China's Rise to Renewable Energy Dominance: A Strategic Move to Hedge Against Oil Blockades and U.S. Hegemony

China's push into Renewables serves as a hedge against U.S. hegemony

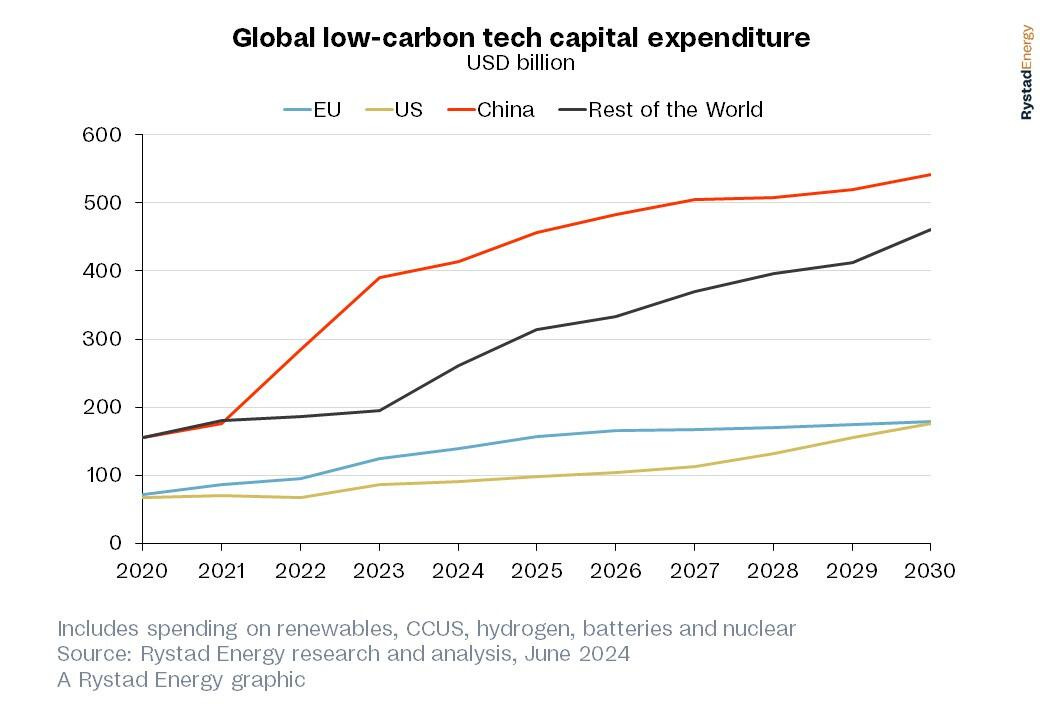

In recent years, China has emerged as a powerhouse in the global renewables supply chain and refining sector, marking a significant shift in the energy landscape. This transformation is not merely a result of economic ambition but also a strategic maneuver aimed at mitigating potential vulnerabilities known to China and her competitors, such as oil blockades through critical chokepoints like the Strait of Malacca, and balancing U.S. hegemony in the energy sector. Understanding China's ascent in renewable energy strategy sheds light on its multifaceted approach to energy security, and geopolitical influence.

China's dominance in the renewables supply chain can be attributed to a deliberate and concerted effort by the Chinese government to invest heavily in renewable energy technologies. Initiatives such as the "Made in China 2025" plan and the Belt and Road Initiative (BRI) have propelled China to become the world's leading manufacturer of solar panels, wind turbines, EVs, and electric vehicle batteries. By leveraging its manufacturing capabilities, economies of scale, slave lobar, lax environmental regulations, and access to coal resources, China has been able to drive down production costs, allowing it to compete more effectively with conventional fossil fuels.

Batteries

The electric vehicle (EV) market, with China as its largest segment, has witnessed exponential growth, driving demand for batteries. Despite efforts by the U.S. and Europe to boost domestic battery production, Asian suppliers continue to dominate the market.

According to Visual Capitalist's Bruno Venditti and Sabrina Lam, the global EV battery market is projected to surge from $17 billion to over $95 billion between 2019 and 2028. The current momentum of EV battery manufacturing often accompanies the “decarbonization” of the transportation sector, however, the intensification of government and market is a response to China more than environmental or climate.

