“Unintended consequences are the rule, not the exception.” – James C. Scott

The transition to a “green” future is supposed to be a tidy one. In theory, we leave fossil fuels behind, embrace shiny new renewables, and all our carbon problems vanish. A few solar panels, wind turbines, and geothermal installations later, and we’re basking in the glow of clean, sustainable energy. It’s simple, right?

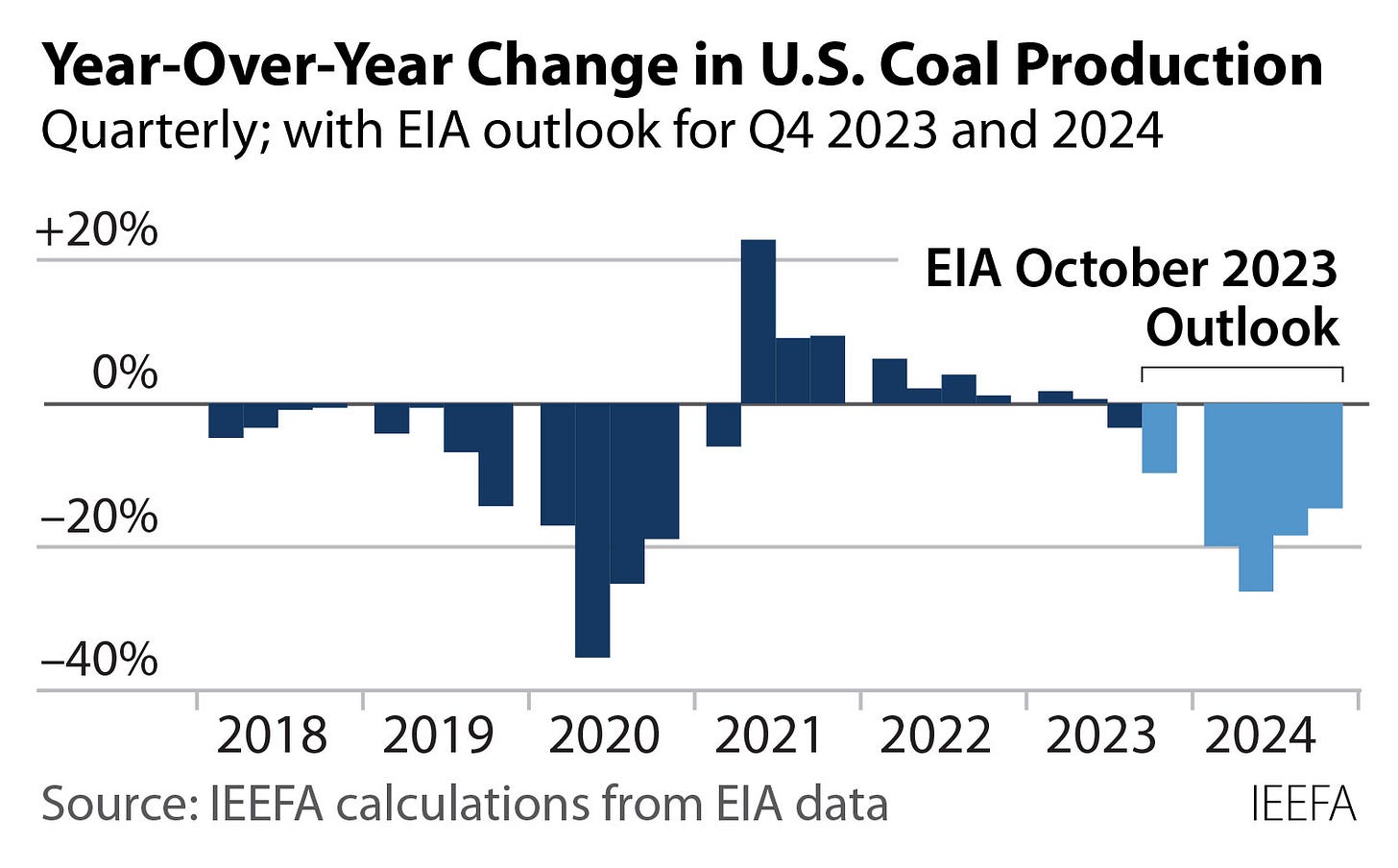

Well, let’s pause and look at the reality. The U.S. coal industry has been pronounced dead on arrival for nearly a decade. Coal, the energy villain of the 21st century, is in decline, we’re told. Wind and solar are the saviors, and natural gas is just the “transitional fuel” that gets us from dirty to clean. The narrative is simple and neat: coal is out, renewables are in.

But if you scratch beneath the surface of this neat storyline, something rather unexpected emerges: coal and natural gas aren’t just clinging to life—they’re being given a fresh lease on it, courtesy of the very policies designed to bury them. And the culprit? The Inflation Reduction Act (IRA), a piece of legislation that promised to lead America to a greener tomorrow but, in classic policy fashion, is delivering some seriously unintended consequences for the fossil fuel industry.

You see, the IRA isn’t just a windfall for renewable energy companies—it’s also a golden ticket for coal and natural gas. While the act does contain provisions meant to reduce carbon emissions, it also sneaks in a little clause that plays right into the hands of coal and gas interests. Welcome to the world of Section 45V, where clean hydrogen production gets all the tax credits, and fossil fuels continue to get all the love.

Let’s talk about Section 45V of the IRA for a minute. At first glance, it seems like the kind of provision we can all get behind. It offers tax incentives for the production of “clean” hydrogen, a fuel that could theoretically power industries without the baggage of carbon emissions. In a world where climate change is front and center, hydrogen is being touted as a game-changer in decarbonizing hard-to-abate sectors like steel and cement production.

