Circular Iron Curtain

How China Is Reusing Its Dying EV Batteries and Solar Panels to Power Its Military Industrial Complex

“Waste is worse than loss. The time is coming when every person who lays claim to the ability will keep the question of waste before him constantly. The scope of thrift is limitless.”

— Thomas Edison

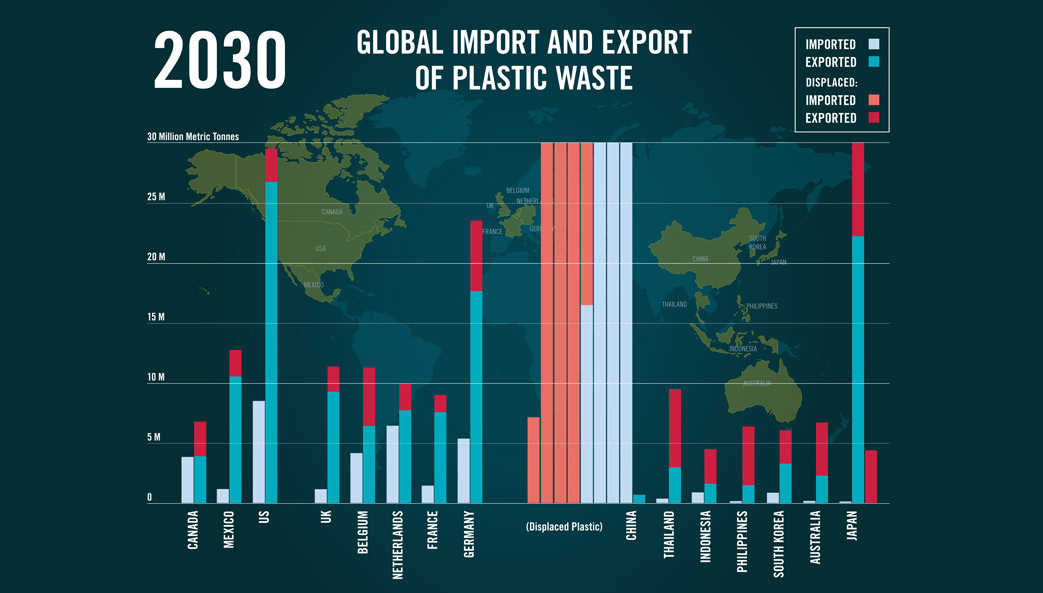

In 2018, the world’s recycling system buckled. For years, China had quietly served as the global hub for processing plastic waste, importing nearly half of the world’s discarded materials and converting them into low-cost goods. Then came “National Sword,” a sweeping ban on foreign waste. Western cities scrambled as recycling programs faltered and warehouses overflowed. It was a wake-up call: the West wasn’t just dependent on China for manufacturing—but even for handling its garbage.

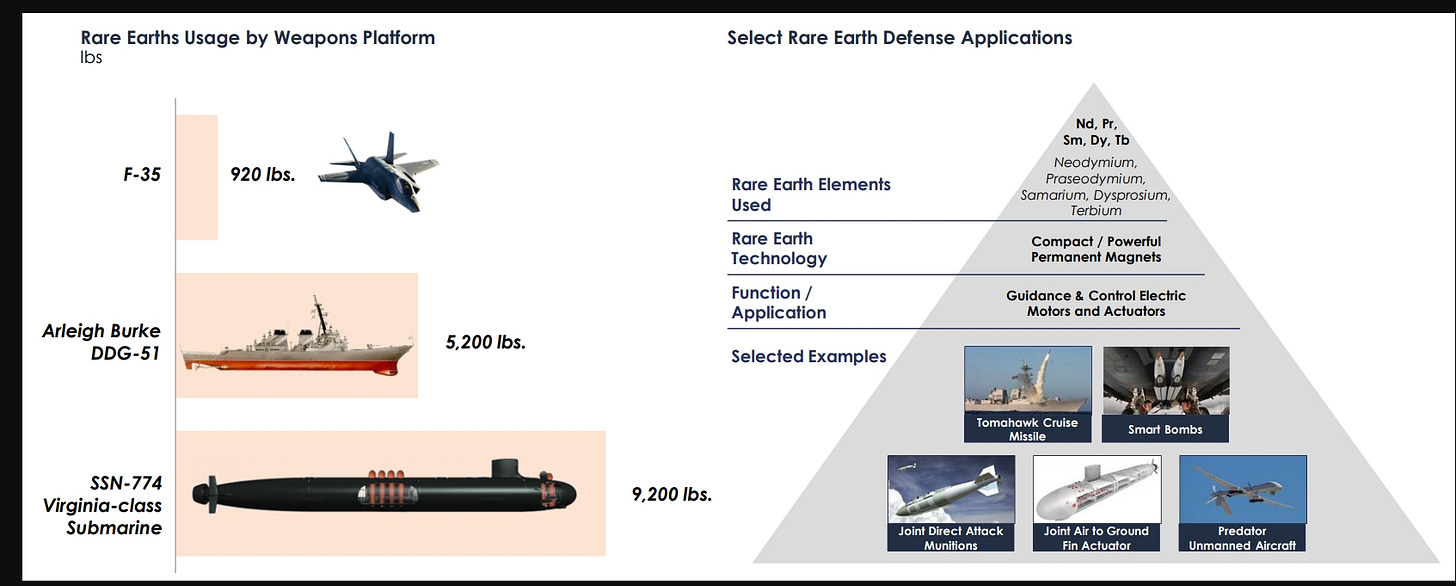

Today, China is flipping that script. Instead of importing trash, it’s reclaiming treasure—specifically, the critical minerals driving the next generation of technology and warfare. Lithium, cobalt, nickel, and rare earth elements are essential to electric vehicle batteries, solar panels, missile systems, and advanced electronics.