Which is why Chinese companies notably lead the charge in this domain. Currently, they command a staggering 56% share of the EV battery market, with Korean companies following at 26% and Japanese manufacturers at 10%. The top 10 producers worldwide are all Asian companies, highlighting the region's dominance.

The foremost battery supplier, CATL, has expanded its market share from 32% in 2021 to 34% in 2022. This Chinese giant provides lithium-ion batteries to a plethora of renowned automakers, including Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo.

Despite facing scrutiny following EV battery fire recalls in the United States, LG Energy Solution remains a key player in the market. In 2021, the South Korean company agreed to reimburse General Motors $1.9 billion for the recall of 143,000 Chevy Bolt EVs due to fire risks from faulty batteries.

Another notable contender is BYD, which has surged to the third spot, nearly doubling its market share over the past year. This Warren Buffett-backed company, not only one of the world's largest automakers by market cap but also a prominent battery producer, is poised to challenge LG Energy Solution's market share in the near future.

As nations globally accelerate their transition to greener energy, a new era of electric vehicles is dawning, accompanied by a surging demand for batteries. These batteries, crucial not only for automotive use but also for home, industrial, and grid energy storage, are increasingly becoming the focus of recycling efforts.

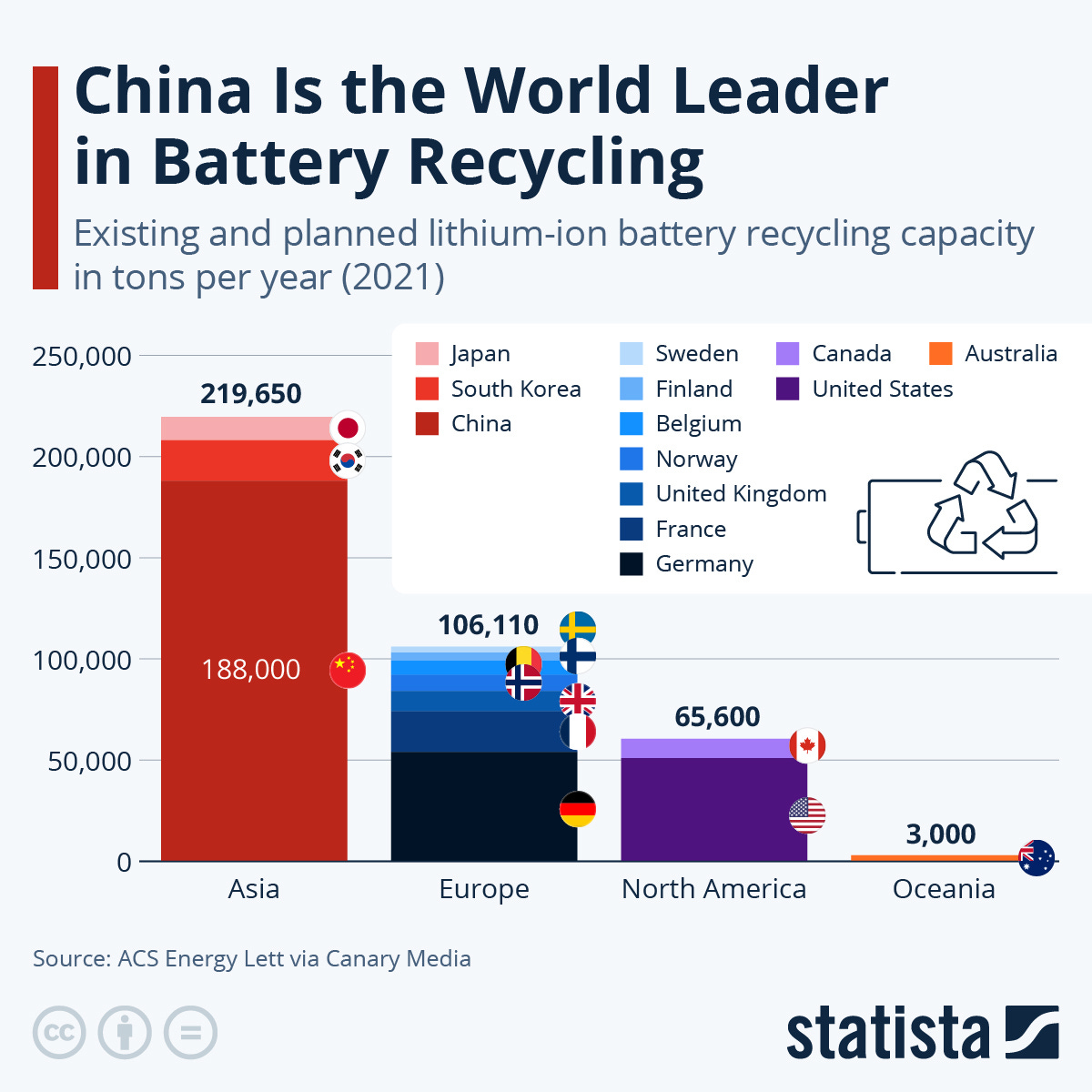

According to a report by Statista's Anna Fleck, the market for recycling lithium-ion batteries is expanding rapidly. The U.S. Environmental Protection Agency highlights that battery recycling conserves critical minerals and valuable materials, presenting a more sustainable alternative to disposal.

Data from ACS Energy Lett, as cited in an article by Maria Virginia Olano on Canary Media, illustrates that in 2021, China led the world in lithium-ion battery recycling, boasting 188,000 tons of existing and planned recycling capacity annually. Following closely were Germany and the United States, albeit with significant gaps in capacity.

Since 2021, plans for expanding lithium-ion battery recycling plants have surged. Researchers at the Fraunhofer Institute for Systems and Innovation Research indicate that while the majority of recycling capacity is concentrated in East Asia, Europe is rapidly ramping up its capabilities. By 2025, Europe could potentially boost its recycling capacities to an estimated 400,000 tons per year.

However, the level of policy support for battery recycling varies widely across countries and regions. For instance, the European Council has set ambitious targets for lithium recovery from waste batteries, aiming for 50 percent by 2027 and 80 percent by 2031, along with implementing new rules on mandatory minimum levels of recycled content for various types of batteries. Olano suggests that the U.S. has lagged in lithium-ion battery recycling due to a comparative lack of supportive policies, falling behind Asian and European markets.

