Golden Parachute

The United States cement a class division and it's because of interest rates.

Much has been made about the United States return to “normalize” interest rates after 15 years of monetary experimentation, breaking capitalism and sowing the seeds of class division that will have to be address at some point in the future. Money in the land of the free became free which cause disruption in opportunity cost warping the capital allocations of businesses and the wealthy. The United States has not did not go down the path of nonmail negative interest rates-real rates in the land of the freedom are negative on a after tax, after inflation bases-as many European countries, which had the effects of saving the top 20% at the expense of the bottom 80%!

On a long-term bases, The Federal Reverse has not done the job in re-training people on how to think about capital, time risk and with an inverted yield curve, The Fed still has a job to do even after jacking interest rates at the fast pace in history to fight inflation. On a side note this will give the appearance of CPI disinflation. As a feature of the structural role the dollar plays in global finance, the stronger the dollar the more the United States can export it’s inflation by making imports cheap. Other factors play was well, however that is well beyond the scope of this post.

The idleness of interest rate increases put bank regulators to sleep as many just stopped stress-testing for rapid changes in the interest rates, you know that thing called duration mismatch, which is why so many banks, sovereign wealth funds, & pensions were caught holding the bag when interest rates increased and forced asset revaluation.

Society has not adapted to this new paradigm and no where is this more clear than in the housing market. Consider this, mortgage rates in the land of the free are hovering around 7%-for those with 700 credit scores-which is high compared to recent history, but is low historically speaking. These new “high mortgage rates” where consider cheap and inconceivable in the past, you combine that with historic inflations rate of 3-4%-much higher today-and tax deductibility with favorable down payment terms, it made the cost of owing a home “neutral or free” even without taking appreciation into account.

