"The harbor is a place of safety; the sea, a place of adventure." — William Shakespeare (The Tempest)

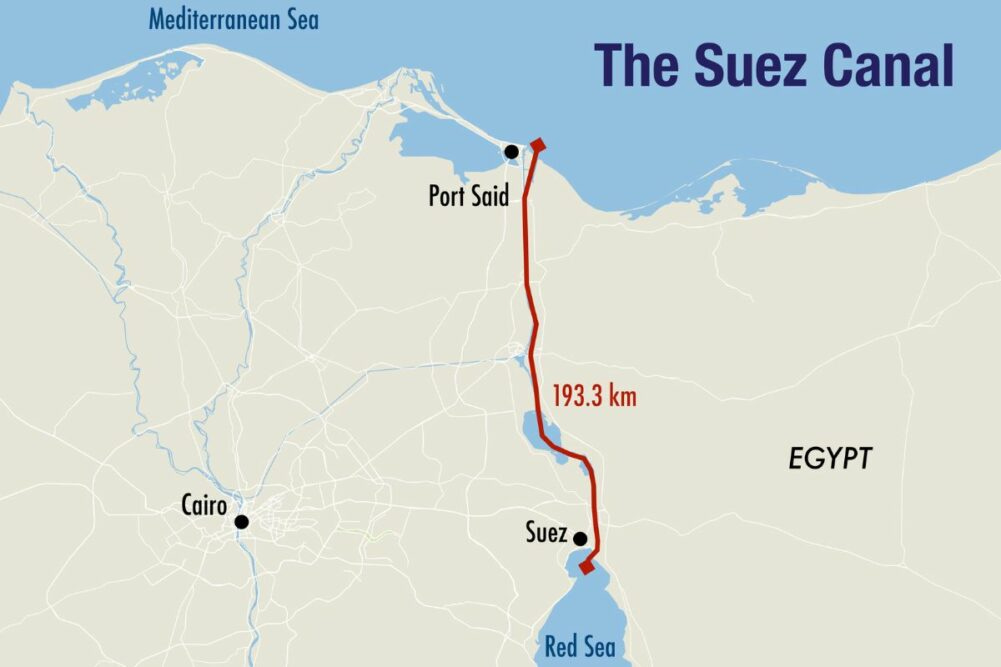

The Suez Canal, one of the most strategically important waterways in the world, was born from the ambition of two European powers: France and Britain. Though the idea of a shortcut connecting the Mediterranean to the Red Sea had been a dream of ancient rulers, it wasn’t until the mid-19th century that this vision would become a reality. French diplomat and engineer Ferdinand de Lesseps spearheaded the project in the 1850s, with the support of Egypt’s ruler, Muhammad Said Pasha. However, it wasn’t long before the project attracted the attention of Britain, which saw the canal as crucial to its imperial ambitions and trade routes, especially with its prized colony, India.

By 1875, Britain had purchased a controlling stake in the canal, establishing joint French-British control and effectively tying the future of global commerce to the success of this waterway. The Suez Canal reduced the time it took to ship goods between Europe and Asia dramatically, transforming global trade, particularly for energy supplies like oil, which would later come to dominate the canal’s cargo.

The canal's geopolitical significance only grew in the 20th century. In 1956, Egyptian President Gamal Abdel Nasser nationalized the canal, leading to the Suez Crisis—a military intervention by Britain, France, and Israel to seize control. Although it ended in failure and marked the end of Western dominance over the Suez, Egypt regained full sovereignty, cementing the importance of the waterway for oil transport. Today, the Suez Canal remains a pivotal global trade route, carrying about 10% of global trade, with roughly 8% of the world’s oil passing through its narrow passage.

However, recent years have seen growing challenges to the Suez Canal’s dominance and operational efficiency. Issues such as overcapacity, piracy, attacks on shipping in the Red Sea, and lingering geopolitical tensions surrounding the canal have raised concerns about its long-term viability.

In 2021, the global economy was shaken when the container ship Ever Given became wedged in the Suez Canal for six days, effectively halting traffic and causing billions of dollars in losses. This incident underscored just how fragile the canal’s operations are, even with its continued importance. As ships continue to grow in size and cargo demand increases, the canal is struggling to keep up with global trade, leading to concerns about its ability to handle future volumes effectively.

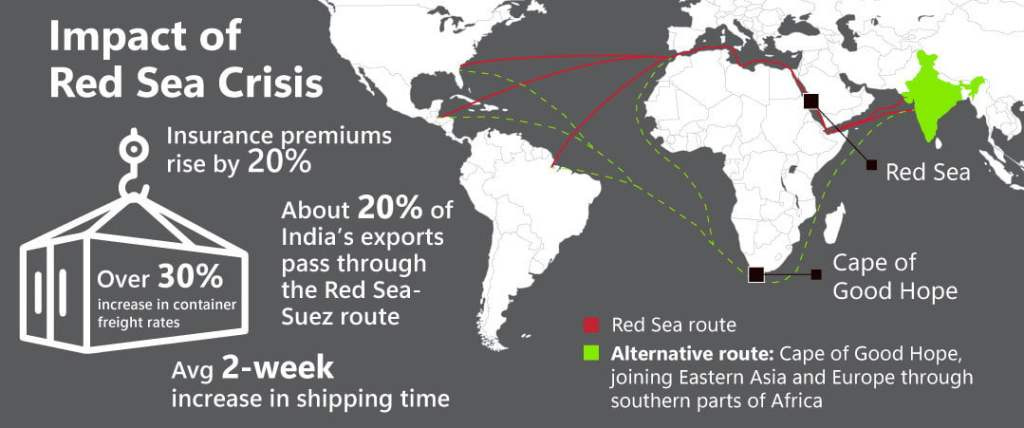

Additionally, the Red Sea, which flanks the Suez Canal, has become increasingly dangerous due to piracy and attacks from groups like Houthi rebels in Yemen. These attacks on ships have raised the security risks for those using the canal, especially for energy shipments. This growing instability is adding another layer of complexity to the already critical role the Suez Canal plays in global oil transport.

Given these challenges, many countries are rethinking their reliance on the Suez Canal for energy shipments, leading to the consideration of alternative routes for transporting vital commodities like oil and natural gas.

Keep reading with a 7-day free trial

Subscribe to The Monetary Skeptic to keep reading this post and get 7 days of free access to the full post archives.