Despite the growing interest in battery recycling, a Bloomberg analysis warns of a potential oversupply of recycling plants in the U.S., outstripping the available discarded batteries to process. This mismatch between recycling infrastructure and supply could persist for over a decade, posing a challenge for the industry's growth in the country.

China's Solar Dominance: Can the U.S. Break In?

The global solar industry is booming, but China holds a commanding position in its supply chain. As the United States aims to enter the solar panel business, challenges loom large, potentially driving up costs for solar panels and electricity. Let's delve into the complexities of this evolving landscape.

Polysilicon, a high-purity form of silicon, is the cornerstone of 97% of the world's solar panels. Historically, the U.S., Europe, and Japan led polysilicon manufacturing, but China's massive investments have reshaped the market. By 2023, China produced a staggering 91% of the world's polysilicon, a dominance amplified by its cost advantages and expansive infrastructure. An aspect that is often overlooked in polysilicon production is that it is a way backdoor way of using natural gas for electrical generation, given that natural gas is used to make hydrogen and large amounts of hydrogen are used to react with tri-chlorosilane gas to produce silicon. Solar panel have a life expectancy of 20 years, given China less exposure to LNG volatility, therefore less exposure for geopolitical pressures.

China's dominance extends to the production of solar ingots and wafers, with over 97% of global output originating from Chinese facilities. The country's strategic location, coupled with low electricity costs from coal and hydroelectric plants, underpins its manufacturing prowess, further widening the gap with U.S. capabilities.

Even raw materials like high-quality quartz sand face challenges in the U.S. While most of the world's sand comes from North Carolina's Appalachian mountains, it is primarily exported to China for crucible production, a crucial component in ingot manufacturing. This reliance on Chinese-made crucibles adds complexity and cost to U.S. solar panel production.

China controls around 80% of the solar-cell market, leveraging cost advantages and a vertically integrated supply chain. In contrast, the U.S. lacks solar-cell manufacturing capabilities, relying heavily on imports. Despite recent legislative efforts to incentivize domestic production, significant hurdles remain in bridging this gap.

Solar panel assembly, while less capital-intensive, remains largely concentrated in China, which accounted for 83% of global production in 2023. The U.S. contributes less than 2%, highlighting its limited presence in this critical stage of the supply chain.