How Interest Rates Facilitated the Greatest Wealth Transfer Ever

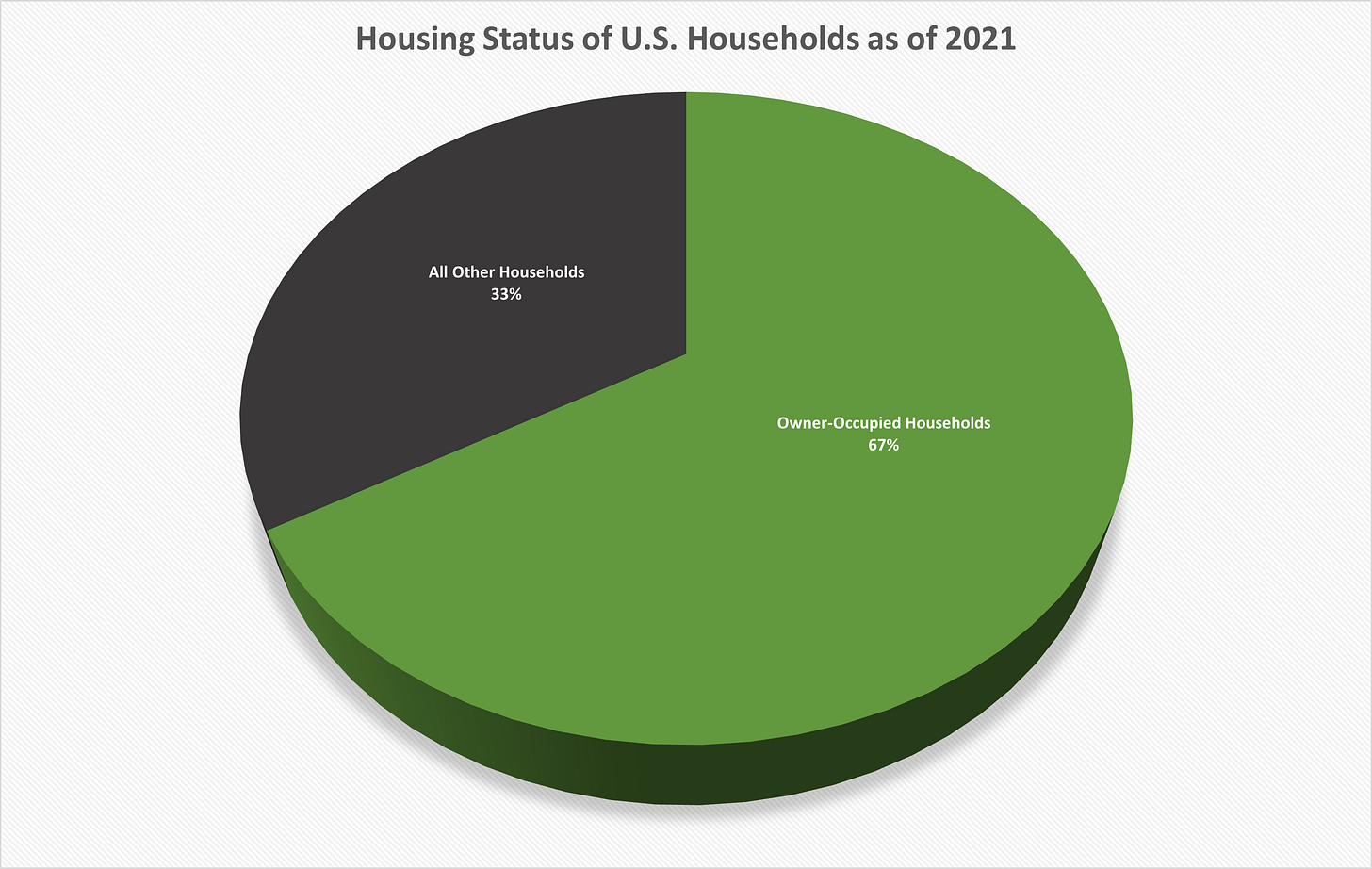

The United States has 125,736,353 of those households 85,220,000 were owner-occupied housing units in the United States, roughly 67% of the U.S.

Of those household, 34,540,000 had no mortgage whatsoever, 1,474,000 had a reverse-mortgage only, a loan secured by payoff equity, 1,232,000 households had paid off their house entirely but choose to access liquidity of their home with a home equity line of credit. Here are these numbers in again in a chart for ease:

Translating to a roughly 28 out of every American household that it own free and clear! The amount of equity cushion that these household have is truly astonishing enabling the weathering of a finical down turn without suffer equity depletion.

What of those 46,000,000 or so owner occupied units that have mortgages, what does their economic situation look like? Well the over whelming-44,000,000 of 46,000,000-were at a median fix-rate at 3.5%. The picture gets rosier when you find out that roughly 12,000,000 household have mortgages under 3%.

