“The Middle East is like a chessboard, with players continually reconfiguring and maneuvering, but the pieces never seem to fit right." — Richard Engel, NBC News Chief Foreign Correspondent

In the geopolitical opera that is the modern world, few stages rival the Middle East for the sheer spectacle of power, influence, and wealth. The region’s pivotal role on the global stage in 2024 is undeniable: it is home to a staggering 48% of the world’s tested oil reserves and over 40% of its natural gas supplies. These numbers place the Middle East at the heart of the world’s energy matrix, making it a region whose political and economic decisions send ripples throughout the global system. The Middle East isn’t just a region—it’s a geopolitical engine that drives the modern world, both in terms of energy and influence.

At the core of this energy behemoth sits Saudi Arabia, a country whose economic and political might is anchored in its oil wealth. Saudi Arabia is home to the Ghawar Field, the world’s largest onshore oil field, making it the crown jewel of global oil production. The Kingdom pumps an impressive 10.4 million barrels of oil per day, which ensures its status as an irreplaceable player in global energy markets. Saudi Arabia’s role in this arena isn’t merely economic—it is also deeply tied to its strategic partnerships, especially with the United States, which relies heavily on the Kingdom to maintain stability in the region.

However, while oil remains dominant, natural gas in the Middle East is just as consequential. Qatar, with its North Field—the largest gas field in the world—stands as a true titan in the global energy game. Iran, too, holds a significant position with the second-largest natural gas reserves globally. The combined weight of these countries ensures that the Middle East remains a key supplier to energy-hungry nations, particularly those in Europe and Asia. This concentration of energy resources gives the region unparalleled geopolitical power—one that is constantly reshaped by both external and internal forces.

The energy wealth of the region has attracted the attention of global powers, particularly the United States, whose sprawling military presence in the Middle East is a testament to its strategic importance. The U.S. maintains around 40,000 service members across the region, operating out of military bases in 19 countries, including Bahrain, Egypt, Iraq, Israel, Saudi Arabia, and the UAE. These bases ensure that Washington can project power and protect its interests in an area critical to global stability.

In Bahrain, the U.S. Navy’s Fifth Fleet operates from the largest permanent U.S. military base in the region. The U.S. also has extensive facilities in Qatar, where its air force maintains a strong presence, and in Saudi Arabia, where bases help secure both regional stability and energy flow. This presence has been a key pillar of American policy in the region for decades, but it is now facing new challenges as emerging players, like Turkey, begin to reshape the geopolitical landscape.

Turkey, a NATO member positioned at the crossroads of Europe and Asia, has been a consistent and important actor in the region’s dynamics. Its strategic location makes it an indispensable player in European energy security. In recent years, Turkey has leveraged its role to become a critical hub for natural gas transit, especially from Central Asia and the Caspian region. Turkey’s ambitions are clear: to control the flow of energy to Europe and reduce Europe’s reliance on Russia. As this geopolitical competition intensifies, Turkey’s role has grown increasingly important, especially given the rise of regional tensions and shifting alliances.

In the broader context of global energy flows, Turkey’s efforts to secure and control pipeline routes from the Caspian and Middle Eastern regions further cement its strategic significance. These ambitions directly impact Russia, whose control over energy flows to Europe has long been a cornerstone of its foreign policy.

However it is the collapse of a unified state that will become the most consequential developments in the Middle East over the last decade. Since the outbreak of the Syrian Civil War in 2011, the country has been locked in a brutal conflict, with multiple factions—each supported by various global powers—fighting for control. The war’s toll has been devastating, not just for the Syrian people but for the geopolitical ambitions of Russia and Iran, two of the most significant foreign players in the conflict.

In the early stages of the Syrian war, both Russia and Iran saw an opportunity to extend their influence in the region. Russia, under President Vladimir Putin, aimed to bolster the regime of Bashar al-Assad, a key ally in the Middle East. For Iran, Syria was integral to its broader “Shia Crescent” strategy, a corridor of influence that stretches from Tehran, through Baghdad, and Damascus, to Hezbollah in Lebanon. To achieve this, Iran invested heavily in military support for Assad, sending troops, financial aid, and militia groups to prop up the regime.

Russia, too, committed significant resources, including airstrikes and military personnel. By 2015, Russian intervention had turned the tide in Assad’s favor, ensuring his survival as the leader of Syria. But as time passed, it became clear that Syria was no longer the stable, reliable ally Russia had hoped for. Instead, the country had become a fragmented state—a patchwork of competing factions, foreign interventions, and local power struggles. This instability not only strained Russian resources but also complicated its wider geopolitical ambitions.