Efforts to revive U.S. solar manufacturing face significant challenges. While the Inflation Reduction Act aims to incentivize domestic production, it may not address underlying disparities in labor and electricity costs. Proposed tariffs on Chinese imports, up to 60% under Trump's plan, could further exacerbate cost pressures, potentially leading to inflationary impacts across the board.

As the U.S. endeavors to break into the solar panel business, it faces an uphill battle against China's entrenched dominance. While efforts to revitalize domestic manufacturing are underway, achieving parity with Chinese competitors remains a formidable task. The outcome will not only impact the cost of solar panels and electricity but also shape the trajectory of the global solar industry for years to come.

EVs dominance

In a meteoric rise that caught many by surprise, China has emerged as a global powerhouse in the realm of electric vehicles (EVs), redefining the landscape of the automotive industry. With an annual sales surge from 1.3 million to a staggering 6.8 million in just two years, China solidified its position as the leading market for EVs in 2022, marking the eighth consecutive year of dominance. In stark contrast, the US lagged significantly behind, selling only about 800,000 EVs in the same period.

The exponential growth of China's EV sector not only buoyed its automotive industry during the pandemic but also propelled the nation towards its aspirations of becoming a frontrunner in climate policy. This unprecedented feat prompts the question: how did China achieve such remarkable success in the electric vehicle domain?

At the heart of China's EV revolution lies a strategic blend of government subsidies, tax incentives, procurement contracts, and robust policy frameworks aimed at bolstering both EV supply and demand. These initiatives paved the way for the emergence of a plethora of domestic EV brands, fostering a dynamic ecosystem of innovation tailored to meet the evolving needs of Chinese consumers. This proactive approach not only galvanized the industry but also cultivated a burgeoning market of young car buyers.

China's foray into EVs traces back to the early 2000s when its traditional internal-combustion car industry faced formidable challenges in competing with established foreign counterparts. Recognizing the limitations of vying for dominance in conventional automotive technologies, the Chinese government redirected its focus towards pioneering electric vehicles—a bold move that promised to carve out a significant niche in the global auto landscape.

Critical to China's EV ascendancy was the unwavering commitment to research and development, underscored by substantial investments in cutting-edge battery technologies. Chinese companies spearheaded innovations in lithium iron phosphate (LFP) batteries, overcoming initial hurdles of energy density and temperature performance. This relentless pursuit of advancement positioned China at the forefront of battery manufacturing, leveraging its control over essential materials to establish a robust supply chain.

The symbiotic relationship between China's EV industry and Tesla-thanks Elon- played a pivotal role in shaping its trajectory. Leveraging financial incentives and favorable government policies, Tesla swiftly established a formidable presence in China, epitomized by the rapid construction of its Gigafactory in Shanghai. This strategic collaboration not only bolstered Tesla's global footprint but also catalyzed innovation within the Chinese EV landscape, fueling competition and technological advancement.

While China's dominance in the EV sphere appears unassailable, replicating its success remains a daunting task for other nations. The intricate interplay of political, economic, and technological factors underscores the complexity of emulating China's model. Nonetheless, emerging markets present lucrative opportunities for expansion, with the potential to further diversify China's export portfolio and consolidate its position as a global leader in electric vehicles.

In essence, China's ascent to the summit of the electric vehicle industry embodies a convergence of visionary policymaking, strategic investments, and relentless innovation—a testament to its unwavering commitment to shaping the future of mobility on a global scale. As China continues to chart new frontiers in electric mobility, the reverberations of its success are poised to resonate far beyond its borders, shaping the trajectory of the automotive industry for years to come.