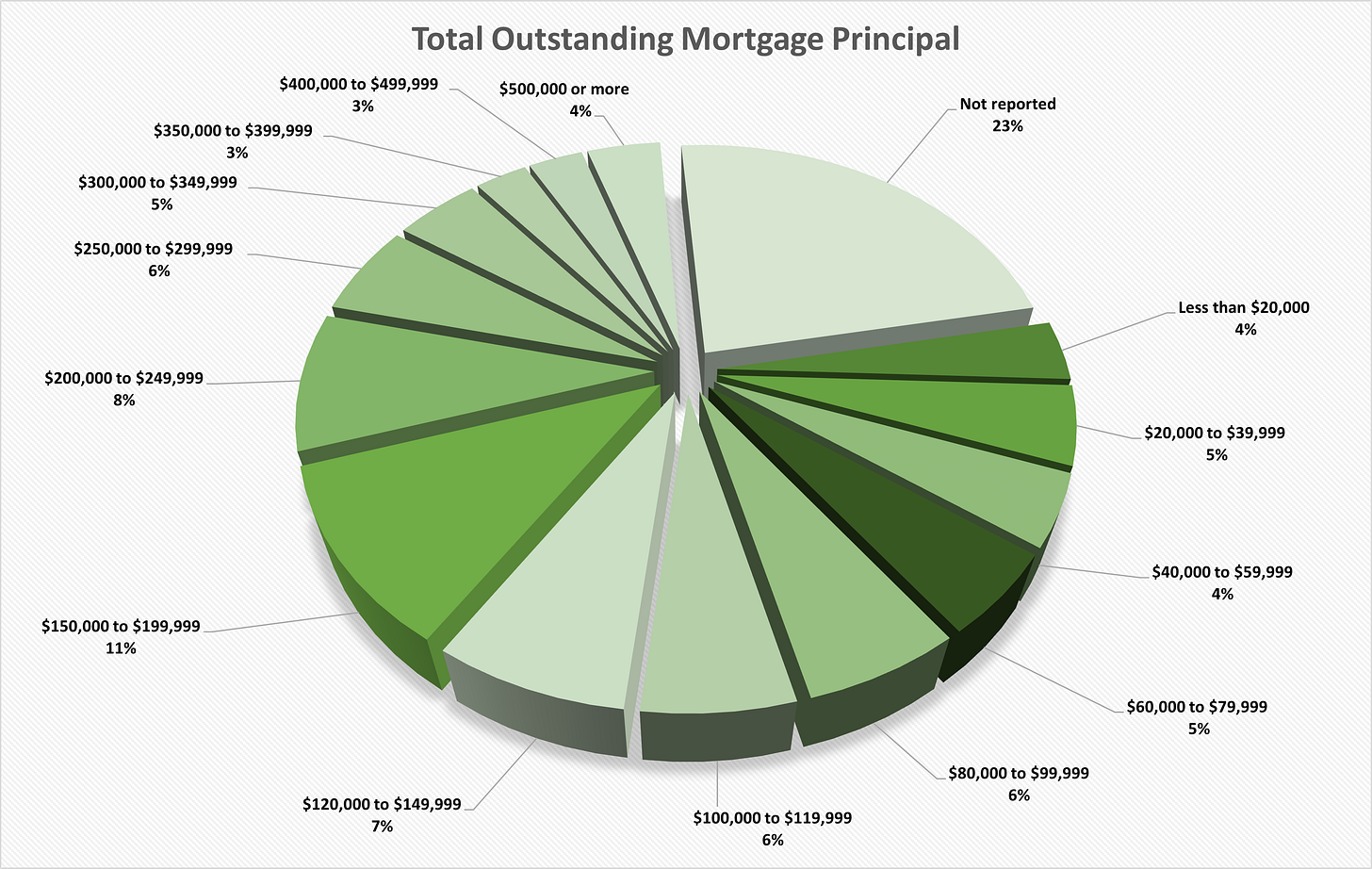

The servicing of the mortgage is not even an issue as the total outstanding mortgage principle very some compared to net income or wealth as the median mortgage is a little north of $150,000.

The monthly payment data is even something to envy as the median is according to the National Association of REALTORS in 2022 the average monthly mortgage payment was $2,317 and 15,124,000 units have mortgages of $999 or less.

We see a country were the majority of it’s population lives in an owner-occupied house with the large percentage owned out right and of those who do have mortgage, the majority are on a fix-rate at the lowest interest rates man kind has ever seen! With inflation set to run north of it’s historical normal of 3-4% couple with tax deductibility, gives many household a negative cost of debt.

What are the implications for our society?

The implications of the current condition should not be understated. We have as a matter of policy created a situation where a portion of our society has secured the greatest financial tailwind ever and is going to have profound consequences with respects to housing formation, social mobility, wealth gap, state migration patterns-which ultimate will effect state & federal elections-& local tax collection which effects education. Adding insult to injury, Wall Street was able to jump in and get their slice of the pie, exacerbating the affordability issue by taking advantage of low borrowing cost and piling that money into residential real estate in key cities. Suffice to say if you are younger taxpaying voter, you got screwed and are caught on the losing end of a trade that you almost can do anything about. Which is why the attitudes towards socialism in the younger generations are so high and demands for government action for intervention are growing. Again this is a policy choice we chose to do this, this did not have to be done but it was and we have to live with the consequences. The damages is done and American society and economy are less flexibility and dynamic stunting its economy. I am of the opinion that the Federal reserve created a caste system dividing the nation all based on the generation into which they were born. A voting demographic warfare. Paradoxically policy makers also took advantage to manipulate markets in order to save “social security”. As options to increase payouts are diminishing-increase taxes on a very decrease working base due to able body people fall out of the workforce, automation, & demographics makes it an unexpectable option-and austerity in the form of inflation takes hold.