Sounds good, right? Hydrogen, after all, produces only water vapor when burned, so it's clean... in theory.

Here’s the catch: the majority of clean hydrogen is still produced using fossil fuels—mostly natural gas. This process is known as steam methane reforming (SMR), and while it’s an efficient way to make hydrogen, it also releases CO2. The solution? Carbon capture and storage (CCS), which is supposed to trap the carbon before it escapes into the atmosphere. Great in theory. But here’s where Section 45V enters the picture: it incentivizes the production of hydrogen, including “blue hydrogen”—which still relies on natural gas and CCS to make hydrogen clean.

But natural gas isn’t the only fossil fuel benefitting from this policy. Coal—yes, coal—has been given a surprising role in the hydrogen supply chain, thanks to a process called coal gasification, which can turn coal into hydrogen. And methane—the very same methane that coal mines emit in vast quantities—is now an asset, rather than a liability. In fact, methane from coal mines (once considered a dangerous pollutant) is now being captured, turned into hydrogen, and used to generate tax credits.

This is where coal finds a new life. Historically, coal mining has been responsible for massive methane leaks—a major environmental hazard. But now, under the IRA’s tax incentives, coal mine methane (CMM) can be captured and used to make hydrogen, creating an entirely new revenue stream for struggling coal operations. It’s a strange, twisted plotline in the fight against climate change: the very methane we want to eliminate from the atmosphere is now being seen as a valuable resource to power the transition to a “clean” future.

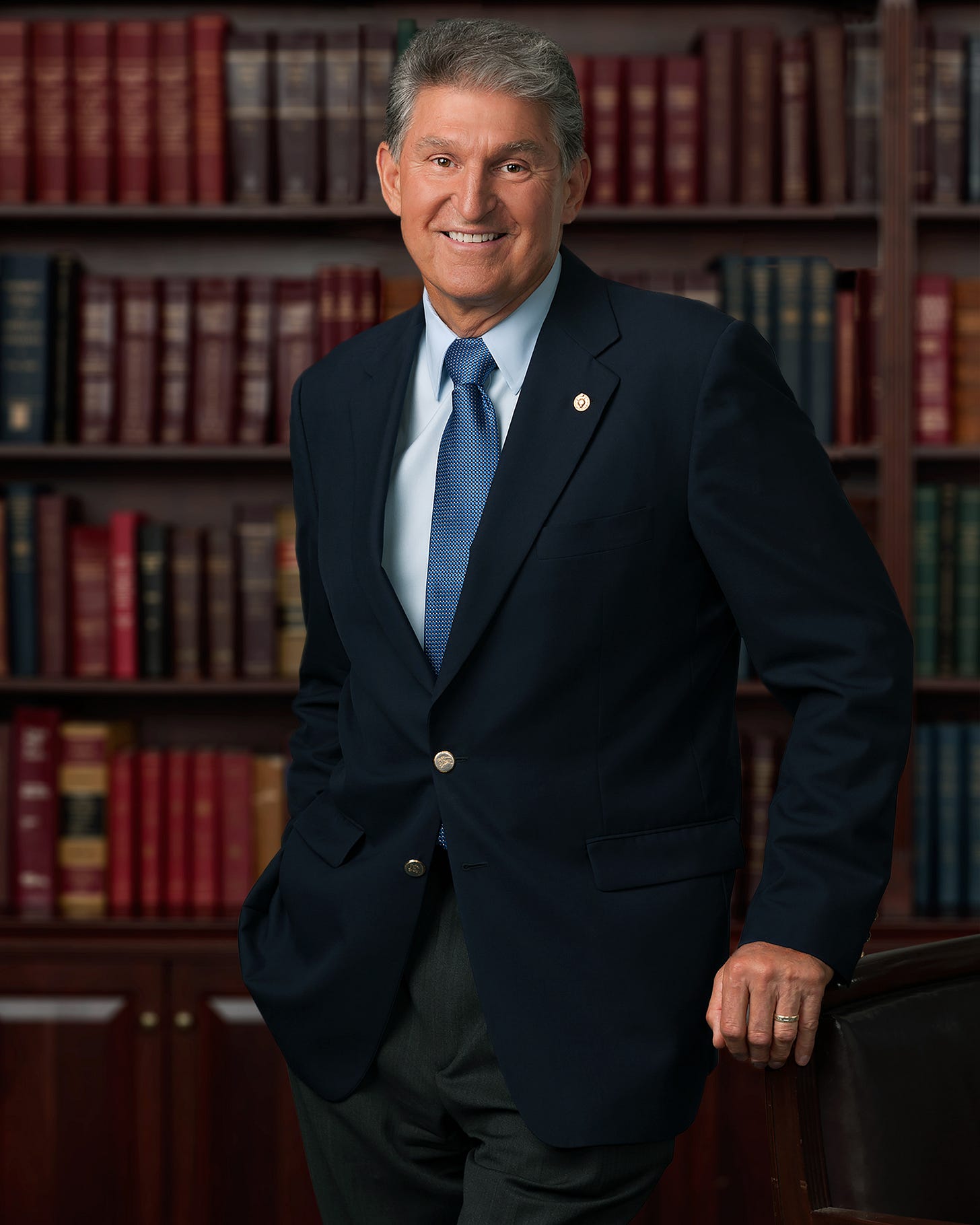

To fully understand how this happened, we need to talk about Joe Manchin, the Democratic senator from West Virginia. If you’re unfamiliar with Manchin, consider this your primer: he’s a coal industry stalwart, and a vocal defender of fossil fuel interests. As one of the key architects of the IRA, Manchin managed to secure provisions that seem to have been tailored specifically to the needs of coal-dependent regions like his own.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.