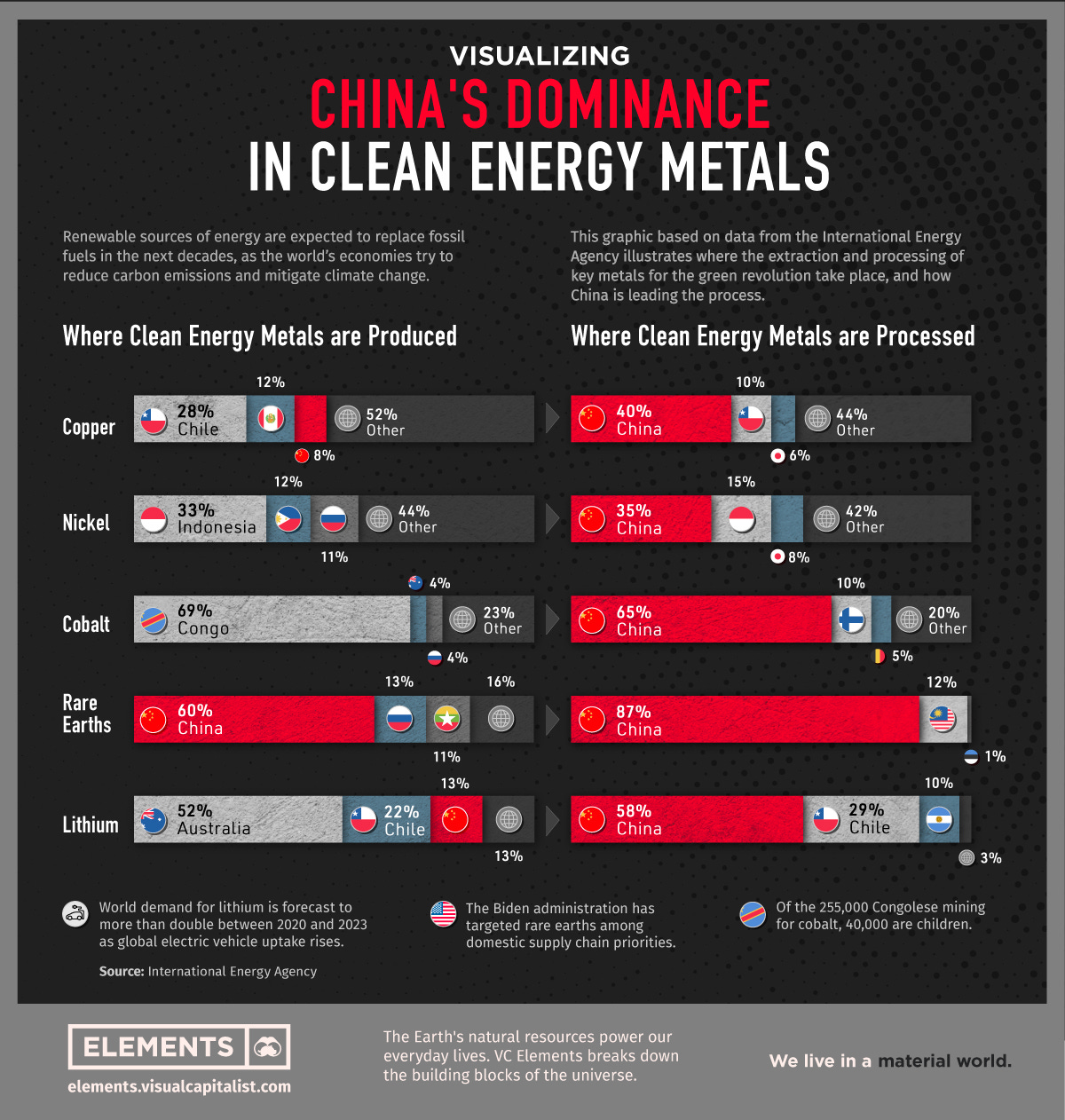

Clean Energy Metals and Refining

China, despite its status as the largest carbon polluter, leads the world in the production of critical minerals essential for green technologies. Rare earth elements, crucial components in high-tech devices, are primarily produced in China, accounting for 60% of global output. Additionally, the country holds a substantial share in lithium production (13%), essential for rechargeable batteries used in various applications.

The dominance of China extends beyond extraction to processing operations, with the country commanding significant shares in refining for nickel, lithium, cobalt, and rare earth elements. This vertical integration underscores China's pivotal role in the clean energy metal supply chain.

Despite its economic stature, the U.S. lags behind in clean energy metal production. In response, the Biden administration has initiated measures to review the country's strategy for critical materials, aiming to narrow the gap with global leaders.

Russia, despite its mineral wealth, is notably absent from the list of top clean energy metal producers. While the country excels in traditional mining sectors, it has yet to establish a significant presence in the emerging green technology supply chain.

The production of metals like cobalt, primarily sourced from the Democratic Republic of Congo (DRC), raises ethical concerns due to reports of corruption and lax regulation. Chinese interests control a significant portion of cobalt operations in the DRC, with some sourced from artisanal mines notorious for exploitative practices, including child labor.