Financially speaking, it is nonsensical to pay off debt with a negative cost. With Treasuries yielding north of 4.5% and world class cash flowing dividend blue chip stocks with rock solid balance sheet and dividend yields in excess of 3% per annum, preferably focusing on those with a history of stable payout ratio and increases greater than inflation, a household doing nothing differently, has a greatly improved the probability of materially higher wealth at the end of twenty or thirty years. This financial gift will be further enhance when taken advantage of market declines over this time frame. You can not blame people for taking advantage of the opportunity, after all people only operate based on incentives.

What remedies are there?

There are a several options available for policy makers to pursue and each one comes with their own trade-offs, winners & loser, etc.

Tax incentives: you could set 0% tax rates for developers that meet certain criteria for square foot, supply, & location. Increase the MCC tax credit for individuals with certain restriction for dwelling time. Increase the tax rate to double the rate of other financial assets to discourage the financialization of the housing market for hedge funds and wall street or ban it outright.

Mass building: have an all out assault on permits for building equal to the war time production, including smaller single family homes, rowhouses and townhouses, and large apartment complexes. The law of supply and demand will ultimately take hold and have a greater weight on home prices than interest rates. This is not immediate has housing is generally a lag, however it is a start and with a 1.2 million deficit, would go a long way.

Increase real estate taxes: you could destroy the housing market by making it unaffordable thereby killing demand causing prices to crash.

How we choose to handle this situation will be a defining moment for the country. If left uncheck the inequality will grow to resemble feudalism, a remnant of the medieval age called the dark ages because of serfdom & a cast system that reinforced inequalities and thereby poverty. It seems that policy makers are responding to their past sins in a pragmatic way allowing the economy to self correct and purge itself. We have seen it with the regionally banking crisis and the commercial real estate market crash. How much self correction needs to happen I do not know, but what is for certain is that Jerome Powell means what he says, higher for longer.

How to protect yourself?

Given the previous generations gift-or wealth transfer-you made be incline to ask, what about me? Is there any way from me to secure security like this? Surprisingly, the answer is yes!

Cash: With cash yielding close to 5%, parking ones funds in a money market account and wait for opportunities to present themselves.

T-bills/T-Notes: Buying bills or notes at their highest yield in decades is another option. You get tax benefits, coupon payment, & the change for capital gains “if” The Fed reverses course and cut rates.

TIPS: Short for Treasury Inflation Protection Security are offering a real yield of 1.7%. There is an old saying that if someone earned a real yield of 1% or 2% from Rome times till today, it would be the greatest accumulation of wealth the world has every since. This won’t always be the case for TIPS, however a real yield is something to take advantage of.

Home Builders: Seems counter intuitive, but with deficits of housing stock at around 1.2 million there is going to be upward pressure for homes as demand outstrip supplies, regardless of what the interest rate does. And because of commodities deflation, homebuilders will have margin power, able to play with prices thru the cycle.

Imagine provided by wallinvestor.com

If you were not part of the generation that received this government back golden parachute, you can at least profit by riding the wave.

As always this is not investment advise, I am not a professional advisor. This is merely my observed opinion, which can change at any time as the fact change. I do get things wrong from time to time. Data sets are from the American Housing Survey (AHS), the U.S. Department of Commerce via the Census, the National Mortgage Database (NMDB) Aggregate Statistics by the Federal Hosing Finance Agency, & Joshua Kennon

Thanks!

So the losers in all this are the owners (those receiving the payments) of the 3% mortgages. Who are they?

The nature of a thirty year is that in a high inflation environment your initial payments have to be super high relative to rent to facilitate lower then rent payments far in the future. It also locks you into staying in one location in order to get that benefit.