel sulfide ore while creating vast ecological damage to the surrounding area there by all but guaranteeing to the continuation use of coal and growth in carbon emissions! So much for E.S.G.

How to Profit

Given the protectionist stance of the goverment to keep resources available for industry development and given the fact that there is not one state-owned entity in Indonesia that controls the production of nickel, investor have a change profit directly and indirectly from Indonesia’s nickel production buildout.

Tsingshan of China and Brazil’s Vale are major producers of nickel in Indonesia along with Glencore. Glencore, who also took part in a $9 billion British consortium investing directly in IMIP, supplies Indonesia with coal from it’s mines in Australia—Australia is the largest exporter of thermal coal to Indonesia.

Given the lack of faith in China’s equity markets and it’s weak rule of law, due in part to it’s communist governance, Vale and Glencore seems like the best options. PT Vale Indonesia Tbk, a Vale subsidiary, as been operating in Indoesia since July 25, 1968 and became a public traded company on May 16, 1990 at the Indonesia Stock Exchange.

The current concessions of 118,017 hectares covering South Sulawesi (70,566 hectares), Central Sulawesi (22,699 hectares) and Southeast Sulawesi (24,752 hectares) runs thru 2025. The average volume of nickel production per year is 75,000 tons. Vale is also contribuited directly to the buildout of IMIP as well.

Commentary

With the growth in demand for enery I am amazed about the lack of forsight by the “big thinkers”. The inability to think of 1st, 2nd, & 3rd order effects of a complex systems asures me that the enviorment will be sacrificed in the name of fighting climate-change. Coal will continue to be use for the forseeable future to meet the E.Vs dream.

As always this is not investment advice just my observation of the market. Please, as I am human and get things wrong consult someone, anyone! I look forward to any and all feedback, reach out.