The global race for clean energy metals underscores the evolving dynamics of geopolitics and resource competition. As demand surges, new players may emerge, challenging China's current dominance in the sector.

The use of renewable energy heralds a new era in global energy production, with clean energy metals serving as the linchpin of this transformation. While China currently leads the charge, the evolving geopolitical landscape presents opportunities for other nations to assert themselves in the burgeoning green technology market.

Ensuring Security: Critical Minerals for China, EU, and the U.S.

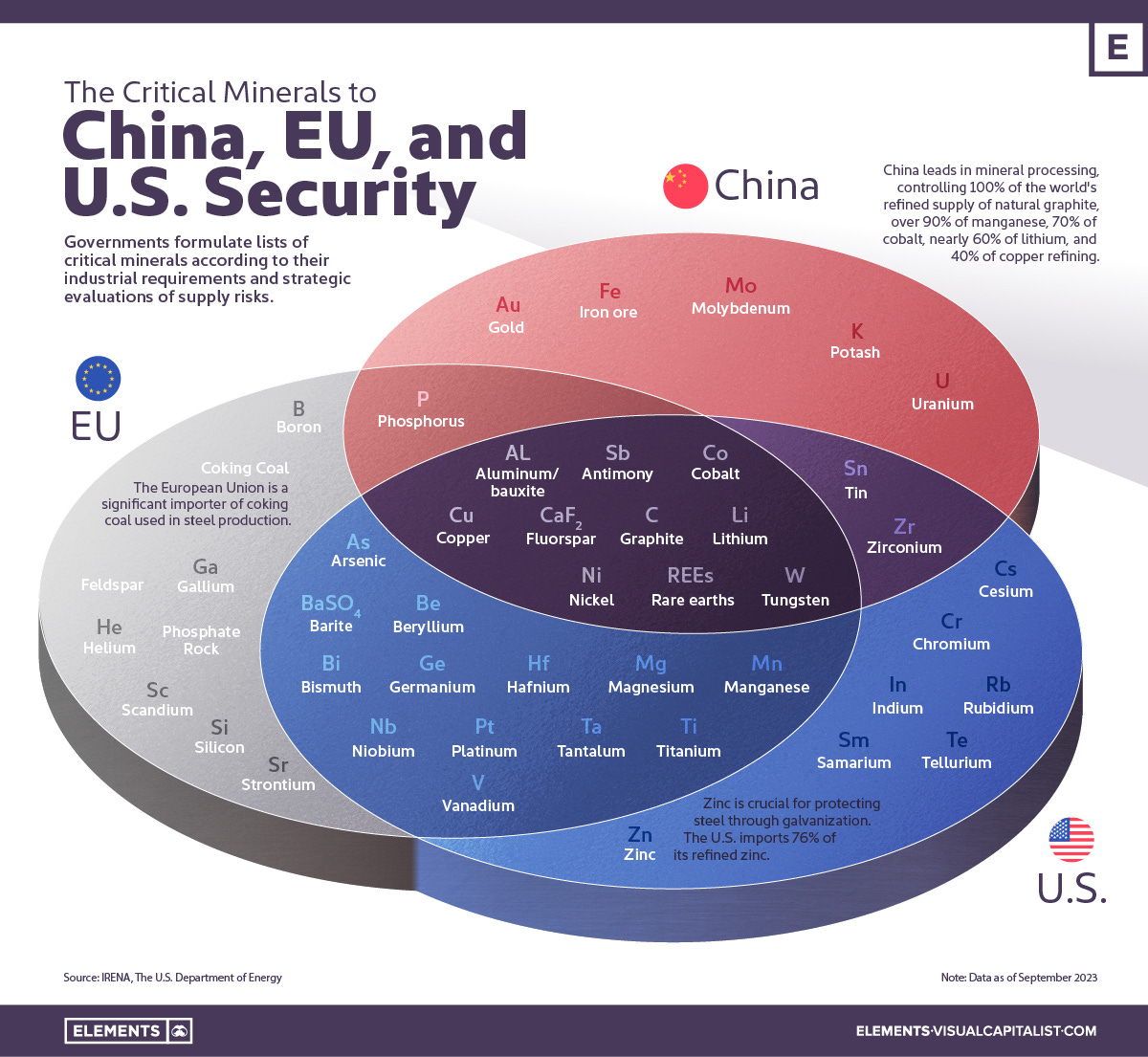

In the race toward hegemony, securing critical minerals has become paramount for nations worldwide. These minerals, essential for clean energy technologies like electric vehicle batteries and renewable power, are at the heart of strategic evaluations of supply risks and industrial requirements. Let's delve into how China, the European Union (EU), and the United States approach this critical aspect of their energy security.