While Western governments remain bogged down in policy debates over EV mandates, trade, and sanctions, China is quietly building a self-sustaining supply chain—recycling and reintegrating critical minerals on an industrial scale. This is more than environmental policy; it’s a strategic realignment. The West once outsourced its waste. Now, China is positioning itself to control the materials that power the future.

Unlike the West’s fragmented approach, China is executing a long-term plan rooted in circular economy principles—reducing external dependencies while consolidating control over global resource flows. For Beijing, this isn’t merely economic. It’s national security.

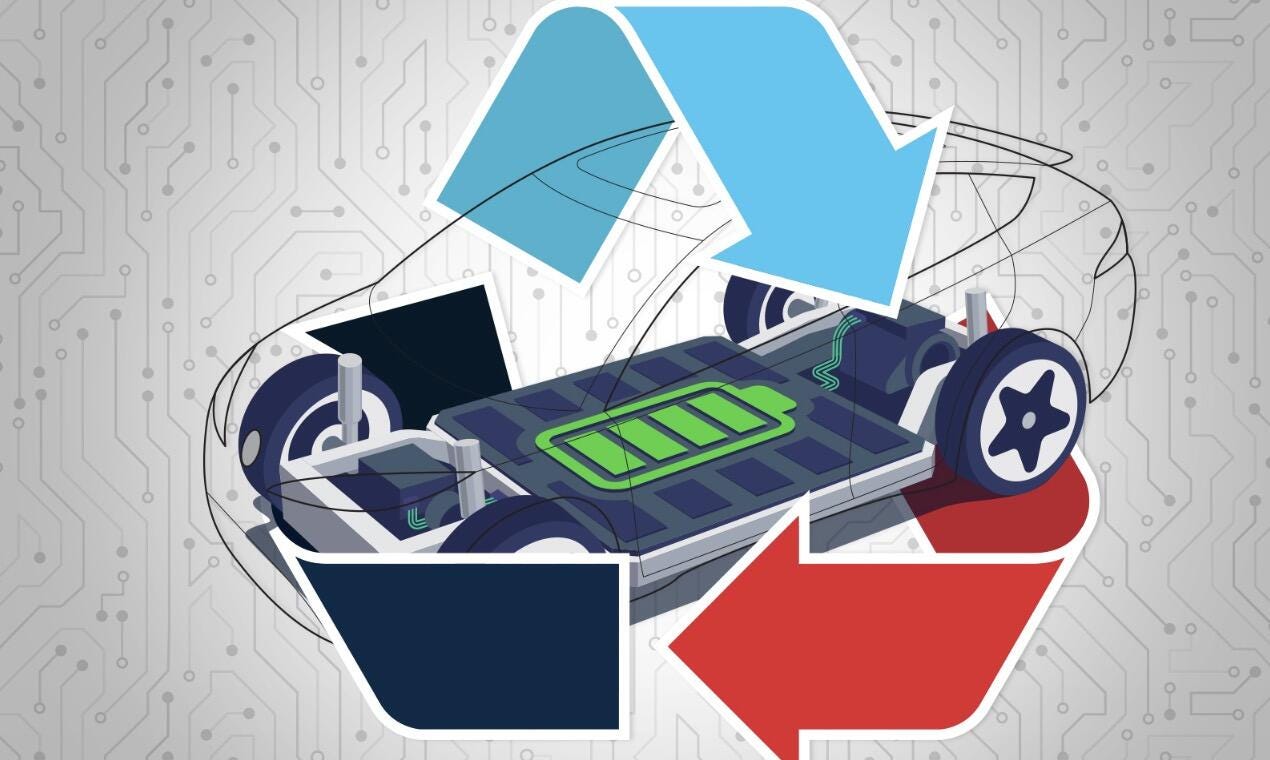

Instead of relying solely on mining, China is investing in advanced technologies to recover valuable minerals from retired EV batteries, solar panels, wind turbines, and industrial waste. What the West discards, China now sees as strategic stockpiles. By 2028, the country expects to process over 4 million tonnes of spent EV batteries each year—unlocking more than $38.5 billion in recoverable materials.

This shift is enabling China to build a resilient domestic resource base. With fewer imports, it becomes less vulnerable to supply chain disruptions or foreign pressure. What’s emerging is a kind of “green autarky”—a closed-loop system designed for strategic self-reliance, not just sustainability.

And the implications go beyond civilian industries. The same minerals recovered from green tech waste are critical to military systems—from missile guidance to drone propulsion. By controlling these inputs, China strengthens its defense sector while insulating it from outside threats.

Where the West views battery recycling primarily as an environmental or economic issue, China treats it as infrastructure for industrial security.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.