Russia’s initial victory in Syria, marked by the recapture of key areas such as Aleppo, gave the impression of a Pyrrhic success. While Assad remained in power, Syria had become an unstable battlefield where Russia had to maintain a permanent military presence to secure its interests. The costs of this intervention were steep, both in terms of military expenditures and the toll it took on Russia’s international standing. The presence of Turkish forces, U.S. military bases, and Israeli airstrikes in Syria further complicated Russia’s position, forcing Moscow to navigate a complex web of rivalries and regional conflicts.

Similarly, Iran’s intervention in Syria has proven to be a double-edged sword. While Tehran has managed to secure a foothold in the Levant, its ambitions have been frustrated by the sectarian and ethnic divisions within Syria. Iran’s support for the Assad regime has placed it at odds with multiple regional powers, including Israel, Saudi Arabia, and the U.S., all of whom have sought to undermine Tehran’s influence. Additionally, Iran’s involvement in Syria has come at a significant financial and human cost. Its efforts to support the Assad regime, while initially viewed as a strategic success, have ultimately left Iran entrenched in a conflict that seems increasingly difficult to resolve.

Syria’s ports, particularly Tartus, have become central to Russia’s broader geopolitical operations. While these military bases allow Russia to project power in the Mediterranean, they also serve as vital logistical hubs for Russia’s influence in Africa. Through Tartus and the airbase at Khmeimim, Russia has established a critical staging ground for operations that extend far beyond the Middle East, particularly in Libya and other African nations.

For months throughout 2024, Khalifa Haftar, the warlord who currently dominates Eastern and Southern Libya, has allowed the Russians to open and operate four air bases across his control territory in exchange for Russia's military support in Libya's civil war. Over the course of 2024, Russia has expanded its aircraft and troop presence at these air bases, cementing its foothold in Libya. This strategic development allows Russia to project power deeper into Africa, establishing a continuous logistical arc from Russia to Syria, Libya, and then further into the African interior.

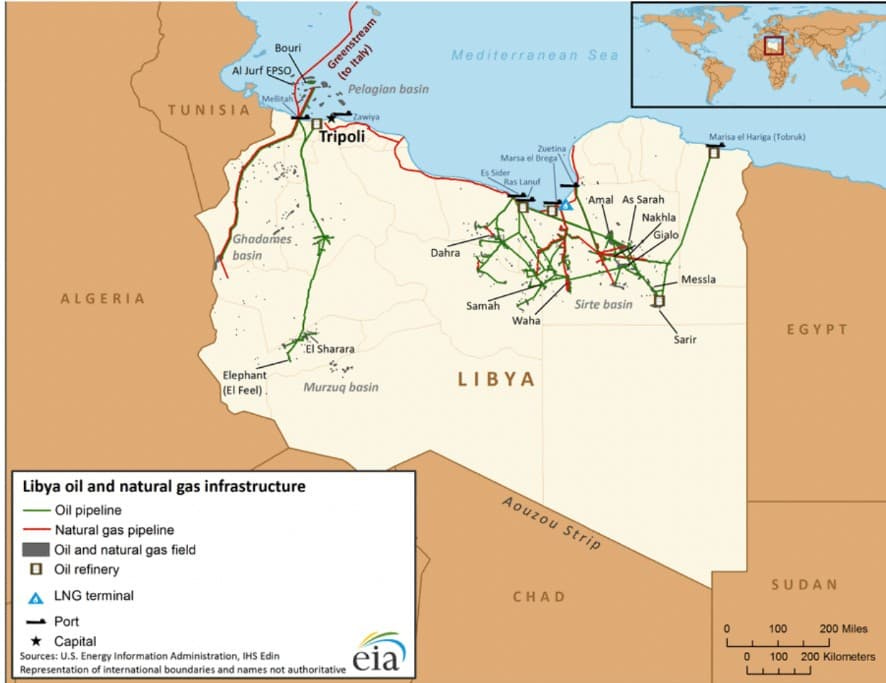

Libya, a key member of OPEC, has long been a critical player in global oil markets. The country’s oil production, particularly from fields such as El Sharara, has faced multiple disruptions over the past decade, largely due to civil war, instability, and foreign interventions. However, Russia’s involvement in Libya, particularly its military backing of Khalifa Haftar’s Libyan National Army (LNA), has further complicated Libya’s oil output.

The instability fostered by the ongoing civil conflict has led to sporadic shutdowns and closures of key oil terminals and pipelines, most notably in the country’s eastern and southern regions. These disruptions have contributed to a significant drop in oil production from Libya, which fell to as low as 200,000 barrels per day at times—well below its potential capacity of 1.6 million barrels per day.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.