Critical minerals, while lacking a universal definition, are identified by countries and regions based on technological needs, supply-demand dynamics, and strategic concerns. As the energy transition accelerates, these lists evolve to reflect emerging requirements and potential bottlenecks.

With global commitments to reduce greenhouse gas emissions, the demand for critical minerals is projected to skyrocket by 2040, doubling the current levels. Recognizing this, nations are increasingly focused on reducing import reliance and bolstering domestic production of these essential materials.

Ten materials feature prominently on the critical minerals lists of the U.S., EU, and China, including cobalt, lithium, graphite, and rare earths. While there is significant overlap, each region's list reflects unique considerations and vulnerabilities.

The EU's critical minerals list includes phosphate rock and coking coal, reflecting the region's limited domestic production and heavy reliance on imports. Phosphate rock, essential for fertilizer manufacturing, is primarily produced in Finland, highlighting the EU's vulnerability to supply disruptions.

The U.S. grapples with a high import dependency on critical minerals, particularly manganese, graphite, and cobalt. Decades of reliance on imports have left the country with limited domestic production capacity, with only a handful of operational mines for key minerals like nickel and lithium.

Despite being the world's largest carbon polluter, China emerges as the dominant producer of critical minerals for the green revolution. From rare earth elements to lithium and nickel, China controls significant shares of the global market, exerting considerable influence over supply chains.

China's critical minerals list extends beyond conventional materials, encompassing gold and uranium. Gold acquisitions serve both economic and geopolitical objectives, while uranium self-sufficiency aligns with the country's ambitious nuclear energy goals.

As nations navigate the complexities of securing critical minerals, strategic investments in domestic production and international partnerships will be crucial. By diversifying supply sources and bolstering resilience, countries can mitigate risks and ensure a sustainable transition to clean energy.

Does China’s Dominance of U.S. Critical Minerals Supply Matter?

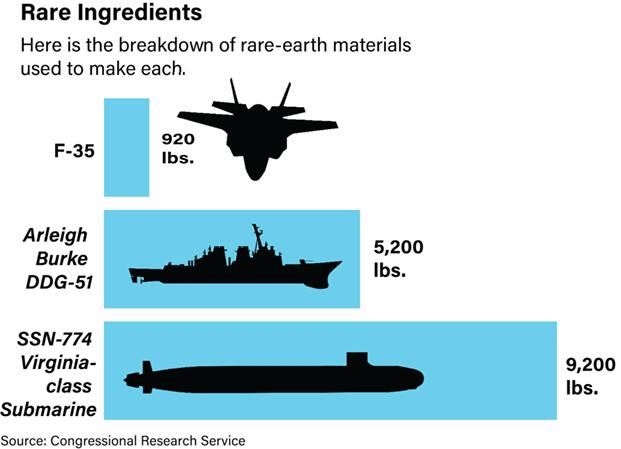

The global rare earth metals market is heavily influenced by China, which dominates both the production and processing of these crucial minerals. With China supplying 90 percent of refined rare earth metals and producing 60 percent of the ore worldwide, it holds a near-monopoly on processing. This strategic advantage gives China significant leverage in determining the distribution of these metals and can impact global supply chains significantly.

China's decision to reduce rare earth exports in 2010 caused prices to soar unexpectedly, demonstrating its ability to influence market dynamics. In response, efforts to encourage rare earth mining outside of China have emerged, including initiatives by the U.S. government to incentivize domestic production of critical minerals like lithium, nickel, and cobalt. However, these attempts have faced challenges, as evidenced by the financial losses incurred by investors in a failed attempt to revive a closed rare earth mine in the U.S.

China's tight control over the rare earth market highlights the need for innovative solutions to mitigate its dominance. While one potential approach could involve governments guaranteeing prices for domestically mined rare earths, such measures contradict the principles of free market economics that have prevailed for decades.

As geopolitical tensions rise and the global consensus on free trade wavers, China's prioritization of national interests over adherence to trade rules becomes increasingly apparent. This shift underscores the potential challenges associated with relying on cheap goods and resources from distant sources in an era of geopolitical uncertainty.

The USGS estimates that China could potentially disrupt the global rare earth oxide supply by cutting off 40–50% production, impacting suppliers of advanced components used in U.S. defense systems.

A version of this sort of trade warfare is already playing out. Earlier this year, China implemented export controls on germanium and gallium. The U.S. relies on China for around 54% of its demand for both minerals, used for producing chips, solar panels, and fiber optics.

China’s controls were seen as a retaliation against the U.S. which has restricted the supply of chips, chip design software, and lithography machines to Chinese companies.

In conclusion

One of the most remarkable facets of China's energy strategy lies in its innovative use of coal resources to drive the transition towards electric vehicles (EVs). Despite being the world's largest consumer of gasoline and diesel, with every two gallons of crude oil refining into one gallon of gasoline, China has taken significant steps to reduce its oil dependency. Through investments in renewable technologies and the promotion of EV adoption, China aims to revolutionize its transportation sector.

By repurposing coal-fired power plants into electric vehicle charging stations and incentivizing the production and purchase of EVs, China is strategically working to hedge its economy. This move is not only about reducing reliance on imported oil but also about insulating the nation from potential disruptions caused by a Western blockade of the Strait of Malacca.

China's dependence on the Strait of Malacca for oil imports is substantial, with roughly 6.5 million barrels per day passing through it. This accounts for approximately 80% of China's oil imports and 60% of its total oil supply, sourced from regions like Venezuela, Africa, and the Middle East. Given the strait's significance as the shortest sea route between East Asia and the Middle East, it plays a vital role in global shipping, including containers and bulk goods.

The strategic importance of the Strait of Malacca has not gone unnoticed in geopolitics, particularly in the context of U.S.-China relations. Some argue that the threat of a blockade in this strategic chokepoint has deterred China from taking aggressive actions, such as invading Taiwan.

In essence, China's innovative use of coal resources to drive the EV transition not only reflects its commitment to sustainability but also its strategic maneuvering to enhance energy security. By reducing reliance on imported oil and fossil fuels, China aims to safeguard its economy against potential disruptions while simultaneously advancing its position as a global leader in clean energy and transportation.

Furthermore, China's strategic investments in refining have bolstered its position in the renewables market. Through acquisitions and partnerships with international firms, Chinese companies have gained access to cutting-edge refining technologies, enabling them to produce high-quality renewable fuels such as biofuels and hydrogen. This vertical integration has strengthened China's grip on the entire renewables value chain, from production to distribution.

Moreover, China is leveraging its renewables infrastructure to balance U.S. hegemony in the energy sector. As the United States has historically dominated global energy markets, China's rise in renewable energy presents a challenge to American influence. By reducing its dependence on imported oil and establishing itself as a leader in renewables, China aims to assert its position as a key player in shaping the future of global energy governance.

China's dominance in the renewables sector has been ferried along because of it’s salve labor practices, environmental degradation, and market manipulation have raised questions about the sustainability and fairness of China's renewable energy ambitions. Additionally, geopolitical tensions with other major powers, particularly the United States, have added another layer of complexity to China's renewable energy strategy.

China's ascent to renewable energy dominance and its coal-to-EV strategy represent a strategic shift in the global energy landscape. By leveraging its manufacturing prowess, abundant coal resources-4th in the world at 138.8 billion tonnes & close proximity to the 3rd largest in Australia & 6th largest in Indonesia, and renewables infrastructure, China aims to hedge against potential oil blockades, balance U.S. hegemony, and promote environmental sustainability. However, challenges such as geopolitical tensions and ethical concerns loom large, highlighting the need for a nuanced approach to navigating the complexities of the renewables market. As China continues to shape the future of energy, the world watches with both admiration and apprehension, aware of the profound implications of China's energy choices for the planet's future and global geopolitics.

Great article. PRC and "renewables" totally fueled by coal. When the whole renewables disaster craters, they will be holding the bag, if not already.

China’s rush to dominate renewables will go down as the dumbest investment in the history of mankind. Fine let them burn up their resources on a subpar low energy density boondoggle. At some point physics and chemistry matter. They’ll be OK because of coal but once again state sponsored control of the economy doesn’t work.